The United Kingdom's job market shows signs of weakening, with a notable rise in the unemployment rate and a slowdown in wage growth. This shift in economic indicators is leading analysts to anticipate a potential interest rate cut by the Bank of England in March. The Office for National Statistics (ONS) data points to a challenging environment for workers, particularly younger ones, prompting calls for focused action to address joblessness.

Economic Data Highlights Shifting Trends

Recent figures from the Office for National Statistics (ONS) paint a picture of a cooling UK labor market.

Unemployment Rate: The unemployment rate has climbed to 5.2%, its highest level in nearly five years, as reported for the three months ending December. This marks a significant increase from previous periods.

Wage Growth: Concurrently, wage growth has continued to slow. This reduction in the pace of pay increases is observed across the board, impacting workers' earning potential.

Payrolled Employees: Data indicates a fall in the number of employees on company payrolls. Reports suggest this decline has occurred in seven out of the last eight months, a trend some link to the April increase in employer National Insurance contributions.

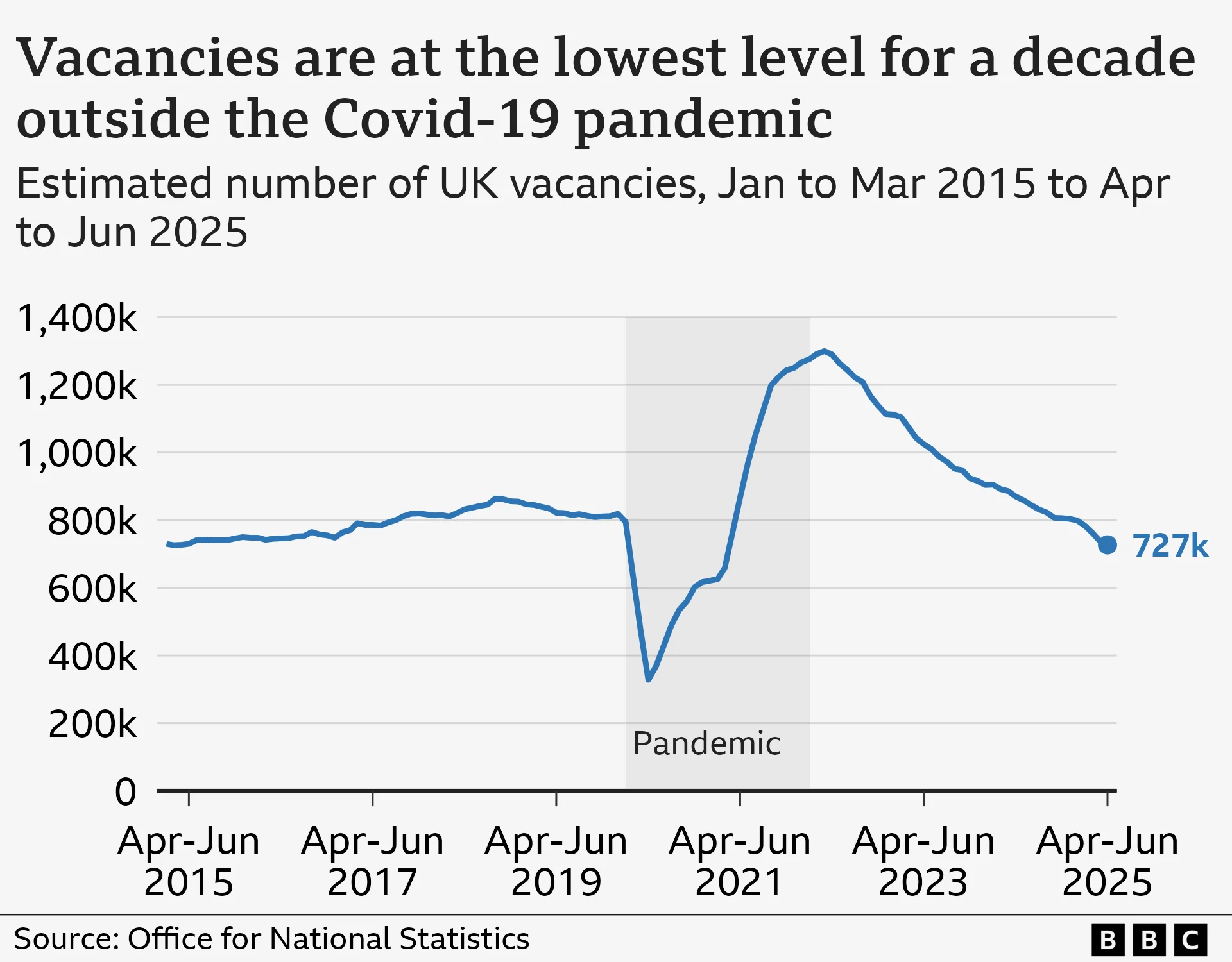

Job Vacancies: The number of available job openings has also decreased, marking three consecutive years of falling vacancies. For the April to June period, vacancies stood at 727,000.

Read More: UK Interest Rates Might Be Cut Soon as More People Are Unemployed

"The lack of green shoots of recovery in the labour market and further fall in wage growth supports the idea that the Bank of England has at least a couple more interest rate cuts in its locker, with the chances of the next cut happening in March rather than April edging higher." - Paul Dales, Chief UK Economist at Capital Economics

Factors Influencing Monetary Policy

The Bank of England's Monetary Policy Committee (MPC) closely monitors labor market data when setting interest rates.

Inflation Control: The MPC has previously stated that stabilizing wage growth is essential for controlling inflation in the long term. The current trend of slowing wage growth, while potentially easing inflationary pressures, also signals a weaker economy.

Market Expectations: The combination of rising unemployment and cooling wage growth has led markets to increasingly expect an interest rate cut. Analysts suggest the conditions are becoming more favorable for the Bank of England to lower its benchmark interest rate, with March emerging as a likely timeframe.

Government Policy: Some analyses suggest that increased employer National Insurance contributions, implemented in April, may have discouraged businesses from hiring. This policy, alongside rises in minimum pay requirements, has drawn criticism for potentially contributing to increased business costs and subsequently affecting employment decisions.

Read More: Health Insurance Costs Going Up in Australia and the US

"Businesses are having to be more creative." - Unnamed Business Representative (regarding staffing challenges)

Impact on Different Worker Groups

Evidence suggests that younger workers are disproportionately affected by the current economic slowdown.

Youth Unemployment: Economists note that younger workers are bearing the brunt of the hiring slowdown. This observation is compounded by the increasing presence of Artificial Intelligence (AI), which firms are reassessing for potential roles, particularly junior positions.

Worker Bargaining Power: As the labor market slackens and layoffs potentially increase, workers' ability to negotiate higher wages diminishes. This downward pressure on bargaining power is expected to continue.

"This slackening in pay growth is likely to gather momentum in the coming months as the downward pressure from mounting lay-offs and higher employment costs increasingly weakens workers’ bargaining position." - Suren Thiru, Economics Director at the Institute of Chartered Accountants in England and Wales

Economic Perspectives and Rate Cut Prospects

Analysts hold varying, though largely convergent, views on the implications of the current data for the Bank of England's policy.

Read More: UK Job Losses Rise to Highest in 5 Years, Pay Grows Slower

Proactive Interest Rate Cuts: Some economists, like Paul Dales from Capital Economics, see the current trends as strong support for further interest rate cuts, with March being a more likely candidate than April. This view suggests the Bank has room to reduce rates beyond what markets are currently anticipating.

Gradual Adjustments: Other analyses suggest the loosening of the labor market is occurring gradually. This implies that the Bank of England might continue with "gradual and cautious" reductions in interest rates, rather than aggressive moves.

Conflicting Economic Forces: While weakening job data supports rate cuts, conflicting forces such as inflation dynamics also play a role. The Bank's governor, Andrew Bailey, has previously indicated that labor market trends would receive greater focus in their decision-making.

Conclusion and Forward Outlook

The latest UK economic data, characterized by rising unemployment and decelerating wage growth, strongly indicates a weakening labor market. This trajectory aligns with conditions that would prompt the Bank of England to consider reducing interest rates. The market sentiment leans towards a March rate cut, although the pace and magnitude of future adjustments will likely depend on the continued evolution of inflation and employment figures. The specific impact on different demographic groups, such as younger workers, highlights the need for targeted economic strategies alongside broader monetary policy.

Sources Used:

Morningstar UK: What Rising UK Unemployment Means for Bank of England Rate Cuts - https://global.morningstar.com/en-gb/markets/what-rising-uk-unemployment-means-bank-england-rate-cuts

The Guardian: UK unemployment rate hits five-year high of 5.2% as wage growth cools - https://www.theguardian.com/business/2026/feb/17/uk-unemployment-rate-ons-interest-rates

BBC News: UK jobs market weakens as unemployment rate rises - https://www.bbc.co.uk/news/articles/cg754negn75o

Sky News: Jobless rate hits four-year high - but makes interest rate cut more likely - https://news.sky.com/story/weaker-jobs-market-makes-interest-rate-cut-more-likely-13397766

Proactiveinvestors: UK unemployment rise points to further 'gradual' Bank of England interest rate cuts - https://www.proactiveinvestors.co.uk/companies/news/1071105/uk-unemployment-rise-points-to-further-gradual-bank-of-england-interest-rate-cuts-1071105.html

BMMagazine: UK unemployment rises as wage growth slows, affecting interest rate cut prospects - https://bmmagazine.co.uk/news/uk-unemployment-rises-as-wage-growth-slows-affecting-interest-rate-cut-prospects/

Read More: Tamil Nadu to Present Interim Budget Before Elections