The United Kingdom's job market is exhibiting a notable cooldown. Official figures indicate a rise in unemployment rates, reaching levels not seen in several years, while the pace of wage growth has decelerated. This shift occurs against a backdrop of cautious hiring by businesses and signals potential shifts in economic policy.

Employment Figures Decline Amidst Easing Wage Pressures

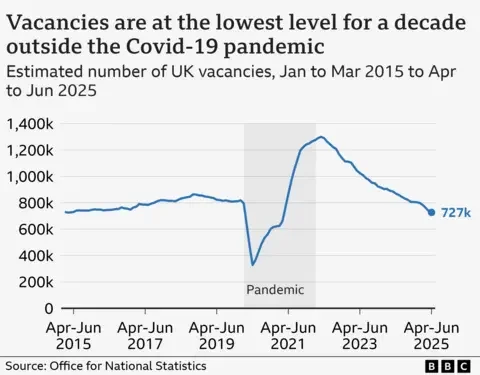

Recent data from the Office for National Statistics (ONS) reveals a weakening in the UK's labour market over the past year. The number of people employed has seen a decline, with sectors such as retail and hospitality reporting job losses. This trend is accompanied by the slowest private sector wage growth in approximately five years. While job vacancies have seen a slight uptick, their overall numbers have remained relatively flat after a sustained period of decrease. Employers appear more hesitant to retain staff or advertise new positions, a sentiment some attribute to recent changes in employer-funded National Insurance contributions and minimum wage adjustments. Simultaneously, an increasing number of individuals are entering the workforce.

Read More: UK Jobs Get Harder to Find, More People Unemployed

Unemployment Rate Edges Upward

The unemployment rate in the UK has climbed, with recent figures indicating a rate of 5.1% between September and November, marking the highest level since early 2021, a period when the world was still dealing with the COVID-19 pandemic and its associated lockdowns. This represents a significant increase from previous periods. Particularly, younger workers, aged 18 to 34, are experiencing higher unemployment rates at 8.7%, suggesting diminished employment prospects for graduates and those at the early stages of their careers.

Wage Growth Moderates Across Sectors

Average earnings growth has shown a marked slowdown. In the three months to October, average earnings growth slipped from 4.9% to 4.7%. Regular pay, excluding bonuses, also decreased from 4.7% to 4.6%. Several private sector industries, including finance, business services, and construction, have seen wage growth fall below 3%. This level is considered by the Bank of England to be consistent with their target of returning inflation to 2%. Public sector wage growth, however, has remained elevated, largely due to pay awards being implemented earlier than in previous years.

Read More: UK Interest Rates Might Be Cut Soon as More People Are Unemployed

Economic Indicators and Policy Implications

The current labour market data suggests a cooling economy, which may influence decisions regarding interest rates. With wage growth easing, economists suggest this strengthens the case for the Bank of England to consider further interest rate cuts. Bank governor Andrew Bailey has indicated he is awaiting further confirmation of a sustained downward trend in inflation before making such decisions. The prospect of cooling wage growth alongside rising unemployment presents a mixed economic outlook, reflecting both efforts to reduce inflation and the emergence of risks related to a broader economic slowdown.

Business Sentiment and Hiring Practices

Employers are exhibiting increased caution regarding hiring and retention. Factors such as budget uncertainty and slowing economic momentum are believed to be weighing heavily on these decisions. The rise in unemployment underscores growing pressure on businesses amidst stalling economic growth. This cautious approach by firms, coupled with policies that increase labour costs, may be contributing to the current state of the job market. Vacancy numbers have also fallen significantly from pre-pandemic levels, indicating a reduced appetite for hiring.

Analysis of Labour Market Data

Official statistics from the ONS form the basis of these observations. However, some sources note that the labour force survey, a key component of this data, has faced challenges with declining response rates, prompting caution in interpreting the figures. Despite these potential limitations, the general trend indicates a weakening labour market. Economists highlight that the easing of pay pressures is a significant development, potentially paving the way for monetary policy adjustments.

Conclusion and Future Outlook

The UK labour market is currently characterized by a combination of rising unemployment and decelerating wage growth. This trend, particularly the slowdown in private sector pay, has significant implications for inflation and monetary policy. While the precise reasons for these shifts are multifaceted, including policy decisions and broader economic conditions, the data points towards a cooling job market. The Bank of England is likely to carefully monitor these indicators as it considers future interest rate decisions. Further data releases will be crucial in determining the trajectory of these trends and their impact on the wider economy.

Sources Used:

The Guardian: Reports on the fall in employed people, slowing wage growth, and employer reluctance to hire.🔗 https://www.theguardian.com/business/2026/jan/20/employed-people-uk-falls-wage-growth-unemployment

Bmmagazine.co.uk (Article 2): Details the rise in the unemployment rate to 5.1%, the slowdown in average earnings growth, and high unemployment among younger workers.🔗 https://bmmagazine.co.uk/news/uk-unemployment-rate-rises-5-1-labour-market-weakens/

Bmmagazine.co.uk (Article 3): Discusses unemployment remaining near a five-year high and easing wage growth, reinforcing expectations of interest rate cuts.🔗 https://bmmagazine.co.uk/news/uk-unemployment-five-year-high-wage-growth-slows/

Bmmagazine.co.uk (Article 4): Reports on slowing wage growth and unemployment reaching a four-year high, presenting a mixed economic picture.🔗 https://bmmagazine.co.uk/news/uk-wage-growth-slows-and-unemployment-rises-to-four-year-high/

The Guardian (Article 5): States that unemployment has hit a near five-year high and wage growth has slowed, referencing the latest labour market figures.🔗 https://www.theguardian.com/business/live/2026/feb/17/uk-unemployment-rate-hits-five-year-high-wage-growth-slows-rachel-reeves-bonds-borrowing-costs-news-updates

BBC News: Highlights the slowdown in private sector wage growth to its lowest rate in five years, while public sector growth remains elevated.🔗 https://www.bbc.co.uk/news/articles/cddgrg87ly5o

Capitalbay.news: Points to private sector pay growth slowing sharply and weak labour data strengthening expectations of a Bank of England interest rate cut.🔗 https://www.capitalbay.news/uk-jobs-market-unemployment-pay-growth-boe

The Guardian (Article 8): Mentions private sector wage growth slowing to its lowest rate in nearly four years, with public sector pay growth rising.🔗 https://www.theguardian.com/business/2025/oct/14/uk-labour-market-job-losses-unemployment-ons

The Guardian (Article 9): Reports on rising unemployment and slowing wage growth, increasing pressure on the Bank of England to cut interest rates.🔗 https://www.theguardian.com/business/2025/jul/17/rise-in-uk-unemployment-and-slowing-wage-growth-add-new-pressure-for-interest-rate-cut

The Guardian (Article 10): Suggests the jobs market is cooling but not collapsing, with some conflicting messages within the labour market data.🔗 https://www.theguardian.com/business/2025/jul/17/the-rise-in-unemployment-shows-the-uk-jobs-market-is-cooling-but-it-is-not-collapsing

BBC News (Article 11): Notes the weakening jobs market making an interest rate cut more likely, and mentions employer caution due to National Insurance contributions.🔗 https://www.bbc.com/news/articles/cg754negn75o

Indeed Hiring Lab: Examines January 2026 labour market trends, highlighting weak hiring appetite and a gradual decline in job postings.🔗 https://www.hiringlab.org/uk/blog/2026/02/02/january-2026-uk-labour-market-update-waning-wage-growth/

Bmmagazine.co.uk (Article 13): Reports unemployment rising to its highest level since the 2021 lockdown and wage growth cooling to its weakest pace in over three years.🔗 https://bmmagazine.co.uk/news/uk-unemployment-rises-to-4-8-wage-growth-cools-2025/

Moneyweek: States that unemployment remains at a multi-year high and wage growth continues to slow.🔗 https://moneyweek.com/economy/uk-wage-growth

Euronews: Discusses UK wages lagging amidst cost pressures and uncertainty, with unemployment rising and vacancy numbers dwindling.🔗 https://www.euronews.com/business/2025/05/13/uk-wage-growth-cools-ahead-of-national-insurance-hike-for-businesses

Morningstar: Reports on declining payrolled employment and continued slowing of earnings growth, indicating fading hiring momentum.🔗 https://global.morningstar.com/en-gb/economy/uk-unemployment-rises-payrolls-pay-growth-slow

Financial Times: Notes that UK unemployment has hit a four-year high as pay growth cools.🔗 https://www.ft.com/content/777a5f71-606a-40b3-892f-71038ff04d68

Read More: UK Job Losses Rise to Highest in 5 Years, Pay Grows Slower