High Stakes for the Chancellor

The United Kingdom's public finances are under intense scrutiny as borrowing costs have sharply increased. Chancellor Rachel Reeves is facing demands to provide reassurance to both Parliament and financial markets. The rising cost of government debt, coupled with a weakening pound, has intensified concerns about the nation's economic stability. This situation places significant pressure on Reeves to navigate difficult choices concerning spending and taxation, with implications for public services and the wider economy.

Context of Financial Strain

In recent months, the UK has experienced a notable increase in its borrowing costs, with gilt yields reaching levels not seen since the financial crisis. This surge in interest rates makes it more expensive for the government to borrow money, potentially impacting its ability to meet fiscal targets.

Read More: UK Jobs Get Harder to Find, More People Unemployed

January 2025: Treasury Minister Darren Jones stated that Reeves would adhere to her promise of borrowing only for investment, despite rising borrowing costs. However, experts noted that these costs could erode Reeves's financial buffer against her fiscal rules, suggesting potential future spending cuts or tax increases. Simultaneously, Reeves was reportedly considering deeper cuts to public services as borrowing costs soared, having ruled out increasing borrowing or taxes. She proceeded with a planned trip to China despite calls to cancel it.

November 2025: Leading up to the Autumn Budget, Reeves was in a delicate position. A pre-Budget speech on November 4th and subsequent public statements, including one on November 5th, did not rule out tax increases, which appeared to signal a shift from previous commitments. Reports emerged of a potential £7.5bn tax rise, with a U-turn on income tax rates, instead opting for a two-year freeze on thresholds. This move was reportedly influenced by market sentiment warning against solely taxing the wealthy to fund spending pledges. Reeves also faced accusations of misleading the public about the state of public finances ahead of the Budget, with Downing Street dismissing these claims. The Institute for Government noted that while Reeves had increased her fiscal headroom, some policy choices arguably undermined long-term fiscal sustainability.

General Context: Throughout 2025, Reeves has been actively managing public finances, balancing the need to address the cost of living crisis with maintaining fiscal stability. This has involved difficult decisions, including proposed cuts to public services, which have led to standoffs with other ministers. There have also been public discussions regarding tax thresholds, such as for state pensioners, with the Treasury indicating that while committed to a fair system, doubling allowances could be costly and untargeted.

Evidence of Financial Pressures

The economic situation has been marked by several key indicators and statements:

Read More: Assam Government Shares Money Plan Before Elections

Rising Borrowing Costs: Gilt yields have reached their highest levels since the financial crisis, making government borrowing more expensive.

Pound Sterling Weakness: The value of the pound has declined, exacerbating economic concerns.

Fiscal Rule Headroom: Experts suggest that recent increases in borrowing costs could significantly reduce the buffer Reeves has built against her main fiscal rule, potentially necessitating future fiscal adjustments.

Policy Statements:

Darren Jones (Treasury Chief Secretary) stated on January 10, 2025, that Reeves would not borrow for day-to-day spending, upholding her commitment to borrow only for investment.

November 2025: Reeves delivered an Autumn Budget with new policies, repeating a pattern of substantial tax rises alongside spending increases in priority areas. However, analysts suggest some choices might undermine fiscal sustainability.

November 4, 2025: In a pre-Budget speech, Reeves did not rule out tax rises, stating she would make "necessary choices" and prepare the public for unpopular decisions.

November 17, 2025: Reports indicated a planned £7.5bn tax rise, stemming from a U-turn on income tax rates.

Public and Market Confidence:

Economists have urged Reeves to make "difficult" choices to boost market confidence and lower borrowing costs, highlighting persistent inflation and high government debt as factors.

Polling data from YouGov and Ipsos in November 2025 indicated that Reform UK leads on public trust regarding the economy.

Downing Street has dismissed claims that Reeves misled the public about the need for tax rises, stating her speeches outlined national challenges.

Internal Government Dynamics: Reeves has faced internal opposition regarding proposed cuts to public services, with ministers arguing against further reductions. She also implemented stricter controls on departmental access to emergency funds ahead of the Budget, emphasizing stability and living within means.

Balancing Fiscal Rules and Public Spending

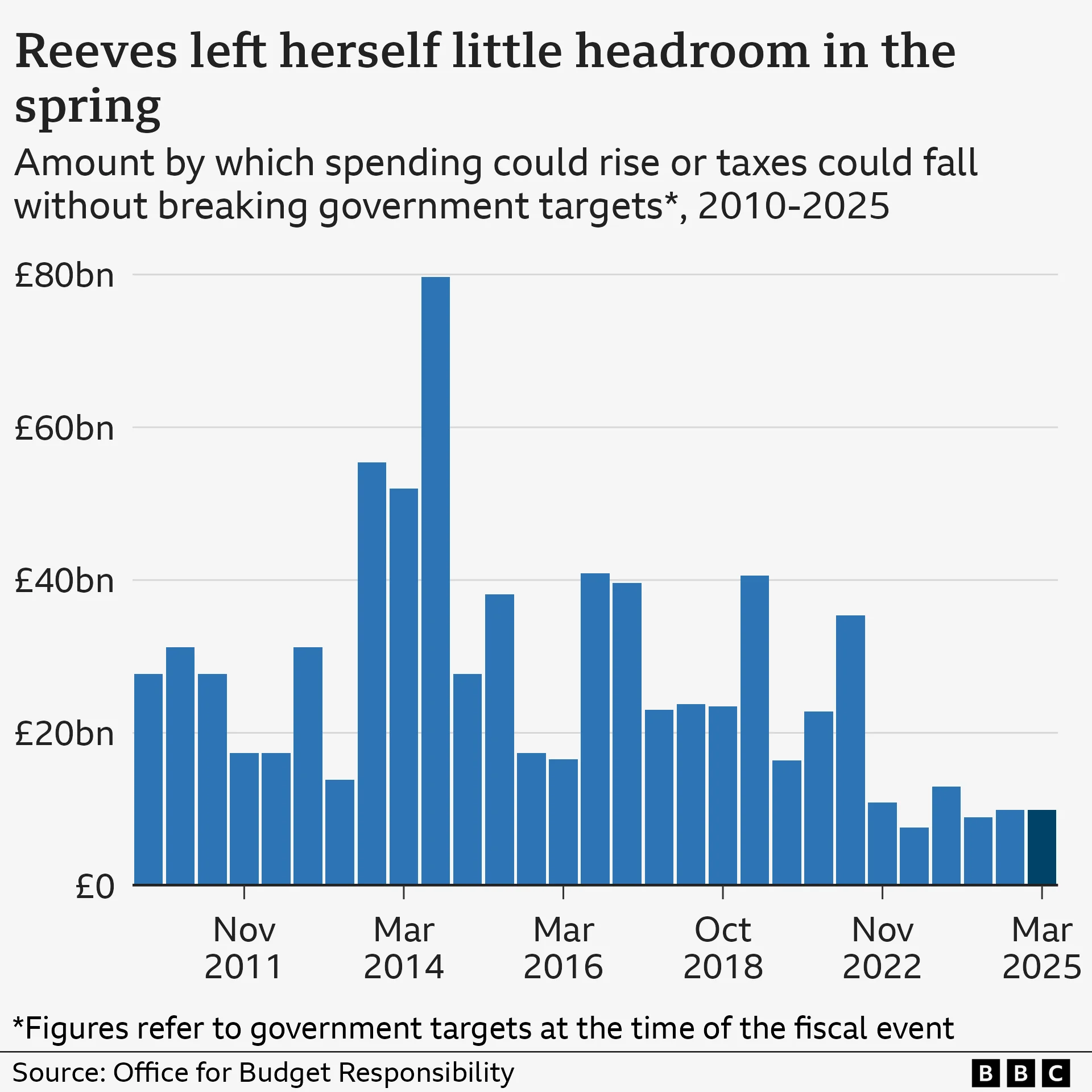

A central challenge for Reeves has been maintaining sufficient "headroom" against her fiscal rules while also addressing pressing public needs.

Read More: UK Interest Rates Might Be Cut Soon as More People Are Unemployed

Fiscal Headroom: The Institute for Government has noted that Reeves has painstakingly built headroom in her budgets. However, this headroom has often been described as "razor thin," leaving her vulnerable to market shocks and forecast adjustments. The need to increase this buffer has been a recurring theme, suggesting that the current levels may not provide adequate resilience.

Public Service Cuts: Reeves has reportedly considered or implemented steeper cuts to public services, particularly in policing and social housing, as a means to repair public finances. This has led to disagreements with other government departments and criticism from affected sectors. However, she has also indicated a desire to avoid austerity and uncontrolled spending, emphasizing that plans for reform are focused on improving systems rather than solely on savings.

Taxation Policy and Public Perception

Reeves's approach to taxation has been a focal point of public and political debate, particularly concerning manifesto pledges.

Read More: UK Job Losses Rise to Highest in 5 Years, Pay Grows Slower

Income Tax and Manifesto Pledges: A significant point of contention has been Reeves's stance on income tax. While a general election manifesto pledge reportedly ruled out hikes, statements in late 2025 suggested a potential U-turn or a nuanced approach, such as freezing thresholds. This has led to accusations of misleading the public and has caused disquiet among some Labour MPs.

Broader Tax Measures: Beyond income tax, other tax measures have been considered or implemented, including potential taxes on higher-value properties, landlords' rental income, and gambling. The Treasury has acknowledged the cost and targeting implications of specific proposals, such as doubling the income tax threshold for state pensioners.

Market Reaction and Confidence

Financial markets have reacted to developments in UK public finances, with Reeves seeking to bolster investor confidence.

Bond Market Volatility: The UK bond market has experienced volatility, driving up borrowing costs. Treasury sources have attributed this to global instability, citing events like the French budget crisis as examples.

Investor Confidence: A "decisive package of tax and spending measures" in the Budget was intended to increase bond investors' confidence and potentially lower borrowing costs. Economists have stressed the importance of Reeves prioritizing difficult decisions to strengthen this confidence.

"Living Within Our Means": Reeves has publicly emphasized the importance of stability and "living within our means" to underpin economic growth in a volatile global environment, a message aimed at both markets and her own MPs.

Expert Analysis and Guidance

Economists and think tanks have offered perspectives on Reeves's fiscal strategy.

Read More: UK Jobs Market Slows Down: More People Unemployed, Wages Grow Slower

The Institute for Government has advised Reeves to use the Budget to reset her fiscal strategy, emphasizing the need for greater headroom against fiscal rules and a clear articulation of her tax and spending plans to ensure public and market understanding.

Economists from bodies like the Resolution Foundation have suggested Reeves should aim to double her fiscal headroom to reassure markets about the government's focus on economic stability.

Former economic policy adviser Nick Williams commented that investors would welcome Reeves's stated priorities and consistent messaging.

Conclusion and Future Implications

The evidence indicates that Chancellor Rachel Reeves is operating under considerable pressure due to rising UK borrowing costs and broader economic uncertainty. Her administration has implemented a strategy that involves substantial tax increases alongside spending priorities, while attempting to maintain fiscal discipline and adhere to fiscal rules.

Key Findings:

Significant pressure exists to reassure markets and MPs regarding public finances.

Borrowing costs have risen sharply, impacting the government's debt management.

Reeves has maintained a commitment to borrowing only for investment but has faced scrutiny over potential tax rises and public service cuts.

Balancing manifesto pledges with fiscal realities, particularly concerning income tax, has been a persistent challenge.

The need for greater "headroom" against fiscal rules is widely acknowledged.

Implications: The decisions made by Reeves will have direct consequences for public services, household finances, and investor confidence. Her ability to effectively communicate and implement a credible fiscal strategy is crucial for navigating the current economic climate.

Next Steps: Ongoing monitoring of borrowing costs, inflation, and market reactions will be essential. Further statements and policy announcements from the Treasury will clarify the long-term direction of fiscal policy under Reeves's leadership. The public's perception of the government's economic management will likely remain a key factor in political discourse.

Sources

The Guardian:

Treasury minister moves to reassure markets after UK borrowing costs soar

Autumn budget 2025: What did we learn from Rachel Reeves’ announcements? (This link is to the Institute for Government, not The Guardian, but is categorized under it due to article content)

Rachel Reeves looks for extra headroom in budget to insulate UK economy against bond market

Britain’s wealthy must shoulder burden of rebuilding ‘creaky’ public services, Rachel Reeves says

Reeves in standoff with ministers over proposed cuts to public services

Reeves mulls deeper cuts to public services as borrowing costs soar

UK budget to target cost of living crisis as Reeves battles to keep Labour MPs on side

Rachel Reeves plans £7.5bn tax rise in budget after U-turn on income tax rates

BBC News:

Chancellor says she can be trusted with the UK's finances despite claims she misled the public

Institute for Government:

Autumn budget 2025: What did we learn from Rachel Reeves’ announcements?

Rachel Reeves should use the budget to reset her fiscal strategy

LBC:

Economists urge Reeves to make ‘difficult’ choices to boost market confidence

Daily Star:

Brits demand change as MP forced to debate major tax threshold

/pratidin/media/media_files/2026/02/17/assam-budget-interim-2026-27-presented-2026-02-17-16-57-11.webp)