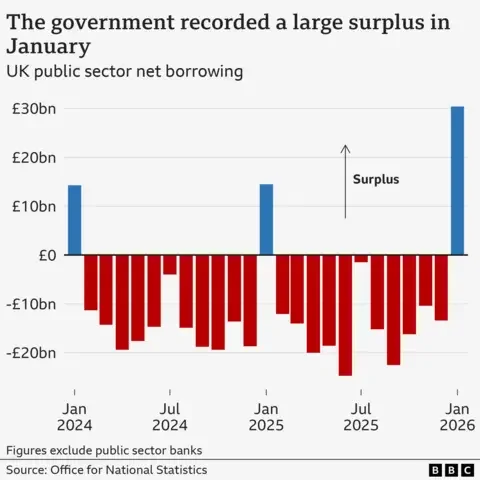

In a notable shift in government finances, the United Kingdom recorded its largest ever monthly budget surplus in January, reaching £30.4 billion. This unexpected fiscal improvement, driven by a surge in tax revenues and lower interest payments on national debt, provides a significant financial boost ahead of the upcoming Spring Statement. While this marks a record for a single month, analysts caution that the public finances remain under strain due to ongoing economic conditions and borrowing levels.

Fiscal Overview: January's Record Performance

Official figures released by the Office for National Statistics (ONS) detail a £30.4 billion budget surplus for January. This means the government collected more money in taxes and other income than it spent during that month. This figure represents the highest surplus recorded for any single month since official records began in 1993.

Key factors contributing to this record surplus include:

Read More: UK Jobs Get Harder to Find, More People Unemployed

Increased Tax Receipts: A significant rise in income tax and capital gains tax payments was a primary driver.

Self-assessed tax payments, typically high in January, were bolstered by a substantial increase in capital gains tax.

The government's decision to freeze income tax thresholds has led to more individuals being pulled into higher tax brackets as their incomes grow, thereby increasing overall tax collection.

Reduced Debt Interest Payments: Lower interest rates on government borrowing meant the state spent less on servicing its debt. This offset some of the increased costs associated with public services and benefit payments.

The surplus in January was double that of January 2025, signaling a substantial year-on-year improvement for the month. This data is particularly significant as it provides the final borrowing figures before Chancellor Rachel Reeves presents her Spring Statement on March 3rd.

Factors Influencing the Surplus

Tax Revenue Surge

The substantial increase in tax revenue was a pivotal element in achieving the record surplus. The Office for National Statistics highlighted that self-assessed tax payments are traditionally strong in January. However, this year was exceptionally so, largely due to a significant uplift in capital gains tax.

Evidence suggests that investors sold assets in anticipation of potential interest rate increases, leading to a surge in capital gains tax payments. This phenomenon is noted as a key contributor to the surplus.

Debt Servicing Costs

A secondary, yet important, factor was the reduction in the cost of servicing the national debt. Lower prevailing interest rates meant that the government's expenditure on interest payments was less than in previous periods.

While this reduced immediate outgoing costs, it also highlights a vulnerability. Higher spending on debt servicing can expose public finances to economic shocks.

Government Spending

Despite increased costs in certain public services and benefits, overall government spending did not outpace the record tax income. This relative stability in spending, combined with the revenue surge and lower interest payments, collectively resulted in the surplus.

Read More: Assam Government Shares Money Plan Before Elections

The Treasury's strategy of careful financial planning is cited as a benefit, even as borrowing levels remain a policy concern.

Expert Perspectives and Cautions

While the January surplus is a significant positive development, experts offer a nuanced view.

Henning Diederichs, a senior technical manager at the Institute of Chartered Accountants in England and Wales, acknowledged the record surplus but stressed that "the public finances continue to be in a difficult position." He indicated that the surplus, while welcome, does not erase underlying fiscal challenges.

Concerns have been raised that the January tax revenue figures might be a "one-off" event. Factors such as anaemic economic growth and a rising unemployment rate could potentially stall future tax revenues.

The reliance on increased capital gains tax, partly driven by investors selling assets, suggests that the current revenue stream may not be sustainable in the long term.

Implications and Future Outlook

The record-breaking surplus offers a temporary reprieve and a stronger position for the government as it navigates fiscal policy.

Boost for the Chancellor: The figures provide a positive backdrop for Chancellor Rachel Reeves as she prepares her Spring Statement, potentially offering more flexibility for policy announcements.

Ongoing Fiscal Challenges: Despite the monthly surplus, the overall level of government borrowing and the long-term health of public finances remain key concerns. Policymakers are focused on strategies to manage debt and protect public services.

Need for Sustainable Growth: The data underscores the importance of achieving consistent economic growth to ensure a steady and reliable tax income, rather than relying on potentially temporary surges in specific tax types.

| Factor | Impact on January Surplus | Long-term Consideration ||—-|—-|—-|| Tax Receipts | Significantly increased (income tax, capital gains tax) | Risk of being a "one-off"; dependent on economic conditions. || Debt Interest Payments | Decreased due to lower interest rates | Highlights vulnerability to interest rate fluctuations. || Government Spending | Stable relative to income | Ongoing pressure on public services and benefits. || Economic Growth | Anaemic | Potential to stall future tax revenues. |

Conclusion

The UK's record £30.4 billion budget surplus in January is a significant fiscal event, driven by robust tax collections and reduced debt interest costs. This achievement provides a timely boost to government finances and a favorable context for the upcoming Spring Statement. However, it is crucial to recognize that this monthly surplus does not resolve the broader challenges facing the UK's public finances. The sustainability of tax revenues, the impact of economic growth, and the management of national debt remain critical areas requiring continued attention and strategic policy interventions.

Read More: UK Interest Rates Might Be Cut Soon as More People Are Unemployed

Key Sources

Financial Times: https://www.ft.com/content/03a830d8-6baf-4f22-8e14-758ec449b291

Context: Full access article providing in-depth financial reporting.

Context: News report detailing the surplus, its causes, and the economic factors at play.

The Guardian: https://www.theguardian.com/politics/2026/feb/19/uk-reports-record-breaking-surplus-rachel-reeves

Context: Political analysis of the surplus and its impact on the Chancellor.

Sky News: https://news.sky.com/story/record-breaking-budget-surplus-as-governments-tax-income-rises-13509835

Context: News report focusing on the rise in tax income and potential risks.

The English Chronicle: https://theenglishchronicle.com/News/13378/

Context: Report on the surplus, emphasizing capital gains tax and policy concerns.

The Independent: https://www.independent.co.uk/news/uk/politics/rachel-reeves-borrowing-surplus-ons-spring-statement-b2924242.html

Context: News report highlighting the surplus as a boost for the Chancellor and detailing ONS figures.

/pratidin/media/media_files/2026/02/17/assam-budget-interim-2026-27-presented-2026-02-17-16-57-11.webp)