Recent stock market movements present a complex picture, with upward momentum in some areas met by caution and decline in others. This divergence stems from a blend of economic uncertainties, selective investor interest, and the ongoing influence of technological advancements, particularly in artificial intelligence.

Economic Crosscurrents and Market Reaction

The U.S. economy faces pressures from persistent inflation, global supply chain disruptions, and rising energy costs. These factors contribute to a cautious sentiment on Wall Street, prompting close observation of the Federal Reserve's policy decisions. Any shift in the Fed's stance could influence market direction and potentially increase volatility.

Economic Headwinds: Inflation, supply chain issues, and energy costs continue to affect the U.S. economy.

Investor Caution: Wall Street is reacting with care due to looming concerns about inflation, interest rates, and geopolitical events.

Federal Reserve Focus: The central bank's upcoming actions are seen as a significant factor for market sentiment.

AI Sector's Bifurcated Performance

The artificial intelligence sector, a significant driver of recent market activity, is exhibiting a highly selective pattern of investment. While major players and companies with established revenue streams and critical infrastructure are attracting capital, other AI-focused entities are experiencing sell-offs.

Read More: IRS Warns Unpaid Taxes Can Cost More Due to Fines and Interest Starting Now

Selective Investment: Capital is flowing into AI leaders with proven income, while other AI companies see reduced investment.

Maturing Investor Behavior: This divergence suggests a more discerning approach from investors within the AI space.

Future Focus: Corporate earnings, especially from AI companies, will be key to understanding the real-world impact and monetization of AI investments. Opportunities are expected in specialized AI hardware, software, and services that help with AI adoption.

Small-Caps and Market Breadth

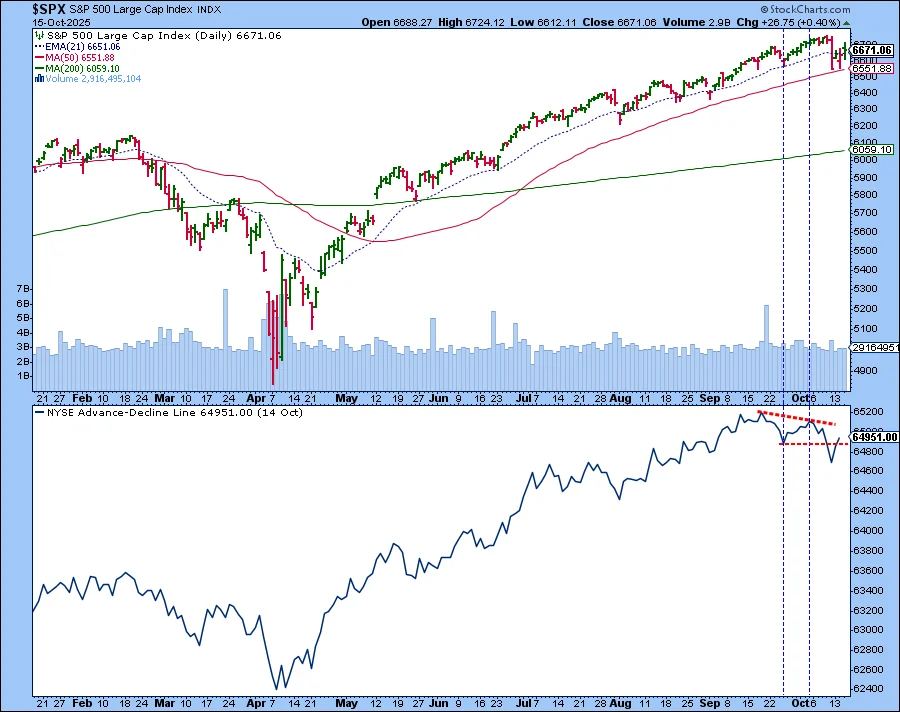

Historically, a rally in small-capitalization stocks signals a healthier and broader market. However, the current environment suggests this indicator may not provide a clear signal, as market swings appear largely driven by headlines. This raises questions about the true underlying strength of the market.

Small-Cap Indicator: Traditionally, rising small-caps suggest market health.

Headline Influence: Recent market movements seem heavily influenced by news cycles.

Uncertainty: The broad market appears hesitant, despite pockets of strength.

Options Market and Volatility

Analyzing market expectations around earnings announcements through the options market reveals a sophisticated dynamic. The options market already prices in expected volatility around earnings. Therefore, comparing this implied movement against actual historical performance during past earnings reveals that the options market is not always a perfect predictor.

Options Pricing: The options market factors in expected stock movement around earnings.

Sophisticated Trading: Some experts advocate for trading based on how earnings are priced, rather than the earnings themselves.

Valuation Hurdles: Current market valuations contribute to this complex pricing.

Global Market Performance

Global equity markets have shown resilience amidst mixed economic data. While U.S. markets have performed strongly, performance outside the U.S. has been more varied, influenced by regional economic conditions and local pressures. Central banks worldwide are under scrutiny for potential policy shifts that could affect global markets.

Read More: Jeremy Clarkson Faces Backlash for Calling £6.50 Pint 'Ludicrous' While His Pub Charges £7

Global Stability: Equity markets have remained stable despite varied economic indicators.

Central Bank Watch: Decisions from central banks, including the Federal Reserve, Bank of England, Bank of Japan, and Bank of Canada, are closely monitored.

Varied Regional Performance: Markets outside the U.S. show mixed results, shaped by local factors.

Expert Analysis

"When news headlines drive the market, stocks could take the elevator down." - Article 1

"This involves comparing the options market’s implied movement for a stock against its actual historical movement during past earnings announcements. The flaw, he explains, is that the options market already prices in the expected volatility around earnings announcements." - Article 2

"This divergence also points to a maturation in investor behavior within the AI space." - Article 3

"With concerns over inflation, interest rates, and geopolitical tensions still looming large, Wall Street has been reacting cautiously." - Article 4

"Global equity markets remained stable last week despite a flurry of mixed economic indicators." - Article 5

"Markets churn as summer slowdown begins, mixed economic data signals caution" - Article 6

Conclusion and Outlook

The current stock market landscape is characterized by conflicting signals and selective investor activity. While broad market indices may show gains, the underlying economic environment presents significant challenges, including inflation and geopolitical uncertainties. The AI sector, a key driver, is experiencing a distinct divide between established leaders and other players. The effectiveness of traditional market indicators like small-cap performance is being questioned due to headline-driven volatility. Investors are carefully navigating these mixed signals, with central bank policies and corporate earnings expected to play crucial roles in shaping future market trends. The degree to which economic headwinds and the selective nature of technological investment will continue to create a churn in the market remains an open question.

Sources:

The Stock Market’s Sending Mixed Signals: Here’s How to Decode Them

Published: Oct 16, 2025

Link: https://articles.stockcharts.com/article/stock-market-sending-mixed-signals-how-to-decode-them/

Decoding the Market's Mixed Signals - Hampton Global Business Review

Published: Jul 22, 2025

Market's Mixed Signals: Dow Jumps as Nvidia Soars Near Highs, Yet AI Sector Sees Selective Sell-Off | FinancialContent

Published: Oct 3, 2025

Stock Market Shows Mixed Signals Amid Economic Uncertainty – NV Today

Published: Jun 5, 2025

Link: https://nvtoday.com/stock-market-shows-mixed-signals-amid-economic-uncertainty/

Global resilience amid mixed signals

Published: Sep 15, 2025

Link: https://moneybase.com/blog/news/global-resilience-amid-mixed-signals

Markets churn as summer slowdown begins, mixed economic data signals caution | FXStreet

Published: Jun 2, 2025