Recent reports indicate that Anduril Industries remains a private entity, with no immediate public stock offerings announced. Access to its shares before a potential Initial Public Offering (IPO) is generally restricted to a select group of investors, primarily accredited investors, and available through specific, limited platforms.

For most retail investors, direct investment in Anduril stock is not currently possible. The company operates as a privately held firm, meaning its shares are not traded on public stock exchanges like the New York Stock Exchange (NYSE) or NASDAQ. This situation creates a significant barrier for the general public seeking to gain exposure to the company's growth.

Anduril's Current Investment Landscape

Several sources confirm Anduril's private status and the resultant limitations on investment.

No Public Trading: Multiple articles emphasize that Anduril is not publicly traded. This means there is no official stock symbol or real-time stock price chart available to the public.

Limited Access for Retail Investors: The consensus is that ordinary investors cannot buy Anduril stock directly.

Pathways for Accredited Investors

While direct public access is unavailable, a few avenues are described for specific investor types:

Read More: SPY ETF: A Simple Way to Invest in Big U.S. Companies

Secondary Markets: Platforms like Hiive and IPO CLUB are mentioned as places where accredited investors may find opportunities to purchase Anduril shares in the secondary market, before any potential IPO. These are described as "secondary allocations" and are subject to availability and seller participation.

Special Purpose Vehicles (SPVs): IPO CLUB specifically notes the use of Single-Name SPVs as a mechanism for accredited investors to gain access to private company allocations.

Definition of Accredited Investor: The term "accredited investor" typically refers to individuals who meet certain income or net worth thresholds, or institutions with specific financial qualifications, as defined by regulatory bodies. This is a critical distinction as it excludes a broad segment of the investing public.

Investment Alternatives and Broader Market Exposure

For those unable to access Anduril directly, alternative investment strategies are suggested:

Exchange-Traded Funds (ETFs): Investors interested in the broader defense or AI technology sectors can consider ETFs that hold shares in companies operating in these fields. The SPDR S&P Kensho Future Security ETF (FITE) is cited as an example, focusing on defense, AI, robotics, and drone companies.

Publicly Traded Defense Companies: Looking at established, publicly traded defense contractors like Lockheed Martin is presented as another way to gain exposure to the sector, though these companies may have different business models and focus areas compared to Anduril.

What Anduril Does

Anduril Industries is identified as a defense technology company. Its specialization lies in:

Autonomous vehicles

Machine learning

Artificial intelligence

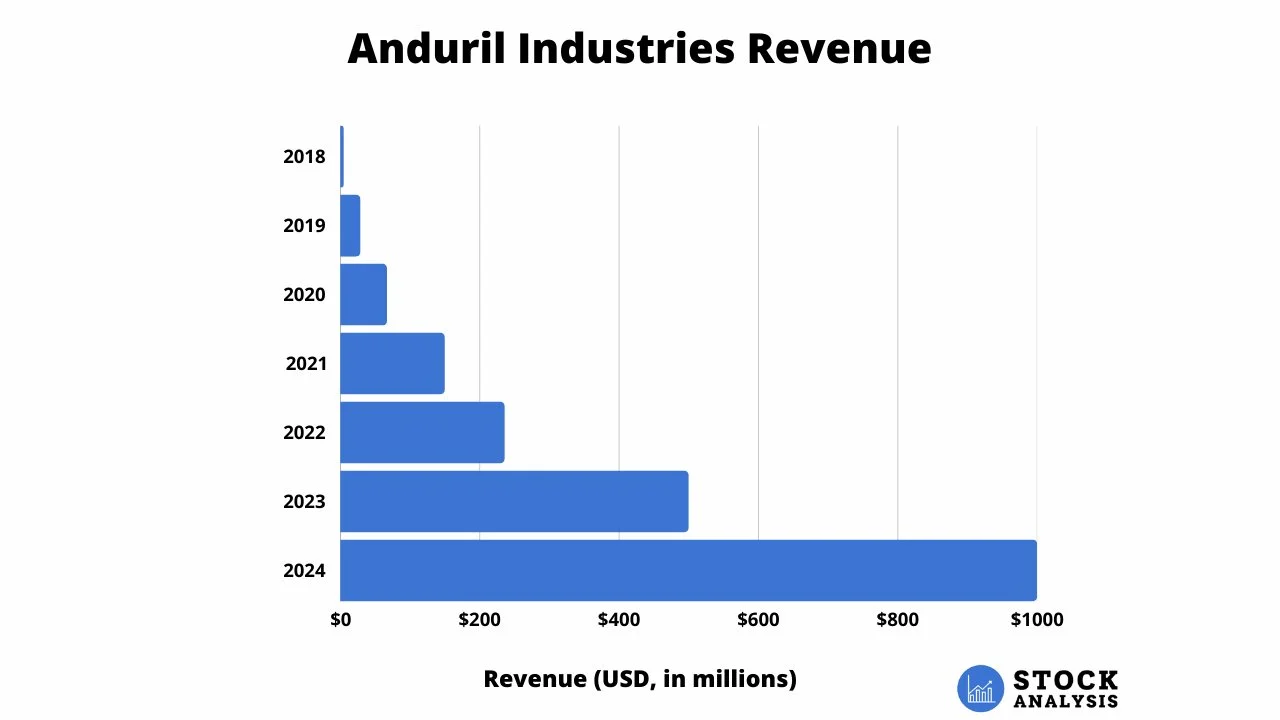

The company has reportedly experienced revenue growth, securing numerous contracts.

Risks Associated with Pre-IPO Investing

Investing in private companies, especially pre-IPO, carries inherent risks. These can include:

Illiquidity: Shares in private companies are often difficult to sell quickly compared to publicly traded stocks.

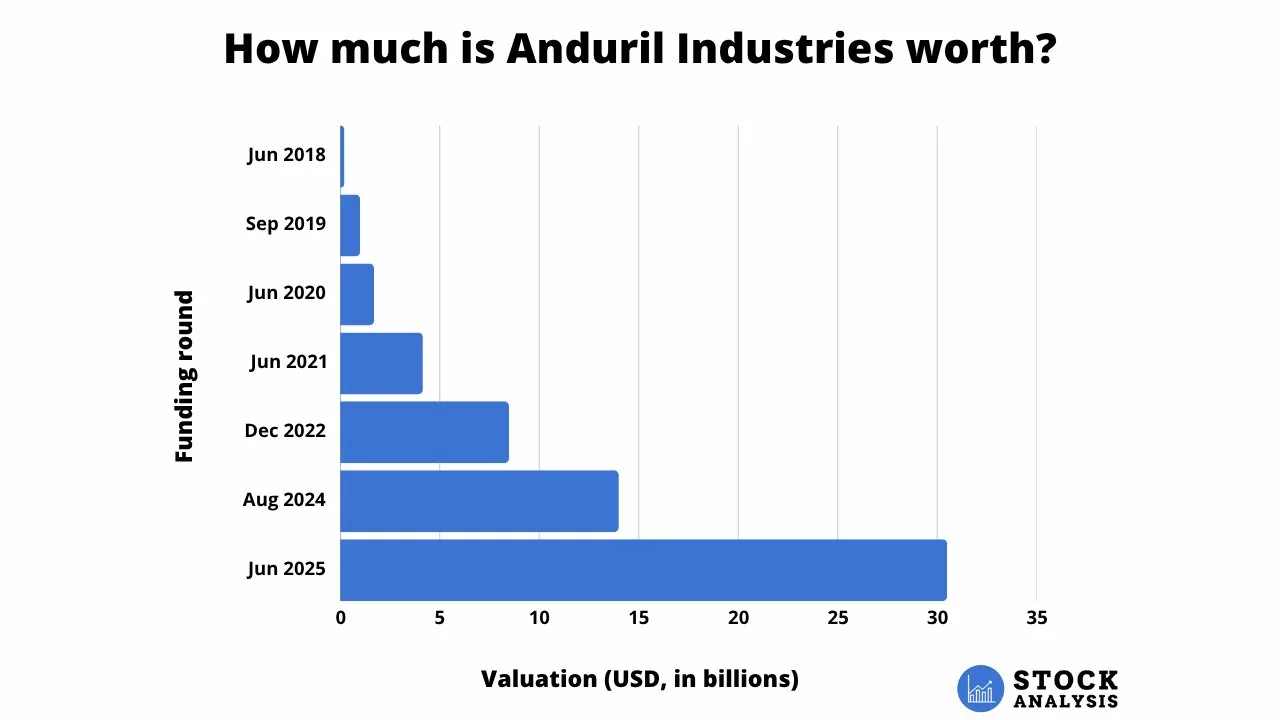

Valuation Uncertainty: Valuations for private companies can be more subjective and volatile.

Lack of Public Disclosure: Private companies are not subject to the same stringent public reporting requirements as publicly traded companies, potentially leading to less transparency.

Conclusion

As of the latest available information, Anduril remains a private company. Direct investment opportunities for the general public are virtually nonexistent. While accredited investors may find limited access through secondary markets and specialized platforms, the path to acquiring Anduril shares is complex and exclusive. For others, investing in related ETFs or publicly traded defense companies represents the primary means of gaining exposure to the sectors in which Anduril operates. The timeline for any potential Anduril IPO has not been publicly disclosed.

Used Sources:

traderhq.com/how-to-buy-anduril-stock/ - States retail investors cannot buy Anduril stock directly as it's a private company.

forgeglobal.com/insights/how-to-invest-in-anduril-pre-ipo/ - Confirms pre-IPO Anduril stock is not available to the general public.

fool.com/investing/how-to-invest/stocks/how-to-invest-in-anduril-stock/ - Mentions ordinary investors are "out of luck" for Anduril stock and suggests ETFs like FITE.

stockanalysis.com/article/invest-in-anduril-stock/ - Suggests accredited investors might buy via Hiive and notes Anduril's revenue growth.

wallstreetzen.com/blog/how-to-buy-anduril-stock/ - States Anduril is not publicly traded and has no stock price.

ipo.club/deals/anduril - Highlights IPO CLUB providing accredited investors access via Single-Name SPVs and notes availability can change.

tradingbrokers.com/how-to-buy-anduril-stock/ - Confirms Anduril is privately held and that buying stock is more challenging than public companies.

upmarket.co/private-markets/pre-ipo/anduril/ - States Anduril is privately held and questions about going public remain.