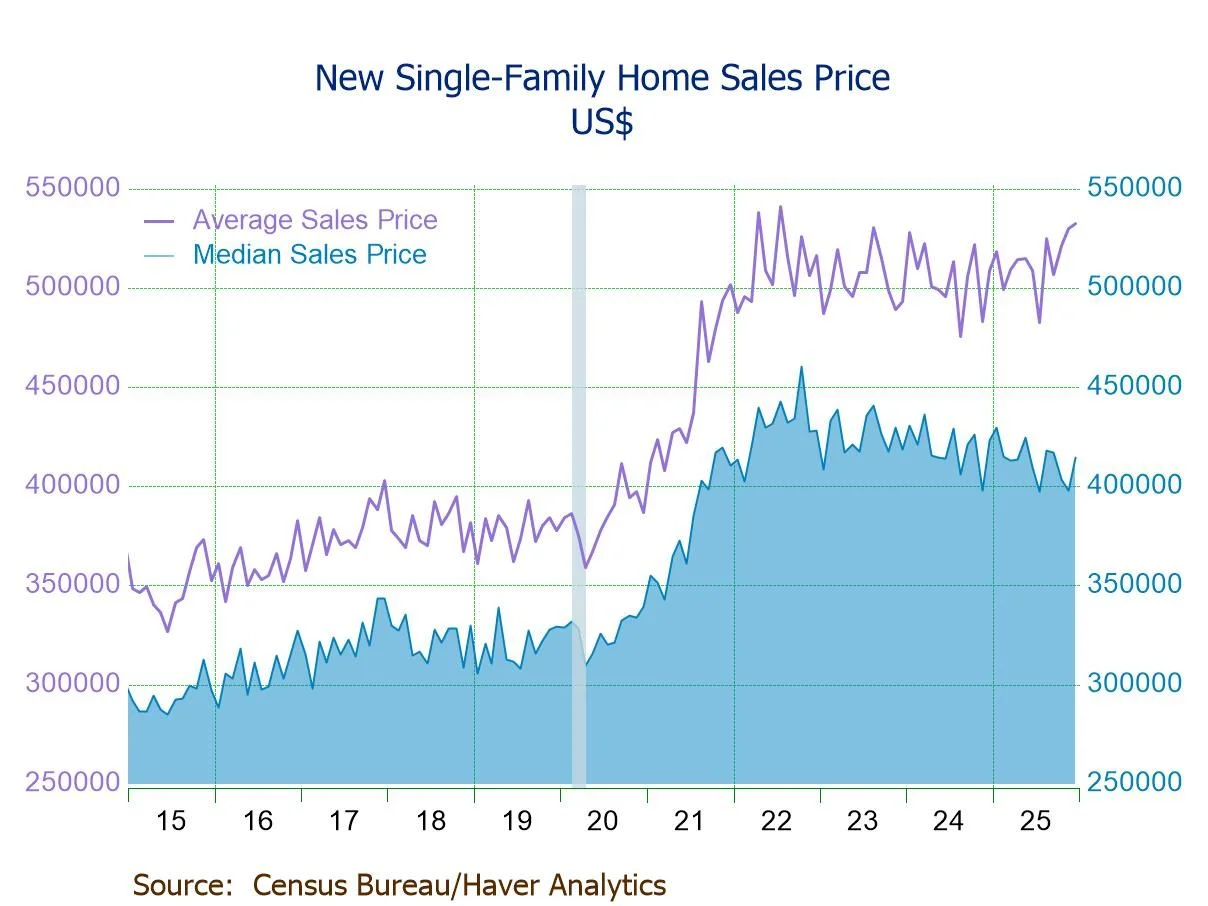

New home sales dropped at the end of 2025, a trend that coincided with a decrease in available homes for sale. This cooling in activity happened despite builders using price cuts and other deals to attract buyers. Meanwhile, contracts for existing homes also saw a notable decline, pointing to broader challenges in the housing market.

Market Activity in December 2025

New home sales, which are recorded when a sales contract is signed, showed a decline in December. Data suggests that builders were working to reduce the number of homes they had on hand.

New single-family home sales fell in December 2025.

Housing inventory for new homes also decreased, falling from 485,000 units in November to 472,000 units in December.

At the sales pace seen in December, it would take 7.6 months to sell all available new homes, a slight reduction from 7.7 months in November.

Factors Affecting Home Sales

Several factors appear to have influenced the slowdown in both new and existing home sales.

Builder Incentives and Costs

Builders continued to offer incentives like price cuts and interest rate reductions to encourage sales. However, the persistent high costs of labor, land, and materials are squeezing builder profits. This suggests that the ability to offer further discounts may be limited.

Read More: How Property Taxes Are Calculated in Your Area and Why They Matter

Builders are leaning on incentives to move inventory.

Costs for labor, land, and materials remain elevated.

Builder margins are being squeezed.

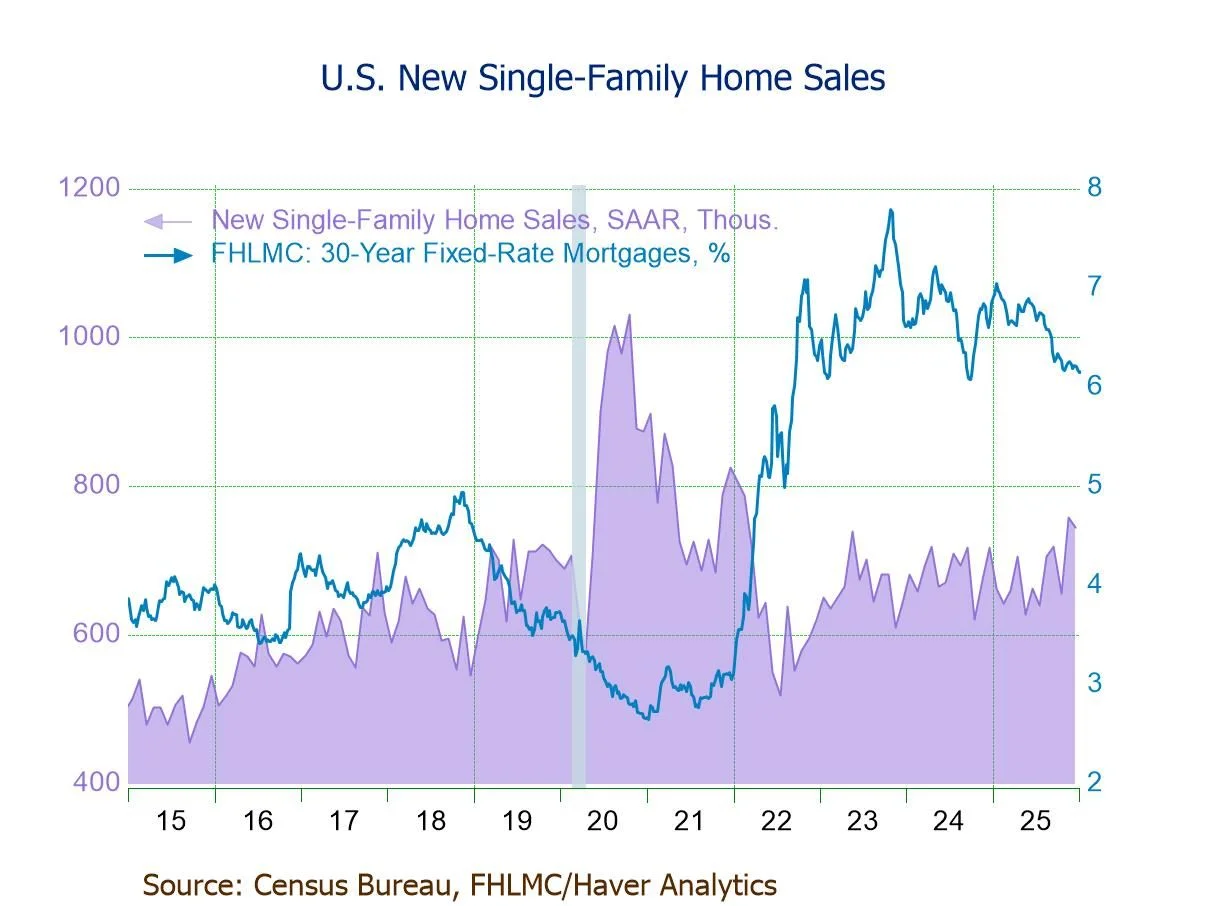

Mortgage Rates and Affordability

While mortgage rates remained relatively steady in December, they have not moved significantly lower. This lack of improvement, combined with already tight housing supply, has presented challenges for potential buyers.

Mortgage rates barely moved in December.

This is slightly lower than the summer, but buyers faced fewer homes available.

Existing Home Sales Decline

Contracts for existing homes, a measure of sales activity, also dropped sharply in December. This decline was attributed to a combination of stagnant mortgage rates, falling housing supply, and general economic uncertainty.

Pending home sales dropped 9.3% from November to December.

This was 3% lower than December 2024.

The typical home spent 60 days on the market, the slowest pace in a decade.

Regional Variations and Buyer Demographics

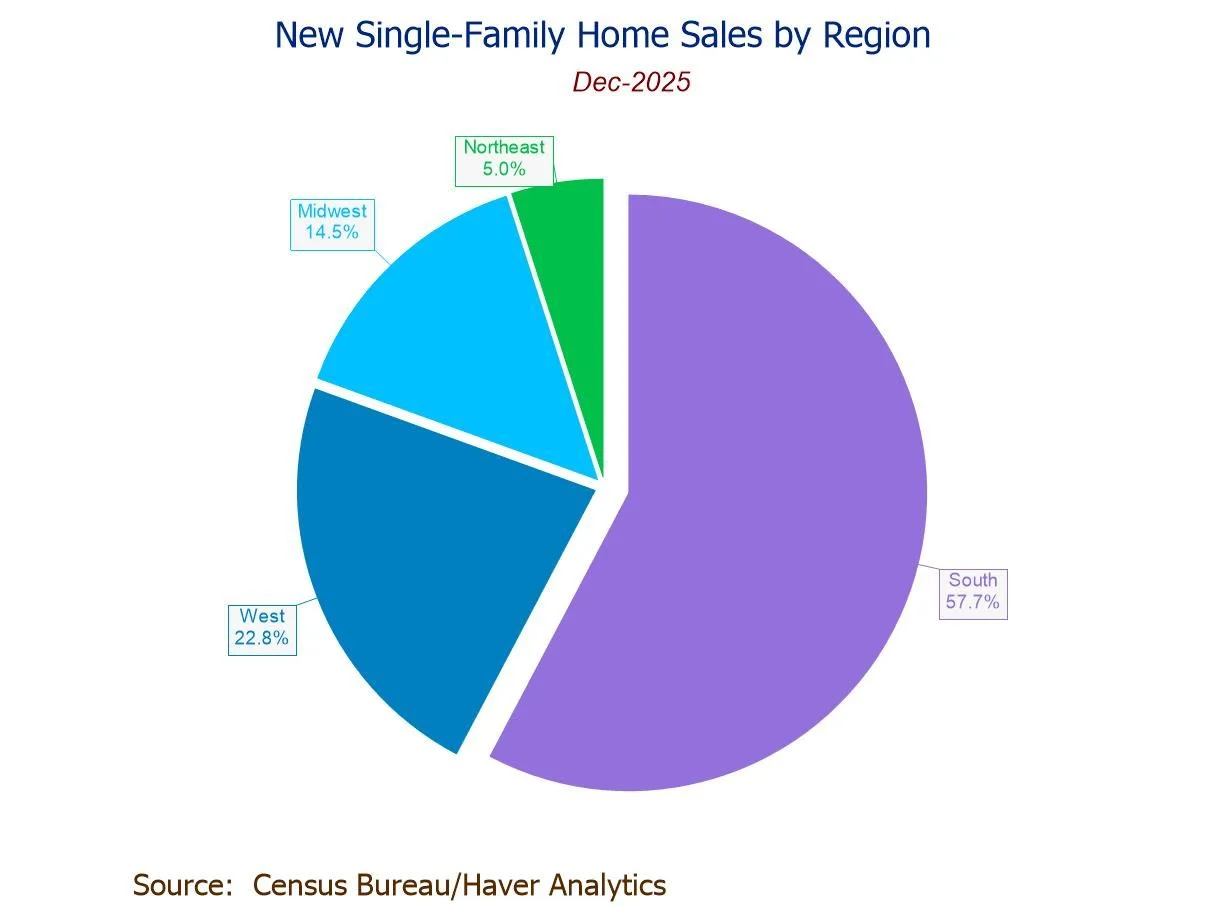

While national trends show a slowdown, some regional markets experienced growth. The South and Midwest, in particular, saw some areas with strong year-over-year gains in pending sales. However, all four major U.S. regions reported month-over-month declines in pending sales, with the Midwest seeing the steepest drop.

All regions posted month-over-month declines in pending sales.

The South led in stronger new home sales to end the year.

Some localized markets showed strong year-over-year growth, especially in the South and Midwest.

Changes in buyer demographics were also noted, with economists pointing to historically low housing inventory as a primary reason for reduced buyer activity.

Read More: Nauru's Economy Changes After Phosphate Mines Close in 1990s

Expert Insights

According to KPMG Senior Economist, builders are still using incentives, but "that lever isn’t unlimited." The report also notes that "All regions posted stronger sales to end the year, with the South leading the pack."

The National Association of Realtors indicated that pending home sales dropped, and sales were lower than the previous year. CNBC reported that "Stagnant mortgage rates, falling housing supply and ongoing economic uncertainty weighed heavily on homebuyers in December."

Conclusion and Implications

December 2025 saw a downturn in new home sales, accompanied by a reduction in new home inventory. This aligns with a significant drop in pending sales for existing homes, driven by steady mortgage rates, limited supply, and broader economic concerns. While some localized markets showed resilience, the overall trend suggests a cooling housing market at the close of 2025. The ongoing tension between elevated building costs and the need for incentives may continue to affect builder activity and profitability. The extent to which the slight decrease in inventory might stimulate new construction remains a point of observation.

Read More: New Mexico Ranch Linked to Jeffrey Epstein Sold to Texas Politician's Family

Sources:

KPMG: https://kpmg.com/us/en/articles/2026/december-2025-new-home-sales.html

Summary Context: Provides insights on new home sales, builder incentives, and regional performance, highlighting the squeeze on builder margins due to rising costs.

Haver Analytics: https://www.haver.com/articles/u-s-new-home-sales-decline-in-december-after-november-s-jump

Summary Context: Reports on the decline in new home sales, noting the recording method (sales contract signing) and providing a forecast expectation for December sales.

Summary Context: Details the sharp drop in pending home sales for existing homes, attributing it to mortgage rates, supply issues, and economic uncertainty.

Crezzio: https://crezzio.com/housing/us-pending-home-sales-plunge-december

Summary Context: Discusses the national slowdown in pending home sales while acknowledging localized growth, particularly in the South and Midwest, and identifies low inventory as a key factor.

U.S. News & World Report: https://money.usnews.com/investing/news/articles/2026-02-20/us-new-home-sales-fall-in-december-inventory-declines

Summary Context: Reports on the fall in new home sales and the progress builders made in reducing inventory, noting the month-end supply figure.

Redfin: https://www.redfin.com/news/home-sales-fall-december-2025/?msockid=00947571a39369f612426276a27968f7

Summary Context: Highlights that pending home sales fell to near pandemic-era lows (excluding the start), notes the longest market time for homes in a decade, and observes sellers retreating as buyers do.

Summary Context: Reports a dip in pending U.S. home sales, questioning if it's a trend or seasonal "winter blues," and mentions that the time homes take to sell is increasing.

)

)