Recent reports indicate that TurboTax is providing a promotion for free federal and state tax filing, primarily through its mobile application. This offer, however, comes with specific eligibility requirements and a deadline, prompting examination of its scope and comparison with other free filing options.

The promotion centers on the TurboTax mobile app, which is presented as a straightforward and transparent method for tax preparation. Users who file their federal and state returns using DIY TurboTax products via the app can take advantage of this offer. A key condition appears to be that this free filing opportunity is available until February 28. Some reports suggest that those who used TurboTax in the previous year might not qualify for this particular promotion, though they may still be eligible if they used the service in earlier years.

Read More: Homeowners Can Save Money on Taxes

Context of Free Tax Filing Options

The availability of free tax filing services is not unique to TurboTax. The Internal Revenue Service (IRS) itself offers an "IRS Free File" program. This program partners with various tax preparation companies to provide free online tax preparation and filing.

IRS Free File: This program allows individuals to file their federal tax returns for free. It offers two main options: guided tax software or Free File Fillable Forms. The IRS emphasizes that users must access these services through the official IRS.gov website to qualify; going directly to a partner’s commercial website may negate eligibility for the free program. Notably, IRS Free File is generally for the current tax year only.

Commercial Competitors: Several commercial tax preparation companies also offer free tiers for their services. Cash App Taxes is cited as a service that processes both federal and state taxes without charge. Its no-cost plan is designed for simpler tax situations, including those reporting W-2 income, claiming the Child Tax Credit, Earned Income Tax Credit, student loan interest deductions, and certain interest and dividend income.

TurboTax's Free Filing Promotion Details

The TurboTax promotion appears to be specifically tied to its mobile app. Reports highlight that this app provides a direct and transparent path to free filing, contrasting it with competitors who might create an impression of free filing while subsequently charging for state returns.

Read More: More People Buying Annuities with Bigger Pension Pots

Eligibility: The offer is for eligible filers. A notable exclusion criterion mentioned is if a user filed with TurboTax in the immediately preceding year. However, past usage in earlier years might not preclude eligibility.

Scope: The promotion aims to cover both federal and state DIY tax filing.

Duration: The free filing opportunity is scheduled to end on February 28.

Integration: The TurboTax app is noted for its integration with Credit Karma, where users might see pre-filled information from their Credit Karma profile, potentially saving time. Early refund deposits into a Credit Karma Money Account could also lead to receiving refunds up to five days sooner.

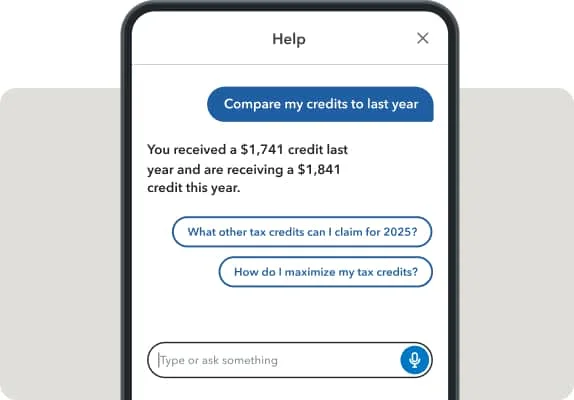

Guarantees: TurboTax offers a "Max Refund Guarantee" and accuracy checks within its service.

Comparison of TurboTax Free Filing with IRS Free File

| Feature | TurboTax Free Filing (Mobile App) | IRS Free File (Guided Software/Fillable Forms) |

|---|---|---|

| Provider | TurboTax (Intuit) | Internal Revenue Service (IRS) via partner companies |

| Federal Filing | Yes | Yes |

| State Filing | Yes (stated as part of the promotion) | Varies by partner; Fillable Forms are federal only; some software may offer |

| Eligibility | Specific criteria, excluding those who filed with TurboTax last year | Income limitations may apply for guided software; fillable forms are broader |

| Deadline | February 28 | Generally tied to tax season deadlines |

| Access Method | TurboTax Mobile App | IRS.gov website (must access via IRS portal) |

| Tax Situations | Broad DIY filing, including federal and state | Guided software handles specific situations; Fillable Forms are for simpler forms |

| Cost Transparency | Presented as straightforward and transparent for eligible filers | Free for federal preparation and filing; state costs may vary by provider |

Data Usage and Privacy

The TurboTax mobile app requires an iOS 17.0 or later operating system for iPhones and iPadOS 17.0 or later for iPads. For Apple Watch, watchOS 6.0 or later is needed. The app's privacy details indicate that certain data may be collected and linked to a user's identity, including data used for tracking purposes. The developer has not yet specified which accessibility features the app supports.

Expert Analysis and Observations

Reports suggest that while TurboTax offers a free tier, the specific terms and conditions are crucial. The distinction between "free tiers" and specific promotions is significant.

Read More: Some States Do Not Use New Federal Tax Breaks

"Many commercial tax-prep companies have free tiers. … The no-cost plan accepts simple state and federal returns reporting W-2 income, the Child Tax Credit, Earned Income Tax Credit, deductions for student loan interest and some interest and dividends." - CNBC Select

This points to a general landscape where free options exist, but their scope and the user's tax complexity are key determinants. The TurboTax promotion, being time-limited and app-specific, requires careful adherence to its stated conditions to avoid unexpected charges.

The emphasis on the mobile app suggests a strategic push by TurboTax to engage users through that platform.

The potential exclusion of recent TurboTax users from this specific free promotion indicates it may be targeted at acquiring new users or re-engaging lapsed customers.

Comparing TurboTax’s offer against the IRS Free File program highlights that the IRS’s direct offering ensures free federal filing through its portal, whereas commercial offers, even when framed as free, might have limitations or specific promotional windows.

Conclusion and Implications

TurboTax is currently promoting a free federal and state tax filing service accessible via its mobile app until February 28. Eligibility for this offer is not universal, with specific conditions such as prior year filing status potentially impacting qualification. This promotion exists within a broader ecosystem of free tax filing options, including the IRS Free File program and free tiers from other commercial providers.

Read More: Rajasthan May Get ₹4.88 Lakh Crore for Key Businesses in 2027

The transparency of TurboTax's offer is highlighted by some sources, yet the exclusion criteria and the limited timeframe necessitate user diligence. For individuals with straightforward tax situations, the IRS Free File program remains a direct, government-backed option. Those considering TurboTax’s free offer should verify their eligibility and be aware of the February 28 deadline. The integration with Credit Karma offers potential benefits like expedited refunds and pre-filled information for users of both services. The data privacy aspects of the mobile app also warrant attention for users concerned about personal information collection.

Sources Used:

Fox News: Details the TurboTax promotion, its deadline, and eligibility nuances, particularly regarding previous TurboTax users.

CNBC Select: Discusses TurboTax's free filing offer and situates it within the broader context of commercial tax software and the IRS Free File program, noting alternative free options like Cash App Taxes.

NY Post: Highlights the TurboTax mobile app as a key tool for simple and guaranteed free federal and state DIY filing for eligible filers, emphasizing transparency.

Link: https://nypost.com/2026/02/12/shopping/heres-how-to-file-for-free-and-easily-with-turbotax/

IRS.gov: Explains the official IRS Free File program, its two methods (guided software and fillable forms), and the importance of accessing it through the IRS portal.

Wired: A personal account of using the TurboTax mobile app for free tax filing, noting features like pre-filled information from Credit Karma and the app's guidance.

Link: https://www.wired.com/story/whats-new-this-year-at-turbotax/

USA Today: Examines the TurboTax app's free filing offer, prompting questions about potential catches, and contrasts it with the IRS Free File Program.

Link: https://www.usatoday.com/story/money/taxes/2025/01/16/turbotax-for-free-use-app/77751871007/

Apple App Store: Provides technical requirements for the TurboTax mobile app (iOS, iPadOS, watchOS) and lists data collection practices.

Link: https://apps.apple.com/us/app/turbotax-file-your-tax-return/id940247939

Read More: New Rules Planned for ETF Prices in India