Oil prices have seen a notable increase, climbing by approximately 4%, following reports of potential U.S. military strikes on Iran. This price jump is linked to concerns that such actions could disrupt global oil supplies, particularly through the Strait of Hormuz, a crucial waterway for energy transport.

Growing Fears of Supply Disruption

The recent escalation of tensions, including reported U.S. military strikes on Iran, has triggered significant movement in oil markets. Traders and analysts are closely watching for any signs of disruption to oil production or transit. The possibility of Iran retaliating and potentially blocking key shipping lanes has become a central concern, driving up the price of oil.

Timeline of Events and Key Actors

Recent Reports: Information suggests that Iran may have ignored key U.S. demands, with military strikes being considered.

U.S. Actions: Reports indicate the U.S. has launched strikes on Iranian nuclear facilities. The deployment of a second aircraft carrier by the U.S. has also been noted, potentially as a measure in anticipation of failed negotiations.

Iran's Response: Iran has vowed retaliation, indicating a broadening of potential targets. Official statements from Iran regarding traffic closures in the Strait of Hormuz during military exercises have also been made.

International Involvement: NATO has commented on the U.S. strikes, with the Secretary General defending them as not violating international law and reiterating Iran's obligation not to develop nuclear weapons.

Evidence of Price Movements and Market Reactions

Price Jump: Oil prices experienced a 4% jump, directly correlated with reports of potential U.S. military actions against Iran.

Strait of Hormuz Traffic: While Iranian state media reported temporary closures in parts of the Strait of Hormuz due to military exercises, one analysis firm did not observe a halt in traffic on a specific Tuesday.

Market Volatility: The conflict in the Middle East has led to "sharp swings" in oil prices, impacting energy bills and petrol prices globally.

Delayed Reaction: Despite early fears, oil prices initially reversed gains as traders processed Iran's "subdued initial response," which tempered immediate concerns about supply disruptions.

Impact on Global Energy Markets

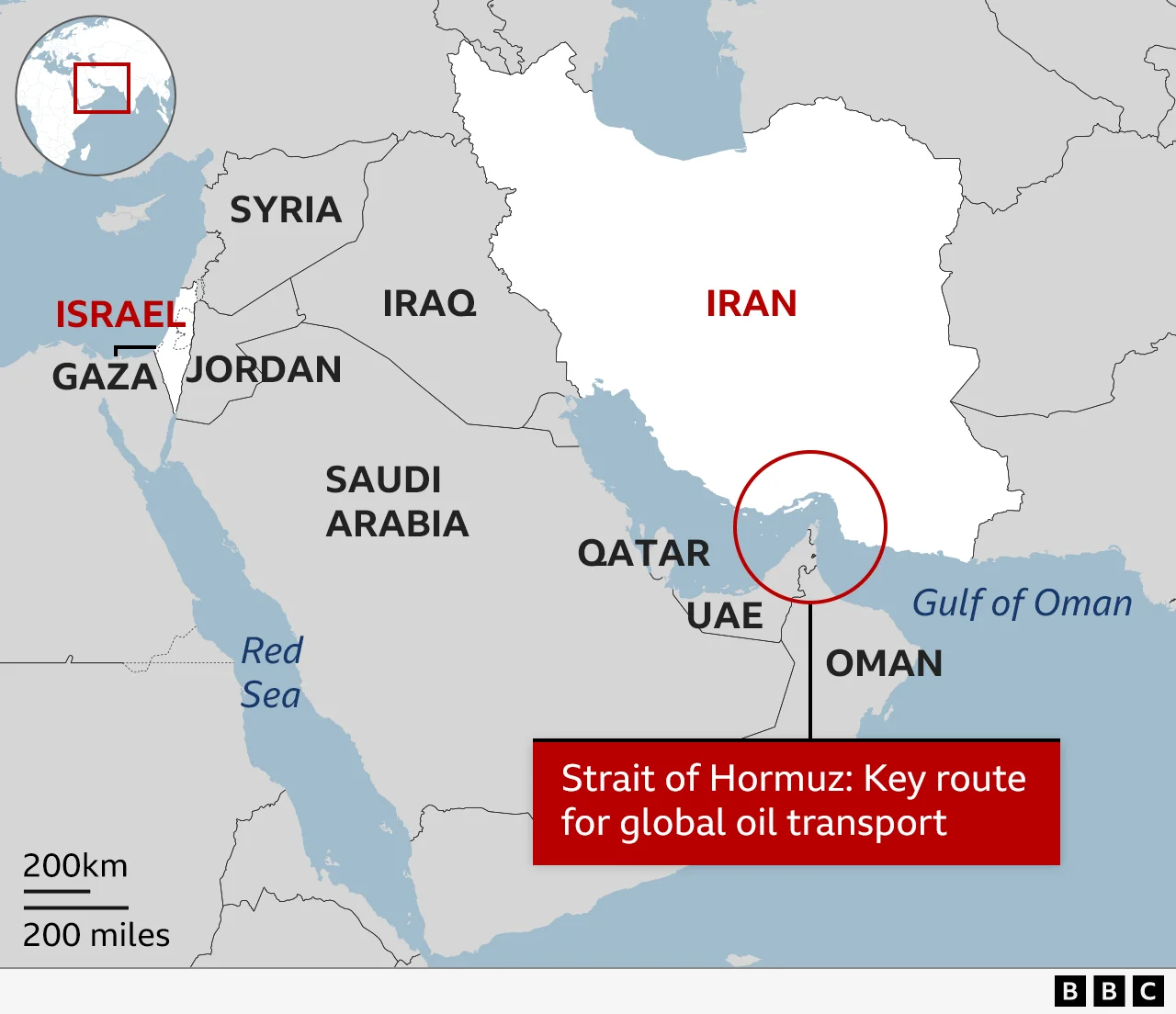

The Strait of Hormuz: A Critical Chokepoint

The Strait of Hormuz is a vital route for global oil shipments. Fears that Iran might block traffic through this narrow waterway have historically led to significant price volatility. The potential for disruption here is a primary driver behind the current market unease and the subsequent rise in oil prices.

Read More: eBay Buys Depop for $1.2 Billion to Reach Younger Shoppers

Retaliation and Escalation Risks

Iran's commitment to retaliate following the U.S. strikes introduces a layer of uncertainty. The scope and nature of this retaliation remain a key concern for global markets. Any further escalation could have more pronounced effects on oil prices and geopolitical stability.

Economic Ramifications

Surging oil prices present a new challenge for economies, including the United States. Experts predict that high oil and gas prices are likely, potentially reigniting inflation. The sustained duration of these elevated fossil fuel prices is a major question for economic forecasting.

Expert Perspectives

"Any conflict in the Middle East is bound to affect global energy prices, which has a knock-on effect on bills and petrol prices." (BBC News analysis)

"High oil and gas prices are a near certainty, experts say." (CNN Business report)

NATO Secretary General Mark Rutte stated that U.S. strikes on Iranian nuclear sites did not violate international law and reaffirmed NATO's stance on Iran's nuclear activities.

Conclusion and Unanswered Questions

The current rise in oil prices appears to be a direct consequence of heightened tensions and the possibility of military action involving the U.S. and Iran. The primary drivers are the fear of supply disruptions, particularly through the Strait of Hormuz, and the potential for retaliatory actions from Iran. While immediate concerns about supply disruptions were temporarily tempered by Iran's initial response, the situation remains fluid.

Read More: British Couple Lindsay and Craig Foreman Get 10 Years in Iran for Espionage

Key questions persist regarding:

The extent and nature of Iran's promised retaliation.

The long-term impact on oil supply routes, especially the Strait of Hormuz.

The duration of elevated oil prices and their sustained effect on the global economy and inflation.

The precise outcome of nuclear talks between the U.S. and Iran.

The market's reaction will likely continue to be sensitive to developments concerning Iran's response and any further actions by the U.S. and its allies.

Sources Used:

CNBC: Reports on U.S. envoys' talks with Iran and potential military strikes influencing oil prices. https://www.cnbc.com/2026/02/18/oil-prices-today-iran-trump-nuclear-talks.html?msockid=289ab1af69826a3c38c9a6aa68a36b69

BBC News: Explains how Middle East conflicts affect energy costs and the importance of the Strait of Hormuz. https://www.bbc.co.uk/news/articles/cg5vr2rvzg4o

Moneycontrol: Mentions oil prices set to rise after U.S. strikes on Iran, raising fears of retaliation. (Summary extraction failed, but linked to the topic). https://www.moneycontrol.com/news/business/commodities/oil-prices-set-to-rise-after-us-strike-on-iran-raises-fears-of-gulf-energy-retaliation-13161019.html

OilPrice.com: Discusses oil markets on edge as Iran vows retaliation and details NATO's stance on U.S. strikes. https://oilprice.com/Energy/Energy-General/Oil-Markets-on-Edge-as-Iran-Vows-Retaliation.html

CNN Business: Highlights the prospect of surging oil prices as a new economic shock following U.S. strikes on Iran. https://www.cnn.com/2025/06/22/business/oil-prices-iran-strikes