Global financial markets are exhibiting varied movements, with declines in US equities and the Australian market, while oil prices have seen a significant surge. These shifts appear linked to geopolitical developments in the Middle East and the release of economic indicators.

Market Movements and Influences

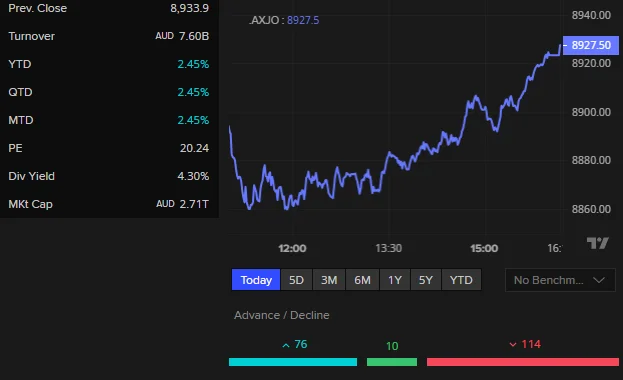

Major stock indices in the United States, including the Dow Jones and Nasdaq Composite, have experienced declines. Concurrently, the Australian Securities Exchange (ASX) has also shown a downward trend, with some instances of it opening lower or sliding.

US Equities: The Dow Jones has recorded points lower, and the Nasdaq Composite has also fallen. This drift has been observed across several reporting periods.

Australian Equities: The ASX has followed a similar pattern, with reports indicating it is set for a slide or opening lower.

Oil Prices: In contrast, crude oil prices have jumped significantly, with reports noting a substantial percentage increase. This surge is directly linked to escalating violence and concerns over the flow of crude oil in the Middle East.

Treasury Yields: The yield on the 10-year US Treasury has shown minor fluctuations, with some reports indicating a slight decrease, while others suggest a rise driven by inflation worries stemming from oil price increases.

Geopolitical Events and Economic Data

Events in the Middle East, specifically involving the US and Iran, are prominently cited as a reason for the jump in oil prices. Simultaneously, economic data releases and anticipated statements from central bank officials are influencing market sentiment.

Middle East Tensions: Escalating violence, including Iran's ballistic missile launches towards Israel and potential responses to US strikes on Iranian nuclear sites, have raised concerns about crude oil supply disruption. Reports mention Iran's parliament endorsing a measure to close the Strait of Hormuz.

Economic Indicators:

US Data: A better-than-expected report on sentiment among US consumers has been noted. US housing starts and building permits are also figures being watched.

Inflation Concerns: Higher oil prices are driving worries that inflation could increase, potentially affecting plans for interest rate cuts.

Central Bank Influence: Traders are awaiting speeches from central bank officials, such as the anticipated address at the Jackson Hole summit, for signals on future monetary policy, particularly regarding interest rate adjustments.

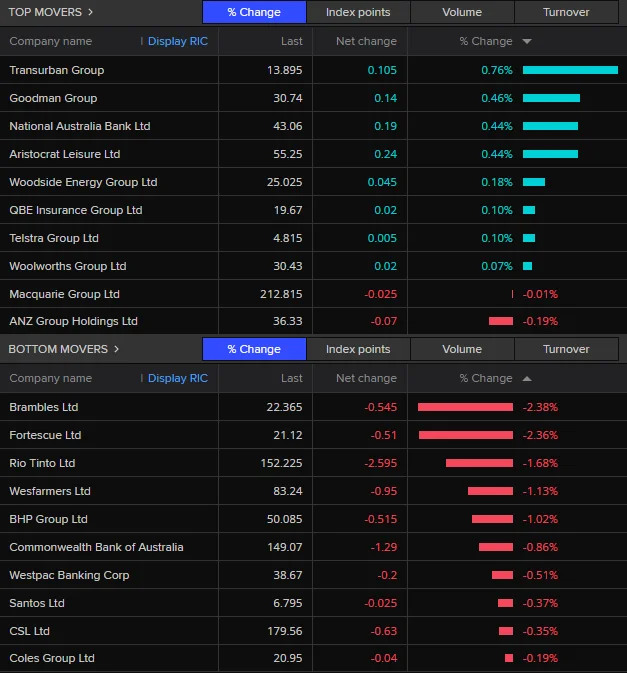

Sector-Specific Performance

Within the broader market movements, certain sectors have shown distinct trends, notably energy stocks and, conversely, declines in other areas.

Read More: Global Counsel lobbying firm collapse after founders' Epstein links revealed

Energy Stocks: Companies in the oil and gas sector have rallied, driven by the surge in crude oil prices. This has led to energy stocks humming or leading the ASX bourse in some instances.

Mining and Tech: Some mining companies, including those involved with gold and rare earths, have seen their shares dumped or fall. Data centre operators and family tracking app companies have also experienced significant drops in share value.

Other Companies: Specific companies like Carvana and Occidental Petroleum have reported stronger profits than expected, with Carvana sinking and Occidental Petroleum jumping in share price.

Investor Sentiment and Outlook

Market participants appear to be exercising caution, particularly ahead of significant economic data releases and central bank pronouncements. The combination of geopolitical uncertainty and the potential impact on inflation and interest rates is fostering a guarded investment approach.

Cautious Positioning: Investors are described as cautious on positioning, awaiting key economic updates and speeches.

Impact of Higher Oil Prices: The rise in oil prices is seen as a potential trigger for fresh concerns about inflation, which could influence central bank decisions on interest rates.

Conflicting Signals: While some companies are reporting stronger profits, the overall market sentiment appears subdued, influenced by broader global economic and geopolitical factors.

Evidence of Market Activity

Expert Analysis and Commentary

"Oil prices leaped, and stocks slumped Friday on worries that escalating violence following Israel’s attack on Iranian nuclear and military targets could damage the flow of crude around the world, along with the global economy." - Associated Press

"Higher yields can tug down on prices for stocks and other investments, while making it more expensive for U.S. companies and households to borrow money." - Associated Press

"The rally followed a spike in global crude prices after Iran's parliament endorsed a measure to close the Strait of Hormuz in response to US strikes on Iranian nuclear sites over the weekend." - Capital Brief

"However, higher oil prices could trigger fresh concerns about inflation and plans for further interest rate cuts." - Capital Brief

Conclusion and Implications

The current financial market landscape is characterized by a divergence in performance across asset classes, largely influenced by escalating geopolitical risks in the Middle East and evolving economic data. The surge in oil prices, directly linked to these tensions, is a significant factor. This rise in crude costs presents a dual concern: it benefits energy companies but also fuels worries about inflation, which could, in turn, impact central bank monetary policy decisions regarding interest rates.

The downward pressure on US and Australian equity markets suggests investor apprehension. This sentiment appears to be driven by a combination of factors including the direct economic implications of potential crude oil supply disruptions, the broader impact of geopolitical instability, and anticipation surrounding upcoming economic data and central bank communications. The market is likely to remain sensitive to developments in the Middle East and any signals regarding inflation and interest rate trajectories.

Read More: Highguard game developers prioritize new updates in February 2026 to stop shutdown fears

Future market movements may depend on how these geopolitical tensions resolve, the observed impact on inflation, and the subsequent policy responses from major central banks.

Primary Sources Used

Australian Financial Review (via smh.com.au): Reports on market movements, including the ASX and Wall Street, and the impact of oil prices.

https://www.smh.com.au/business/markets/asx-set-to-slide-as-wall-street-drifts-lower-oil-jumps-on-us-iran-tensions-20260220-p5o3x8.html

https://www.smh.com.au/business/markets/asx-set-to-slip-as-wall-street-drifts-lower-20251216-p5nnxx.html

Stockhead: Provides market wrap-ups, focusing on Australian stocks and commodity influences.

https://stockhead.com.au/news/lunch-wrap-asx-drifts-lower-but-oil-prices-keep-energy-stocks-humming/

Proactive Investors: Offers morning market catch-ups, highlighting the link between Wall Street movements and the ASX start.

https://www.proactiveinvestors.com.au/companies/news/1076892/the-morning-catch-up-asx-set-for-slow-start-as-wall-street-drifts-sideways-1076892.html

Associated Press (AP): Reports on significant global market events, including oil price surges and stock market reactions tied to geopolitical incidents.

https://apnews.com/article/israel-iran-attack-oil-stock-market-fe6d0aed826aec5f041ed492f19ea12d

Capital Brief: Covers Australian market openings and their relation to international events and commodity prices.

https://www.capitalbrief.com/briefing/australian-shares-to-fall-after-us-strikes-iran-nuclear-sites-ec309471-a57d-48e6-830e-e38a975f6b35/