The US Supreme Court has made a choice that limits President Donald Trump's power to put taxes on goods from other countries. This decision affects a main policy used to help American businesses. While President Trump has said he still feels strong enough to continue his plans for trade, the court's ruling means the government might get less money. Companies that paid these taxes may now ask for their money back. This process is expected to be difficult and could take a long time, raising questions about what comes next for trade and government funds.

Ruling on Presidential Tariff Powers

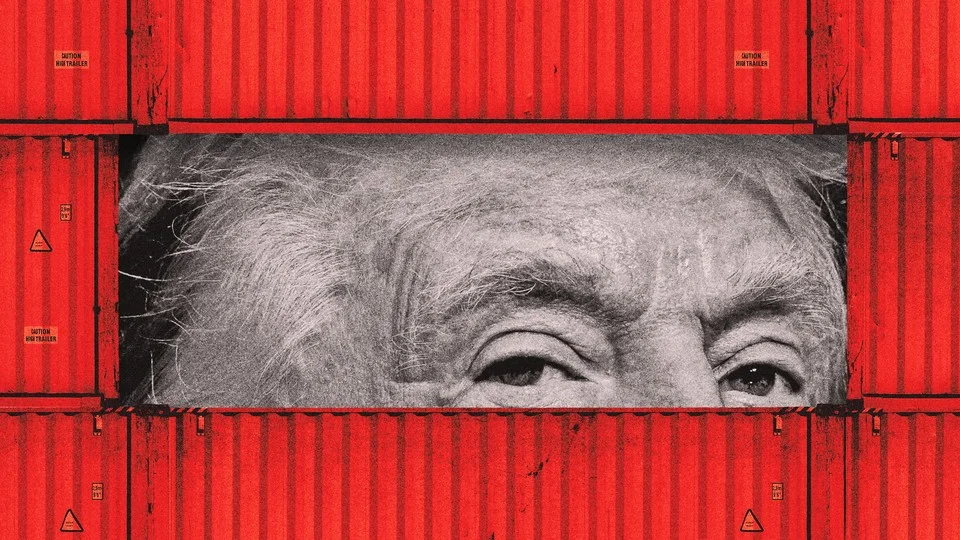

The US Supreme Court recently decided that President Donald Trump did not have the power to put many taxes on goods coming into the United States using an emergency law. This ruling happened on a Friday and directly impacts a key policy President Trump used to try and make American factories strong again. The court's decision specifically reduced his power under the International Emergency Economic Powers Act (IEEPA). President Trump had used these taxes to collect a large amount of money for the government.

Read More: Supreme Court Stops President's Tariffs; New 10% Global Tax Announced

President Trump stated he feels "emboldened to continue his trade war" because the court only limited his powers under the IEEPA. He said the process will take "a little more time, but the end result is going to get us more money."

President Donald Trump on Friday morning faced a big policy problem as the U.S. Supreme Court found he did not have the right to put many international taxes under an emergency law.

President Trump's Response to the Ruling

After the court's decision, President Trump made several public statements. He said that he believes he can still continue his efforts to change trade rules, even with the court's limits on his powers.

President Trump believes the court only cut his power under the IEEPA and that he still has ways to make his trade policy work.

When asked if he would need help from Congress to put new taxes on imports, President Trump said it was "not necessary."

Regarding money that might be owed back to companies, President Trump "dismissed the idea of any refunds" on Friday.

Some reports show President Trump called the justices 'disgrace to our nation' after the ruling.

Questions Around Tariff Refunds

The Supreme Court's ruling brings up important questions about giving money back to companies that paid these specific taxes. This process is seen as complex.

Treasury Secretary Scott Bessent said that giving money back could "take a year."

However, earlier officials from the Trump administration had stated that companies "would receive refunds without the need for court action" if the Supreme Court found the taxes were collected against the law.

This suggests a difference between earlier official statements and the current view on how long the refund process might take.

Future Paths for US Trade Taxes

Even with the Supreme Court's decision, it appears there are other ways for a president to use taxes on imports to meet trade goals.

Both the first Trump administration and the Biden administration have used a different law, called Section 301, to put or raise taxes on goods from China.

This suggests that losing at the Supreme Court might not stop a president from trying to set up trade taxes again using different legal ways.

Government Money and Trade

The decision by the Supreme Court also has an impact on the government's income.

Read More: Los Angeles County Sues Roblox on February 19, 2026, Over Child Safety Failures

The emergency taxes set by President Trump brought in a large part of the government's money from trade taxes.

If these taxes are now stopped or reduced, less money will be available for the government to use.

Conclusion

The US Supreme Court's ruling has changed how President Donald Trump can use an emergency law to put taxes on foreign goods. While President Trump says he feels strong enough to continue his trade efforts and does not need Congress for new tax policies, the court's decision means less money for the government. The question of refunding money to companies that paid these taxes is complex and could take a long time, possibly up to a year. However, other ways to set trade taxes, like using Section 301, remain available. The overall effect on American trade policies and government funds is now a key point for watch.

Used Sources:

What will happen to Trump’s tariffs after supreme court verdict?

Context: Discusses Trump's reaction to the Supreme Court ruling, his intention to continue the trade war, and his dismissal of refunds.

Link: https://www.theguardian.com/us-news/2026/feb/20/what-will-happen-to-trump-tariffs-after-supreme-court-verdict

4 issues to watch after Supreme Court ruling overturns Trump tariffs

Context: Highlights the complexity of refunds, the potential one-year delay for refunds as stated by Treasury Secretary Scott Bessent, and the impact of reduced tariffs on government revenue.

Link: https://www.usatoday.com/story/news/politics/2026/02/20/tariffs-trump-supreme-court-refunds-trade-deals/88103891007/

Trump Rages Against ‘Disloyal’ Justices Over Tariff Ruling: Live Updates

Context: Covers Trump's strong reaction to the ruling, his statement that he doesn't need Congress for tariffs, and the Supreme Court finding his lack of authority.

Link: https://nymag.com/intelligencer/article/supreme-courts-trump-tariffs-live-updates-reaction-analysis.html

Get Ready for Zombie Tariffs

Context: Explores alternative methods for imposing tariffs, such as Section 301, used by both Trump and Biden administrations, suggesting ways for Trump to continue his trade strategy despite the ruling.

Link: https://www.theatlantic.com/economy/2026/02/supreme-court-trump-tariffs/686083/