The Reserve Bank of India (RBI) has introduced new rules affecting how banks lend to stockbrokers. These changes, effective from 2026, aim to strengthen financial stability by addressing potential risks in the financial markets. The regulations will influence how brokers access funds for their operations, which could, in turn, shape the investment landscape for those involved in exchange-related and brokerage stocks. The core of the new directives centers on collateral requirements, restrictions on proprietary trading funding, and enhanced monitoring of capital market exposures.

Background: Evolving Financial Regulations

The RBI's new directives, namely the Commercial Banks Credit Facilities Amendment Directions, 2026, represent an evolution in the regulatory framework governing bank lending to financial intermediaries. Historically, banks have provided crucial funding to brokers to manage their daily operations, including settlement needs and client margin facilities.

Read More: Health Insurance Costs Going Up in Australia and the US

Working Capital: Brokers rely on bank loans to cover their day-to-day expenses.

Margin Trading Facility (MTF): Banks facilitate funds that brokers use to offer margin trading to their clients.

Settlement Obligations: Brokers require immediate funds to meet their commitments during market settlements.

Proprietary Trading: Until now, banks have funded brokers' own trading activities.

The recent amendments signal a proactive stance by the RBI to mitigate risks associated with these lending practices, particularly concerning market speculation and collateral valuation.

Key Regulatory Changes and Their Immediate Implications

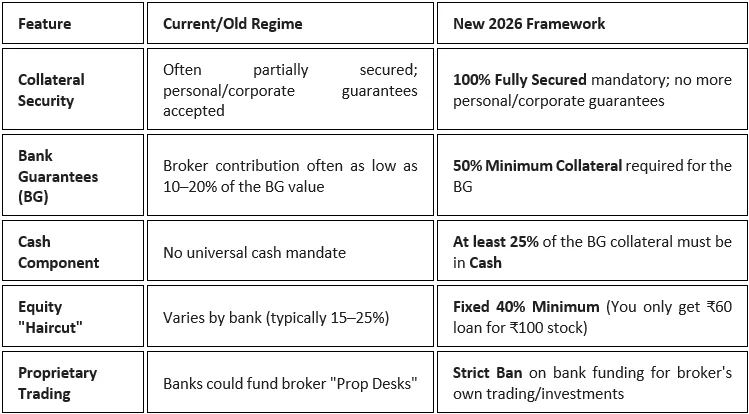

The RBI's new rules introduce several significant shifts in the lending landscape for brokers:

No Bank Funding for Proprietary Trading: A key amendment explicitly prohibits banks from financing a broker's own trading positions. This aims to prevent banks from indirectly fueling market speculation.

Exception: Banks can still provide working capital for market-making activities, managing settlement timing mismatches, and Margin Trading Facilities (MTF) for clients.

Mandatory 100% Collateral Monitoring: Banks are now required to continuously monitor the value of collateral they hold against loans to brokers.

Stricter Rules on Bank Guarantees (BGs): The use of Bank Guarantees for exchange margins is prohibited under the new amendments.

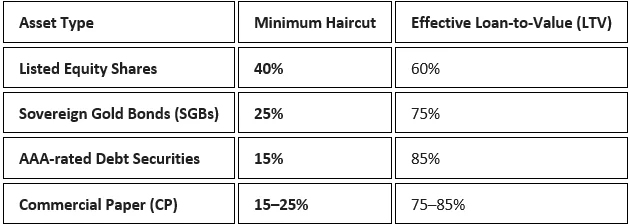

Minimum 40% Haircut on Equity Shares: When banks accept equity shares as collateral, they must apply a minimum 40% haircut to their value. This means the effective loan value against these shares is reduced.

Exposure Limits and Concentration Risk: All exposures to capital market intermediaries will be treated as capital market exposure. This implies stricter limits and closer scrutiny on the concentration of lending to these entities.

Impact on Brokers and Market Participants

These regulatory adjustments are poised to create several direct and indirect effects for brokers and those who invest in their stocks:

Funding Access and Operational Adjustments

Brokers who relied on bank funding for proprietary trading will need to find alternative capital sources or cease such activities. The requirement for continuous collateral monitoring and the haircut on equity may also influence the cost of borrowing and the amount of leverage available.

Read More: India's AI Summit Starts with Long Lines and Confusion

Operational Shift: Brokers might need to reconfigure their financial strategies to align with the new lending norms.

Collateral Management: Enhanced collateral monitoring could lead to more stringent margin calls for brokers and potentially their clients.

Investment Considerations for Exchange and Brokerage Stocks

For investors, understanding these changes is crucial for evaluating brokerage firms. The impact could manifest in several ways:

Profitability: Reduced access to cheap funding for proprietary trading might affect a broker's overall profitability.

Risk Profile: Stricter regulations could enhance the stability and reduce the risk profile of brokerage firms in the long run.

Market Activity: Changes in how brokers can fund client margin facilities might influence retail investor participation in margin trading.

Expert Analysis and Perspectives

Financial analysts suggest that the RBI's move is a prudent step towards safeguarding financial markets.

Read More: Tamil Nadu to Present Interim Budget Before Elections

"These amendments are designed to curtail excessive risk-taking within the financial system by intermediaries like brokers. The focus on robust collateral and limiting speculative funding is a commendable regulatory foresight." - Financial Sector Analyst (Attributed to industry commentary)

While the immediate impact might necessitate adjustments for brokers, the long-term goal is a more resilient market infrastructure. The prohibition on bank funding for proprietary trading is particularly significant, aiming to decouple bank lending from speculative market activities.

Conclusion: Navigating the New Regulatory Terrain

The RBI's new credit facilities directions for banks lending to brokers usher in a period of significant adaptation. The core objectives appear to be the enhancement of financial system stability and the mitigation of systemic risk.

Brokers will likely experience a shift in their funding dynamics, requiring greater emphasis on asset-backed lending and client-focused services.

Investors in exchange and brokerage stocks will need to re-evaluate company valuations and risk assessments in light of these new operational constraints and opportunities.

The long-term implications will depend on how effectively brokers adapt their business models and how the market absorbs these structural changes.

Read More: Indian Stock Market Moves Up and Down

The emphasis on transparent collateral management and reduced speculative leverage signals a move towards a more disciplined and sustainable financial ecosystem.

Sources:

Liquide Blog: https://blog.liquide.life/rbi-new-lending-norms-brokers-2026-impact/ - Provides detailed explanation of new norms and their immediate impact on banks and brokers, focusing on proprietary trading and collateral.

Indmoney: https://www.indmoney.com/blog/stocks/rbi-circular-on-brokers-explained - Offers a comprehensive breakdown of the RBI circular, covering changes to credit rules, collateral requirements, exposure limits, and potential consequences for retail investors and brokers.

)