A Quiet Start to the Year for New Share Offerings

The initial offerings of stocks, known as primary issuances, have seen a notable slowdown. In January, only three companies successfully raised funds, bringing in a total of ₹4,765 crore. This stands in stark contrast to December, when ten companies collectively secured ₹21,858 crore. This reduced activity suggests that potential investors are adopting a more reserved stance towards newly offered shares.

Factors Dampening Investor Enthusiasm

Several elements appear to be contributing to this hesitant market climate:

Subdued Post-Listing Performance: Recent companies that have offered shares have not performed as strongly after they began trading. This lack of strong returns after the initial offering has made investors more careful.

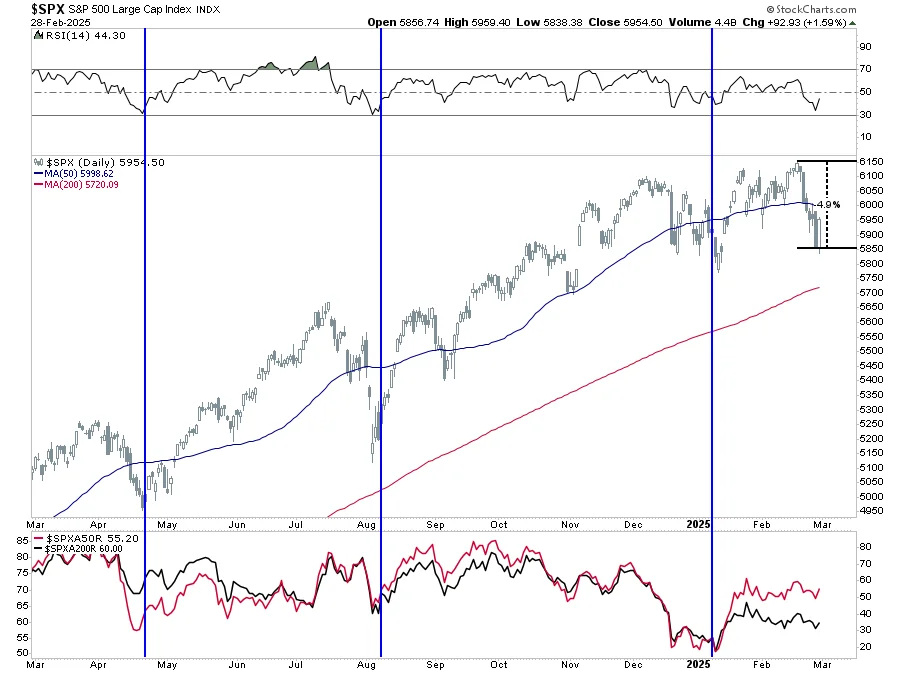

Secondary Market Gloom: A general sense of pessimism, termed "bearish sentiment," in the broader stock market is directly impacting the appetite for new shares. When the overall market is perceived as falling or stagnant, investors tend to shy away from taking on new risks associated with primary issuances.

Retail Investor Confidence: The caution displayed by individual investors, referred to as "retail confidence," has been notably affected. This indicates a broader unease among smaller market participants.

Read More: Asian Markets May Open Higher as Big Companies Talk Deals

The primary market has experienced a significant drop in activity, with fewer companies raising capital in January compared to December. This downturn is linked to investor apprehension stemming from the poor performance of recently listed stocks and a generally negative mood in the wider stock market.

Understanding Market Sentiment: Bullish vs. Bearish

The terms "bullish" and "bearish" describe the overall mood or direction of a financial market.

| Market Condition | Investor Behavior | Typical Outcome |

|---|---|---|

| Bullish | Investors are optimistic and expect prices to rise. They are more likely to buy. | Prices tend to increase over a prolonged period, known as a bull market. |

| Bearish | Investors are pessimistic and expect prices to fall. They are more likely to sell or avoid buying. | Prices tend to decrease over a prolonged period, known as a bear market. |

| Bearish Signals | Specific patterns or events that suggest a market is likely to decline. This can include strong selling pressure. | Increased investor anxiety and uncertainty, a preparation for potential market cycles downwards. |

Interpreting Bearish Signals

Bearish signals often involve technical indicators such as a "Bearish Engulfing" pattern, where the trading volume of a declining price period completely overwhelms the previous period. Another indicator is three consecutive strong down candles, signaling intense selling pressure. This prevailing mood can lead to heightened anxiety among investors, prompting a need for risk management.

Economic Undercurrents Shaping Market Mood

Broader economic factors are also playing a role in shaping investor sentiment, contributing to the current bearish outlook.

Read More: New Ways to Collect Information Online Besides Google Forms

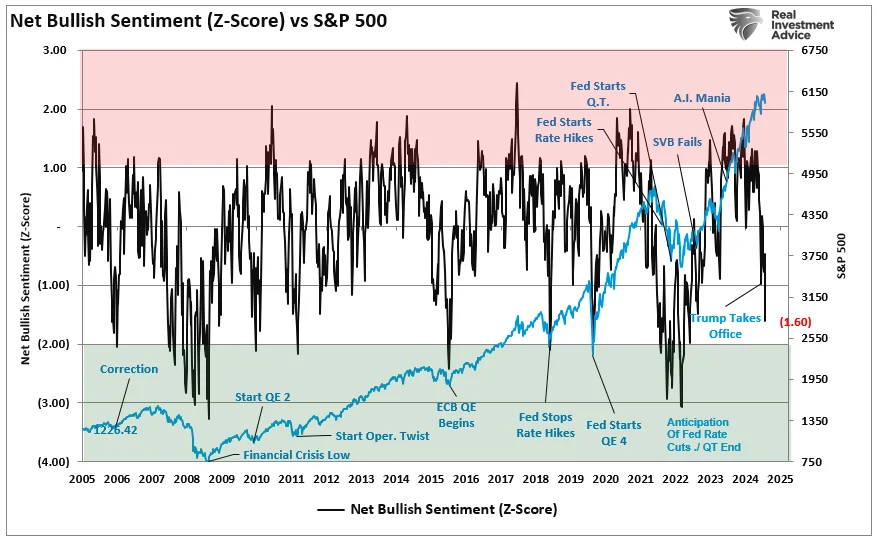

International Trade Uncertainty: Concerns surrounding international trade agreements have made investors wary. This uncertainty often leads to increased market volatility.

Consumer Confidence Dip: A significant decline in consumer confidence, reflecting a bearish outlook on future spending, has been observed. This suggests that individuals are anticipating economic challenges.

Central Bank Policies: The monetary policies enacted by central banks in response to economic conditions also influence market sentiment. These decisions can either reassure or unnerve investors, contributing to the overall market mood.

Contrarian Views in Bearish Markets

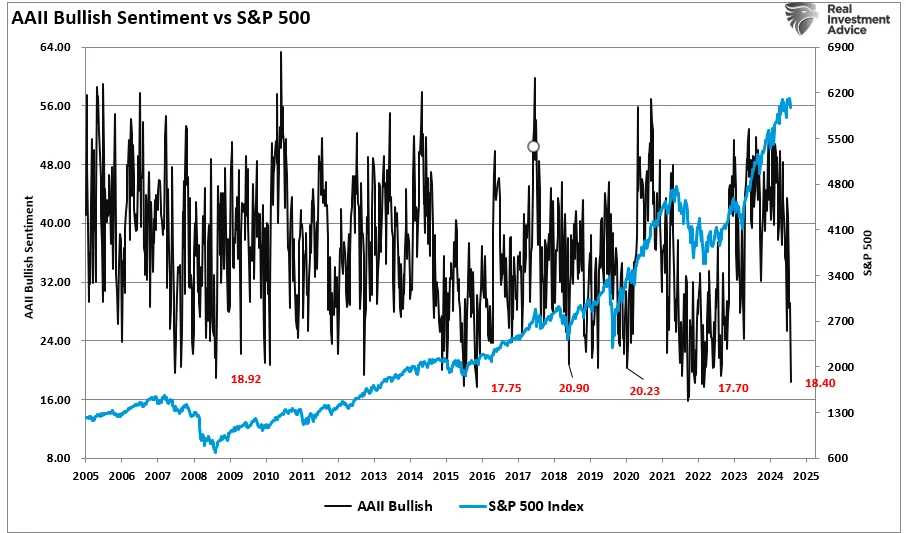

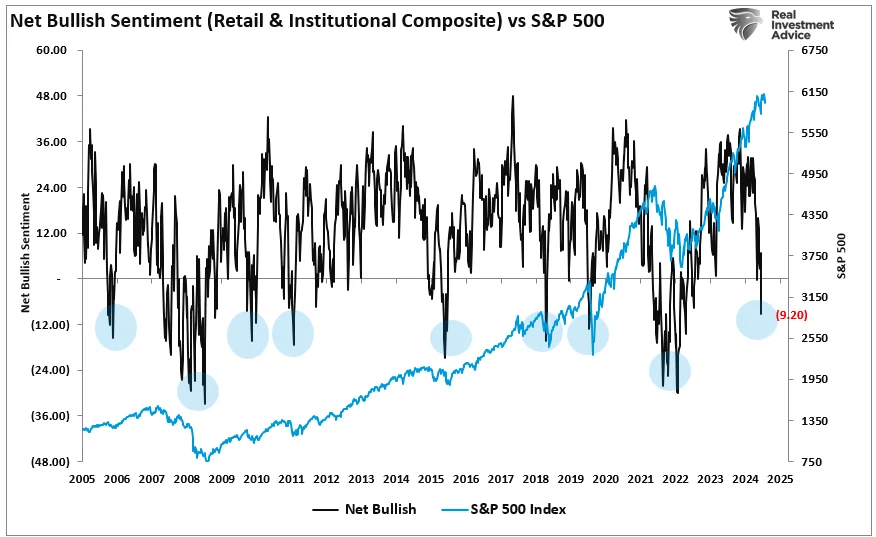

Interestingly, extreme bearishness can sometimes be interpreted as a potential buying opportunity from a contrarian perspective.

"While concerns about the recent market correction have risen, and bearish headlines are rampant, investor sentiment has become so bearish that it’s bullish. While that may be hard to fathom, negative sentiment occurs near market lows from a contrarian investing view." (Investing.com)

Read More: Nifty 100-DMA Breach: Rally or Ruthless Trap? Experts Warn of Economic Crossroads!

This view suggests that when sentiment becomes excessively negative, with widespread pessimism, it might precede a market rebound. As prices rise, investors who were previously bearish may reverse their positions to buy back into the market.

Evidence of Shifting Primary Market Dynamics

The data from January clearly illustrates a shift away from the robust activity seen in December.

| Month | Number of Companies | Amount Raised (₹ crore) |

|---|---|---|

| January | 3 | 4,765 |

| December | 10 | 21,858 |

Note: The December figures include significant issuances from ICICI Prudential Asset Management Company (₹10,603 crore) and Meesho (₹5,421 crore).

This significant drop in the number of successful fundraising efforts and the total capital raised underscores the current challenges in the primary market.

Expert Insights on Market Sentiment

The current market conditions reflect a confluence of factors that are understandably leading to investor caution.

The lack of strong post-listing gains for recent initial public offerings (IPOs) is a critical deterrent. Investors are hesitant to commit capital when there is no clear indication of immediate profitability after a stock begins trading.

A prevailing bearish sentiment in the secondary market is an undeniable drag. When the broader market is experiencing declines or stagnation, the risk perceived in new ventures increases, making investors more selective.

The dampened confidence among retail investors is particularly telling. This segment of the market is often sensitive to visible returns and perceived risks, and their withdrawal signals a widespread unease.

Conclusion

The primary market has experienced a marked downturn, evidenced by a substantial decrease in the number of companies raising capital and the total funds collected in January compared to December. This trend is directly linked to subdued investor confidence, fueled by the underwhelming performance of recently listed stocks and a pervasive bearish sentiment across the wider financial markets. International trade uncertainties and a dip in consumer confidence further contribute to this cautious environment. While extreme bearishness can sometimes signal a contrarian opportunity, the immediate reality for primary issuances is a period of reduced activity and heightened investor selectivity.

Sources:

The Hindu Business Line: Primary Market Activity Cools Amidst Widespread Investor Caution. Published 13 hours ago. https://www.thehindubusinessline.com/markets/bearish-market-sentiments-drag-down-primary-issuances/article70631930.ece

Investing.com: Bearish Sentiment Surges as If the Market Just Crashed. Published Mar 4, 2025. https://www.investing.com/analysis/bearish-sentiment-surges-as-if-the-market-just-crashed-200657925

MITTTRADE: What is Bullish and Bearish? Understanding Bullish and Bearish Trends. Accessed Date of Access - Assumed recent]. [https://www.mitrade.com/insights/trading-tips/market-sentiment/bullish-bearish

FasterCapital: Bearish Signals: Interpreting Bearish Signals: Preparing for a Sentiment Shift. Accessed Date of Access - Assumed recent]. [https://fastercapital.com/content/Bearish-Signals—Interpreting-Bearish-Signals—Preparing-for-a-Sentiment-Shift.html

Fidelity: Tariffs turn market sentiment historically bearish. Accessed Date of Access - Assumed recent]. [https://institutional.fidelity.com/advisors/insights/topics/market-commentary/tariffs-turn-markets-sentiment-historically-bearish

Investors Hacks: The Bearish Turn: Unraveling the Factors Behind the Stock Market Downturn. Published Mar 13, 2025. https://investorshacks.com/2025/03/13/bearish-stock-markets/

GovBusinessJournal: Bearish sentiments drive T-Bills yield up 32bps to 23.7% with aggregate subscription settling lower at N308.66 billion. Accessed Date of Access - Assumed recent]. [https://govbusinessjournal.com/bearish-sentiments-drive-t-bills-yield-up-32bps-to-23-7-with-aggregate-subscription-settling-lower-at-n308-66-billion/

Read More: BrewDog Beer Company is For Sale