The impending expiry of the patent for semaglutide, the core component of the widely used weight-loss drugs Ozempic and Wegovy, is paving the way for Indian pharmaceutical firms to introduce more affordable generic versions. This shift is expected to dramatically increase global access to these treatments, which have seen immense demand for managing diabetes and obesity.

Global Demand for Semaglutide Surges

Semaglutide, the active ingredient in Novo Nordisk's Ozempic and Wegovy, has become a significant player in the pharmaceutical market. Initially approved for type 2 diabetes, its efficacy in promoting weight loss has led to widespread off-label use and a surge in demand.

High Prevalence of Target Conditions: Globally, a substantial portion of the adult population lives with conditions for which semaglutide is prescribed. For example, in some regions, the proportion of adults living with obesity is as high as 36%, and those with diabetes is around 16%. The global population exceeds 8.23 billion, with over 1 billion people having a Body Mass Index (BMI) of 30 kg/m² or higher.

Drug's Dual Approval: Ozempic is approved for type 2 diabetes, while Wegovy is specifically approved for weight loss and management. Both utilize semaglutide, with dosage differences tailored to their intended use.

Market Impact: The drug's success has created an "unprecedented patent battle," with generic manufacturers aiming to capture a share of this lucrative market.

Patent Expiry and Generic Entry

The patent protection for semaglutide is a key factor determining when generic versions can enter the market.

March 2026 Expiration: The patent for semaglutide is set to expire in March 2026 in several major countries. This date is crucial for the planned introduction of generic alternatives.

Complex Patent Landscape: Novo Nordisk secured patents in various regions, leading to differing expiration dates. This creates a complex environment for companies aiming to produce generics.

Regulatory Approvals: Companies are actively seeking regulatory approval for their generic versions. For instance, Dr. Reddy's Laboratories has already received approval from Indian regulators to manufacture and sell a generic version of Ozempic and is awaiting approval for a generic Wegovy.

Indian Pharmaceutical Companies Lead the Charge

Indian pharmaceutical companies are at the forefront of developing and producing generic semaglutide.

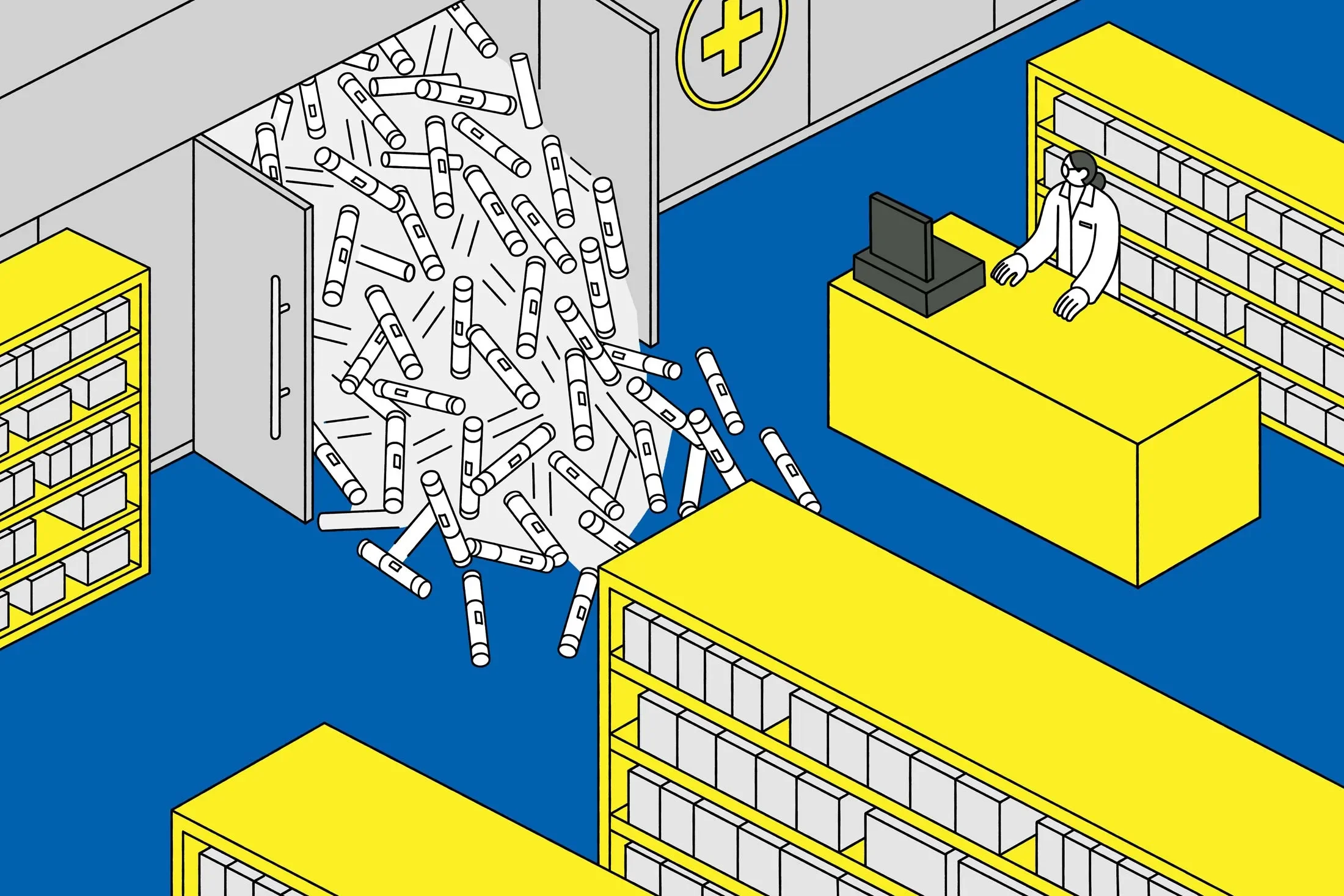

Manufacturing Capacity: India has become an increasingly attractive location for pharmaceutical manufacturing. Indian giants are preparing to "flood the market" with generic versions once patents expire.

Legal Challenges: Some Indian companies, like Dr. Reddy's Laboratories and Natco Pharma, are engaged in legal battles with Novo Nordisk over patent validity. These court cases could determine how quickly cheaper versions become available in India.

Pricing Strategy: Generic manufacturers are anticipating significant price reductions. Dr. Reddy's has indicated that a 50-60% discount compared to the innovator drug is "very comfortable." The monthly cost of Wegovy in India currently ranges from approximately $119.65 to $16,400 Indian rupees for the lowest to highest doses, respectively.

Export Potential: There is potential for Indian generics to be exported, which could further expand global access. An interim court order in Delhi has allowed Dr. Reddy's and OneSource to continue manufacturing and exporting semaglutide.

Challenges and Future Outlook

While the entry of generics is anticipated, challenges remain.

Read More: New Wegovy Pill for Weight Loss Approved by FDA in Late 2025

Regulatory Hurdles: Evaluating generic semaglutide drugs is more complex than for many other medications, requiring thorough review by health authorities like Health Canada.

Limited Current Access: Despite its popularity, "most of the world still has only limited access to the drug," a situation expected to change dramatically with the advent of generics.

Novo Nordisk's Strategy: Novo Nordisk is likely preparing its strategy in anticipation of patent expiries and increased competition from generic manufacturers.

The expiration of semaglutide patents and the subsequent introduction of generic versions by companies like Dr. Reddy's Laboratories signal a significant shift in the weight-loss and diabetes drug market, with the potential to enhance accessibility and affordability for millions worldwide.

Sources

CNN: Reports on Indian pharmaceutical companies preparing to launch generic Ozempic as the patent for semaglutide nears expiration. Discusses India's growing role in the global pharmaceutical market.

Parola Analytics: Examines the patent landscape surrounding Novo Nordisk's semaglutide-based drugs, including Ozempic and Wegovy, and the implications of patent expirations.

Link: https://parolaanalytics.com/blog/ozempic-weight-loss-patents-novo-nordisk/

Chemical & Engineering News (CEN): Discusses the implications of GLP-1 drug patent expirations, noting that the patent on semaglutide will expire in five major countries in 2026. Highlights demand and mentions Dr. Reddy's Laboratories receiving regulatory permission for generic semaglutide.

Link: https://cen.acs.org/pharmaceuticals/Looming-GLP-1-drug-patent/103/web/2025/12

The Economic Times: Details Dr. Reddy's Laboratories' plans for a competitively priced generic version of Wegovy, following approval from India's drug regulator. Mentions potential discounts and current pricing in India.

Business Standard: Reports on Indian pharmaceutical companies, including Dr. Reddy's Laboratories and Natco Pharma, taking Novo Nordisk to court over semaglutide patents, aiming to make cheaper versions of Ozempic and Wegovy available sooner.

Columbia Journal of Law & the Arts: Explains the patent battles surrounding semaglutide and the complex expiration timelines due to patent term extensions, noting generic manufacturers' attempts to enter the market.

Link: https://journals.library.columbia.edu/index.php/stlr/blog/view/653

Bloomberg: Covers the impending arrival of generic Ozempic and Wegovy, highlighting how these cheaper alternatives are poised to significantly alter the weight-loss drug market and improve global access.

Mondaq: Provides an overview of the semaglutide patent landscape, noting that Ozempic and Wegovy share the same active ingredient, semaglutide, and are used for diabetes and weight management, respectively.

Link: https://www.mondaq.com/uk/patent/1669402/a-snapshot-of-the-semaglutide-patent-landscape

CBC News: Discusses the potential for Canada to become one of the first countries to offer generic versions of drugs like Ozempic, as Health Canada reviews submissions, which could significantly lower prices.

Link: https://www.cbc.ca/news/health/ozempic-glp1-health-canada-generic-9.7034498

)