A significant and growing number of Americans, including those with higher incomes, are finding it increasingly challenging to keep up with their financial obligations. This trend is observed across various debt categories, from credit cards to auto loans, and is occurring even as nominal incomes have risen. The data suggests a widening gap between what people earn and what they can afford, impacting financial stability nationwide.

Economic Pressures Intensify for American Households

Recent data and reports indicate a widespread financial strain affecting American households. While overall income may appear to be rising, the cost of essential goods and services is climbing at a pace that outstrips many wage increases. This has led to a marked increase in payment delinquencies, particularly among higher-income brackets, which have historically been more insulated from such pressures.

Read More: US Prices Rise Slower in Early 2026

Rising Expenses Outpace Income: Housing and energy costs have seen notable increases, contributing to a general rise in consumer prices. This disparity between income growth and cost of living is a key factor.

Payment Delinquencies Ascending: A concerning development is the rise in late payments on credit cards and auto loans. This trend is not confined to lower-income groups, with upper-income earners also showing increased difficulty.

Perception of Financial Decline: Many Americans report feeling financially worse off compared to previous years, a sentiment that persists despite a seemingly robust job market and higher wages.

Evidence of Widespread Financial Strain

Multiple sources corroborate the observation of increased financial pressure on American households:

Credit Card and Auto Loan Delinquencies: Delinquencies for individuals earning at least $150,000 annually have risen by nearly 20% over the past two years. This increase is faster than that seen in lower and middle-income groups. (Bloomberg Law)

Real Purchasing Power Decline: Despite earning more, some states have seen a significant drop in real purchasing power. For instance, New Jersey experienced a 7% decrease, while Rhode Island saw a nearly 6.9% decline. Conversely, Idaho workers saw a 3.1% gain. (Newsweek)

Paycheck-to-Paycheck Living: The number of households living paycheck to paycheck has increased. While the increase is more pronounced among younger generations, there has been "almost no increase" in higher- and middle-income households experiencing this strain, according to one report. (USA Today)

General Debt Delinquencies: Across major metropolitan areas, nearly 30% of Americans were behind on at least one debt payment in the third quarter of 2023. This includes credit cards, auto loans, mortgages, and student loans. (LendingTree via Fox Business)

Slowing Income Growth: For nearly two years, inflation has outpaced average pay raises, signaling a slowdown in household income growth that poses risks to consumer spending and the broader economy. (USA Today)

Housing Costs: A Persistent Burden

The escalating cost of housing is a significant contributor to the financial challenges faced by many Americans.

Read More: US Immigration Rules Change for Yemeni People

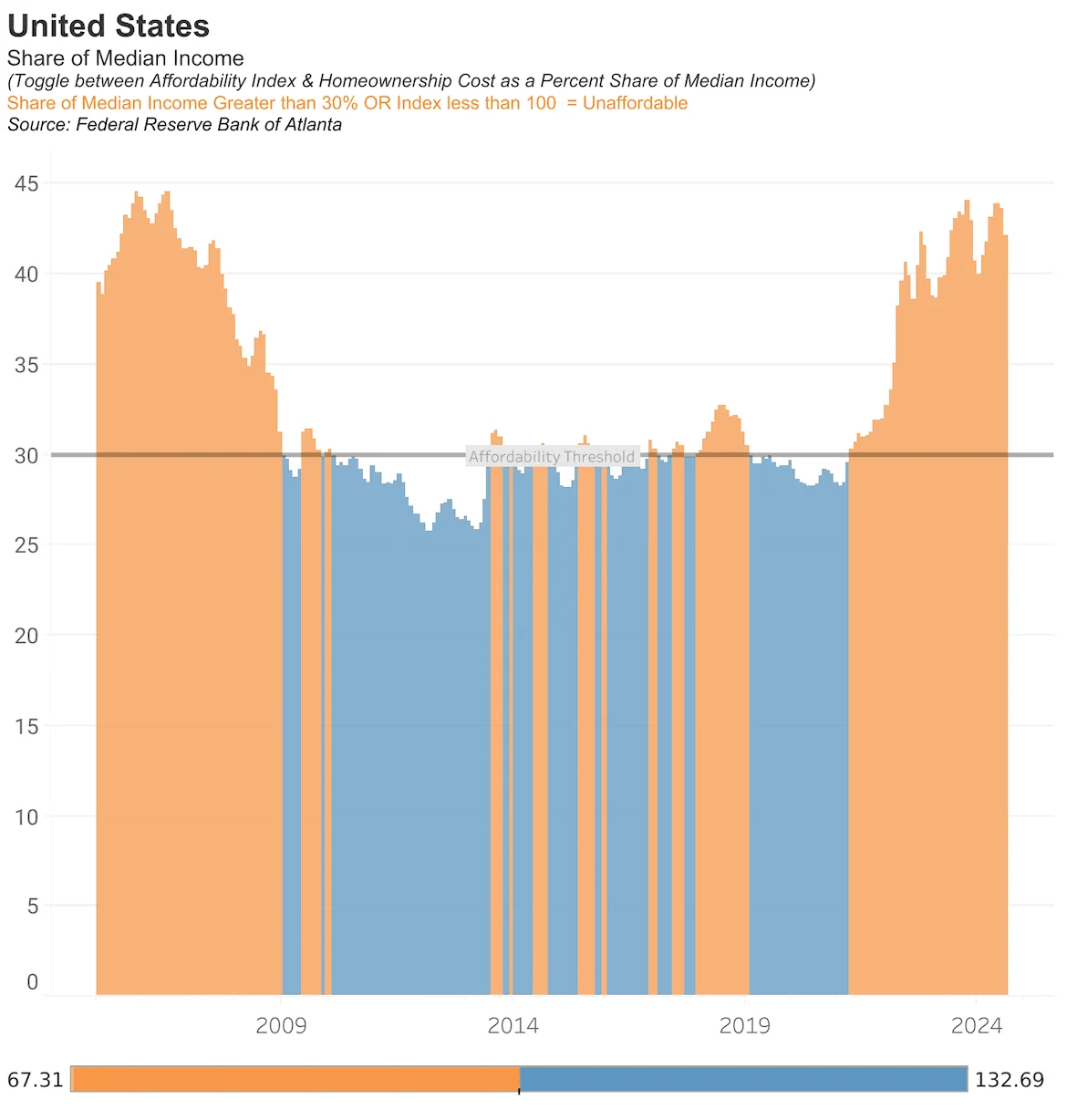

Persistent Affordability Issues: Over the past two decades, house prices have consistently outpaced income growth. This trend has created a persistent burden on housing affordability. (St. Louis Fed)

State-Level Disparities: While some states like Idaho have seen gains in real buying power, others, including New Jersey, Rhode Island, Maryland, New York, and Massachusetts, have experienced significant declines, often linked to housing cost increases. (Newsweek)

Health Care Costs Add to Financial Stress

Beyond housing and general consumer goods, healthcare expenses represent another substantial financial pressure point for American families.

Affordability Concerns: High healthcare costs are a long-standing burden, influencing decisions about insurance and seeking necessary medical care. (KFF)

Impact on Specific Groups: Young adults and Hispanic adults are particularly likely to report difficulties affording healthcare, adding to their overall financial strain. (KFF)

Shifting Consumer Behavior and Economic Outlook

The current economic climate is leading to observable shifts in consumer behavior and contributing to a general sense of financial unease.

Read More: More Americans Sell Plasma to Pay Bills

Increased Pressure: A rise in credit card payment defaults suggests that more individuals are under financial pressure, even with a seemingly better job market and higher wages than four years ago. (Investopedia)

Consumer Spending Reliance: Strong consumer spending has been a pillar of the U.S. economy, but economists are monitoring Americans' ability to maintain these spending levels given the rising delinquencies. (CNN Business)

Economic Sentiment: A significant portion of Americans feel they are in a worse financial position now compared to 2020, despite improvements in job markets and wages, indicating a disconnect between aggregate economic indicators and individual financial well-being. (Investopedia)

Expert Perspectives on the Economic Landscape

Financial experts and analysts offer insights into the current economic environment and its implications.

"Upper-income Americans are increasingly falling behind on credit card and auto loan payments, signaling an underlying vulnerability in the US economy as the labor market slows." - Bloomberg Law

"More American households are living paycheck to paycheck, according to a new study. Millennials, Gen X counterparts are living paycheck to paycheck. … There has also been almost no increase in the number of higher- and middle-income households living paycheck to paycheck, the report said." - USA Today

Conclusion: A Complex Economic Picture

The available data paints a nuanced and concerning picture of the U.S. economy. While headline figures may indicate growth in incomes and employment, the lived financial reality for a significant segment of the population, including higher-income earners, is one of increasing strain. The persistent rise in housing and healthcare costs, coupled with inflation that has outpaced wage growth for extended periods, is eroding purchasing power.

Read More: Doctor Says Jeffrey Epstein Was Strangled, Not Hanged

Increased Delinquencies Signal Vulnerability: The upward trend in payment delinquencies, particularly among those with higher incomes, suggests a systemic issue rather than isolated cases.

Discrepancy Between Income and Affordability: The core challenge appears to be a growing disconnect between nominal income increases and the actual cost of maintaining a desired standard of living.

Policy Implications: The findings warrant careful consideration by policymakers regarding the impact of inflation, cost of living, and debt burdens on diverse income groups. Further investigation into the specific drivers of increased delinquencies among higher earners is indicated.

Sources:

Bloomberg Law: Upper-Income Americans Are Falling Behind on Their Debt Payments (July 29, 2025) - https://news.bloomberglaw.com/banking-law/upper-income-americans-are-falling-behind-on-their-debt-payments

CNN Business: Analysis: Americans are falling behind on their payments (April 25, 2024) - https://edition.cnn.com/2024/04/25/investing/premarket-stocks-trading-consumer-spending/index.html

Fox Business: Nearly 30% of Americans behind on debt payments in largest metros, study finds (Date of publication not specified in provided data) - https://www.foxbusiness.com/economy/nearly-30-americans-behind-debt-payments-largest-metros-study

Investopedia: Most Americans Feel They're Worse Off Now Than In 2020—Here's What The Data Says (November 4, 2024) - https://www.investopedia.com/most-americans-feel-they-are-financially-worse-off-now-than-in-2020-what-the-data-says-election-economy-8734610

KFF: Americans’ Challenges with Health Care Costs (Published 2 weeks prior to retrieval) - https://www.kff.org/health-costs/americans-challenges-with-health-care-costs/

Newsweek: Americans earn more than ever, yet can afford less (Published 6 days prior to retrieval) - https://www.newsweek.com/americans-earn-more-than-ever-yet-can-afford-less-11475405

St. Louis Fed: When Houses Outrun Paychecks: The Lost Decades of Housing Affordability (Published 15 hours prior to retrieval) - https://www.stlouisfed.org/on-the-economy/2026/feb/when-houses-outrun-paychecks-lost-decades-housing-affordability

USA Today: The number of households living paycheck to paycheck has risen. Why? (November 20, 2025) - https://www.usatoday.com/story/money/2025/11/15/more-living-paycheck-to-paycheck-why/87201940007/

USA Today: US household income growth is slowing, posing risks for consumer spending and economy (February 27, 2025) - https://www.usatoday.com/story/money/2025/02/24/income-growth-slowing-economy/79339787007/

YouGov: A growing share of Americans say their household income is falling behind their expenses (December 4, 2025) - https://today.yougov.com/economy/articles/53633-a-growing-share-of-americans-say-their-household-income-is-falling-behind-their-expenses

Read More: India's Finance Minister Says Economy is Growing, Middle Class is Bigger

:max_bytes(150000):strip_icc()/GettyImages-2182160067-2a3294c252214004985e0a4c5fda432e.jpg)