Whispers from the Earth: Are forgotten rock samples holding the key to a silver revolution?

Beneath the sun-baked plains of southwestern Chihuahua, Mexico, a story of buried treasure and forgotten potential is unfolding. Advance Metals (ASX: AVM), a company with its eyes firmly set on the future of precious metals, has stumbled upon a goldmine – quite literally – within the dusty archives of its Yoquivo project. The question on everyone's lips: was this a lucky break, or a calculated move that's about to pay off big time?

This isn't just about a few shiny rocks. We're talking about potentially unlocking vast new reserves of silver and gold, turning old data into new fortunes. The implications stretch far beyond Advance Metals, potentially impacting global supply and demand for these vital commodities. But is the excitement justified, or is this just another flash in the pan in the volatile world of junior mining?

The Echoes of Past Exploration: A Tale of Two Continents

Advance Metals operates with a clear strategy: focus on high-grade precious metal assets. Their portfolio in Mexico is a testament to this, boasting three projects – Guadalupe y Calvo, Yoquivo, and Gavilanes – which collectively hold a staggering ~100 million ounces of silver equivalent in resources. Yoquivo, the current star of the show, has an estimated resource of 17.2 million ounces of silver equivalent.

Read More: Kaiser Reef Plans to Make More Gold in Tasmania and Victoria

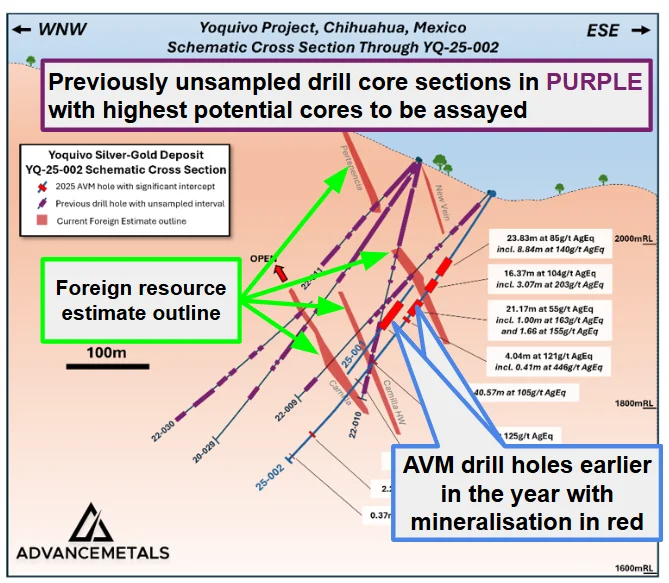

However, the story of Yoquivo isn't entirely new. Decades of exploration have taken place at this site by various entities, including Golden Minerals (NYSE-A: AUMN, TSX: AUMN), the project's former owner. This history left behind a substantial legacy: over 6,300 meters of previously unsampled core from historic drilling, representing more than half of the total drilling ever conducted there.

This forgotten treasure trove sat untouched until recently. Why were these sections overlooked in the first place? Was it a lack of technology, a change in focus, or something else entirely? The current re-sampling program is a direct response to this historical oversight.

Unearthing Hidden Riches: The Core Sample Revelation

The game-changer came when Advance Metals decided to revisit these old core samples. Using precise targeting, they initiated a program to re-assay sections that had never been tested. The results? Nothing short of spectacular.

Read More: Kaiser Reef to Make More Gold in Victoria and Tasmania

Widespread elevated silver-gold values were confirmed across multiple holes.

Previously hidden high-grade intervals have been brought to light.

Initial results from a 4,500-meter re-sampling program at Yoquivo have revealed significant mineralisation.

Approximately 519 meters of sampled intervals showed silver/gold mineralisation exceeding 4 grams per tonne (g/t) silver equivalent.

One particularly exciting interval from the first batch of results, comprising 222.7 meters of core across 11 holes, showed grades reaching up to 370 g/t silver and 6.2 g/t gold.

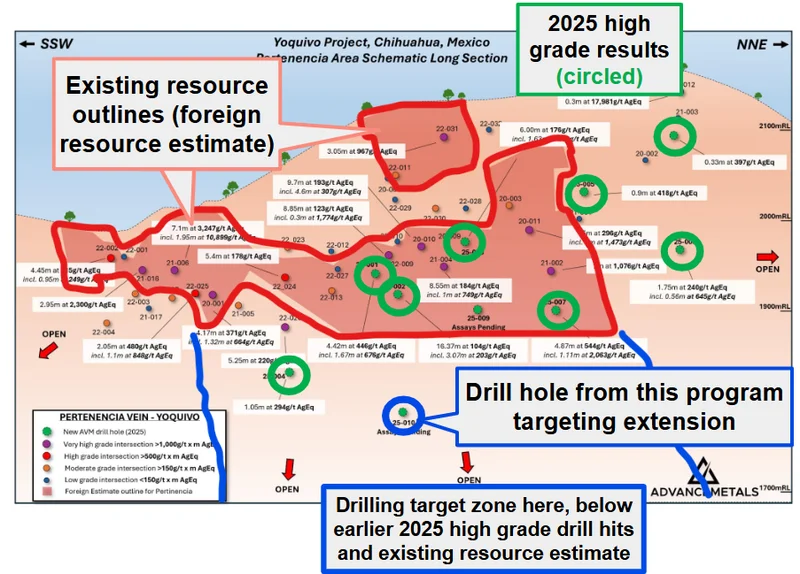

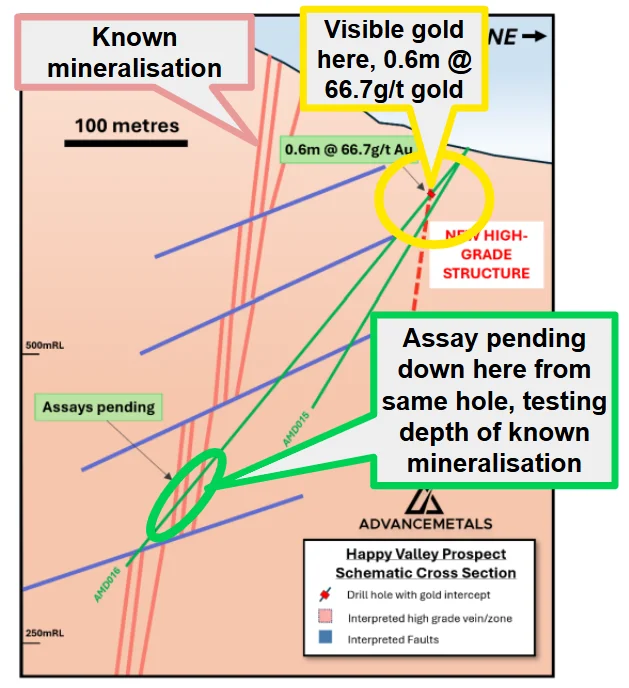

The deep diamond drilling conducted recently also yielded impressive findings, intersecting four distinct silver-gold zones, with two stronger intervals noted.

A 1.2-meter section assayed at 295 g/t silver equivalent was reported.

Another interval delivered 8 meters at 79 g/t silver equivalent from a depth of 160 meters.

Bonanza Grades and Deeper Potential: The Devil's in the Details

The re-sampling program has unearthed some truly exceptional grades, sparking the "bonanza" excitement. These high-grade intersections suggest the presence of rich, localized mineral deposits within the broader system.

Read More: Aurum Resources Finds More Gold in Côte d’Ivoire

Consider these remarkable findings from holes drilled in 2022:

Hole YQ-022-025: Intersected 2.05 meters at 480 g/t silver equivalent from 135.15 meters, including a spectacular 1.1 meters at 848 g/t silver equivalent.

Hole YQ-022-002: Returned 4.45 meters at 115 g/t silver equivalent from 119.2 meters, with a high-grade core of 0.95 meters at 249 g/t silver equivalent.

A more recent deep hole, YQ-25-007, intersected 7.6 meters at 116 g/t silver equivalent, which itself contained a jaw-dropping 1.11 meters at 2,063 g/t silver equivalent (equivalent to 1,556 g/t silver and 6.6 g/t gold).

These results are significant because they often surpass previously assayed intervals from the same holes. This begs the question: What other high-grade pockets are waiting to be discovered in the remaining unassayed core?

Strategic Moves and Future Prospects: Beyond the Drill Bit

Advance Metals is not resting on its laurels. The company is actively preparing for a recommencement of drilling at Yoquivo, with a diamond rig expected on site shortly. The newly acquired assay data will be crucial in refining their geological model and will feed directly into an updated JORC-compliant Mineral Resource Estimate (MRE).

Read More: Sarytogan Graphite Project in Kazakhstan Reaches Important Milestone

This focus on the MRE is critical. A robust, JORC-compliant resource is the bedrock for any serious mining operation and significantly enhances a company's valuation. It signals to the market that Advance Metals is moving beyond exploration and towards tangible production potential.

The implications are far-reaching:

Potential Acquisition Target: A project like Yoquivo, with its proven high-grade mineralization and significant exploration upside, could make Advance Metals a highly attractive acquisition target for larger mining companies looking to replenish their reserves.

Market Excitement: The high-grade discoveries have already ignited market excitement, a crucial factor in attracting further investment and capital for future development.

Contribution to Supply: With silver prices in a bullish environment, successful development at Yoquivo could make a meaningful contribution to future silver supply.

Unanswered Questions and The Road Ahead

While the recent findings are undoubtedly positive, several questions remain.

What caused the initial oversight of these core samples? Was it purely historical limitations, or were there other factors at play?

How representative are these initial results of the entire unassayed core? What percentage of the remaining un-sampled material is likely to yield similar grades?

What is the economic viability of extracting these high-grade veins at depth? Understanding the metallurgical characteristics and mining costs will be key.

How will these new discoveries impact the overall resource estimate? Will it significantly increase the ounces, and more importantly, the grade of the Yoquivo project?

The strategy of re-assaying historical core is a smart, cost-effective way to unlock hidden value. However, it also highlights a recurring theme in the mining industry: the importance of diligent data management and comprehensive historical review. The success at Yoquivo serves as a potent reminder that sometimes, the answers are already buried in the ground, waiting to be re-examined with fresh eyes and modern technology. Advance Metals appears to have struck gold – or rather, silver – by looking backward to move forward.

Sources:

.jpeg)