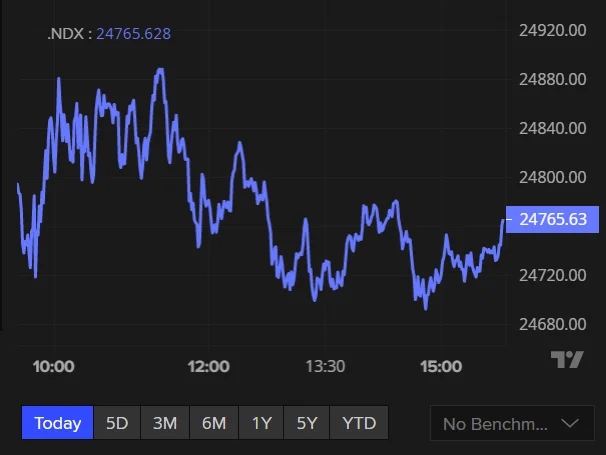

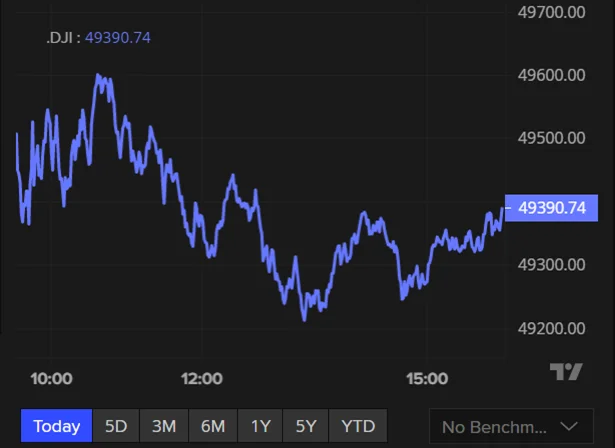

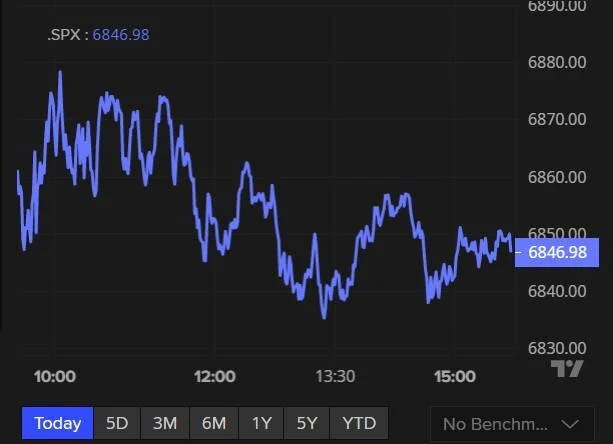

A cautious mood pervades global markets, with Australian shares poised for a lower open. This anticipated decline follows a downturn on Wall Street and is amplified by rising oil prices, which have jumped due to escalating geopolitical tensions between the United States and Iran. Investors are also scrutinizing upcoming economic data and the evolving impact of artificial intelligence on business models.

Market Performance and Influences

Australian shares are expected to open weaker, mirroring the performance of Wall Street. The S&P 500 closed Thursday with its yearly gains largely erased, a move attributed to investors exiting financial stocks. This rotation in the market is occurring as geopolitical tensions intensify.

Oil prices have extended their gains, driven by increasing tensions between the US and Iran. This rise in crude prices contributes to a cautious investor sentiment globally.

Currencies exhibited choppy movements against the US dollar. The Japanese yen saw an increase, while the Australian dollar experienced a dip.

Upcoming economic indicators from the US, including GDP growth, personal income & spending, PCE inflation, and new home sales, are being closely watched. Additionally, S&P Global PMIs are scheduled for release.

Corporate Activity and Sector Focus

Recent corporate news highlights significant events for QBE Insurance Group Limited. The company released its preliminary FY2025 results, including details on dividend rates and payment dates.

Read More: Trump Family Suggests Dollar Upgrade While Investing in Crypto in 2025

QBE was among companies that saw their shares "dumped" on the market, according to one report, following analyst concerns.

The broader insurance sector faces discussions around the potential for rising premiums nationwide, particularly as IAG reports a surge in payouts due to severe weather events and vehicle theft.

A report from the CSIRO and Insurance Council has flagged the need for "guardrails" in the insurance industry's deployment of artificial intelligence to protect consumers.

Software stocks remain under pressure, with companies like Salesforce, Intuit, and Cadence Design Systems experiencing declines as investors re-evaluate the influence of AI on their business frameworks.

Wall Street's Performance and Concerns

US sharemarkets registered a fall on Thursday. The S&P 500 is now close to its year-to-date flatline.

Investors are observed to be rotating out of financial stocks, signaling a potential shift in market sentiment.

Concerns surrounding private credit are a notable factor influencing Wall Street's performance.

The reassessment of artificial intelligence's impact on business models is contributing to pressure on software companies.

Evidence

Article 1 Summary: "Base metal prices fell on Thursday. Choppy currencies Currencies were choppy against the US dollar in European and US trade. … The Aussie dollar dipped from US70.78 cents to US70.26 cents and was near US70.55 cents at the US close."

Article 2 Summary: "US sharemarkets fell on Thursday, leaving the S&P 500 close to flat for the year as investors rotated out of financial stocks and monitored rising geopolitical tensions. Oil rises as geopolitical tensions build … Australian shares are set to open lower, tracking weakness on Wall Street and firmer oil prices."

Article 3 Summary: "ASX ends week up 1.7pc; Iress soars 12pc as QBE, GQG dumped Bourses’ first weekly rise in three weeks; Iress rockets on takeover talks; QBE hammered on analyst concerns…" Also mentions "Insurance premiums could rise nationwide as IAG claims surge".

Article 1 & 2 Combined: Both articles independently mention upcoming US economic data releases, including GDP, personal income & spending, and PCE inflation.

Geopolitical Tensions and Oil Market

Escalating geopolitical tensions between the US and Iran are a significant driver of current market sentiment, particularly influencing the oil market.

Crude prices have seen an extension of gains, directly linked to the heightened tensions.

This rise in oil prices contributes to cautious investor sentiment globally and is a factor expected to weigh on the Australian market opening.

Insurance Sector Dynamics

The Australian insurance sector is facing several key developments, impacting both insurers and consumers.

QBE Insurance Group has released its preliminary results for FY2025. The company was noted as being "hammered on analyst concerns" in market activity.

IAG, Australia's largest insurer, has reported a substantial increase in payouts due to severe weather in Queensland and carjackings in Victoria. This situation raises the prospect of rising insurance premiums across the nation.

Concerns are being voiced about the reputational risks associated with the deployment of artificial intelligence within the insurance industry. A joint report emphasizes the necessity of establishing protective measures for insurance consumers as AI integration progresses.

Conclusion

The Australian market is anticipated to open lower as it navigates a confluence of factors. Wall Street's retreat, driven by concerns over private credit and a rotation out of financial stocks, provides a negative lead. Simultaneously, the surge in oil prices, fueled by increasing US-Iran tensions, adds a layer of geopolitical risk and global economic uncertainty. The performance of specific companies, such as QBE, which has faced analyst concerns, will also be under scrutiny. Upcoming US economic data releases and ongoing discussions surrounding the impact of artificial intelligence on corporate models are further elements shaping market sentiment. The insurance sector, in particular, is under pressure due to rising claim costs, suggesting a potential for increased premiums for consumers.

Read More: Chaz Mostert Wins First Supercars Title But Doesn't Feel Like Number One

Sources

Proactive Investors: "The Morning Catch-Up: Energy-led ASX record but index set to slide today, Wall Street churn and oil back in focus" - https://www.proactiveinvestors.com.au/companies/news/1087648/the-morning-catch-up-energy-led-asx-record-but-index-set-to-slide-today-wall-street-churn-and-oil-back-in-focus-1087648.html

Sharecafe: "Wall Street falls on private credit concerns; ASX to open weaker" - https://www.sharecafe.com.au/2026/02/20/wall-street-falls-on-private-credit-concerns-asx-to-open-weaker/

Australian Financial Review (AFR): "QBE News, Analysis, Announcements & Results | QBE Insurance Group Limited" - https://www.afr.com/company/asx/qbe