The global financial stage is abuzz with whispers of recovery, but a seasoned observer can’t shake the nagging question: Is this a genuine healing, or merely a brief pause before the next plunge? Markets, like a tightrope walker, seem to be finding a precarious balance, swayed by pronouncements from powerful figures and the ever-present specter of economic uncertainty. We've seen rallies, we've seen drops, and now, as quickly as the storm clouds gathered, they seem to be parting, leaving investors to wonder if the sun is truly out, or just peeking through.

The Tariffs That Twist and Turn: A History of Volatility

The current market sentiment is deeply intertwined with a recurring narrative: trade tensions, particularly those involving tariffs. For years, these geopolitical maneuvers have acted as a powerful, often unpredictable, force shaping market movements. Remember the back-and-forth?

Read More: UK Economy Grew a Little at End of 2025

"Textbook Trump Volatility": One article explicitly labels the market's reaction to trade talk shifts as "textbook Trump volatility—bark, rattle, retreat." This suggests a predictable pattern where aggressive posturing is followed by de-escalation, conditioning markets to react predictably, almost like "Pavlov’s dogs" (FXStreet).

"Tariff Crisis" and "Tariff Threat": These phrases repeatedly appear, highlighting how central trade disputes have been to recent market turbulence (ii.co.uk, FXStreet).

"Delay Trade" and "EU Reprieve": The market has shown a clear positive reaction to news of tariff delays or negotiations, with significant upticks observed in futures markets (Fortune). For instance, a delay in threatened tariffs on EU goods by the U.S. President led to notable jumps in S&P 500, Nasdaq, and Dow futures (Fortune).

How long have these tariff-related market swings been a dominant factor?

What specific industries or companies have been most consistently impacted by this back-and-forth?

The Anatomy of a Market Downturn: What We Know and What We Don't

Economists and analysts have been dissecting market corrections and downturns for decades, yet predicting their duration and impact remains an elusive art. While history offers a valuable, albeit imperfect, guide, each event carries its own unique set of catalysts and recovery paths.

Read More: Retirees Need Cars But Worry About Money

"Market Corrections and Larger Drops Are Always Unsettling": This is a fundamental truth for any investor. The psychological impact of seeing one's portfolio value decline can be profound, leading to fear-driven decisions (Invesco).

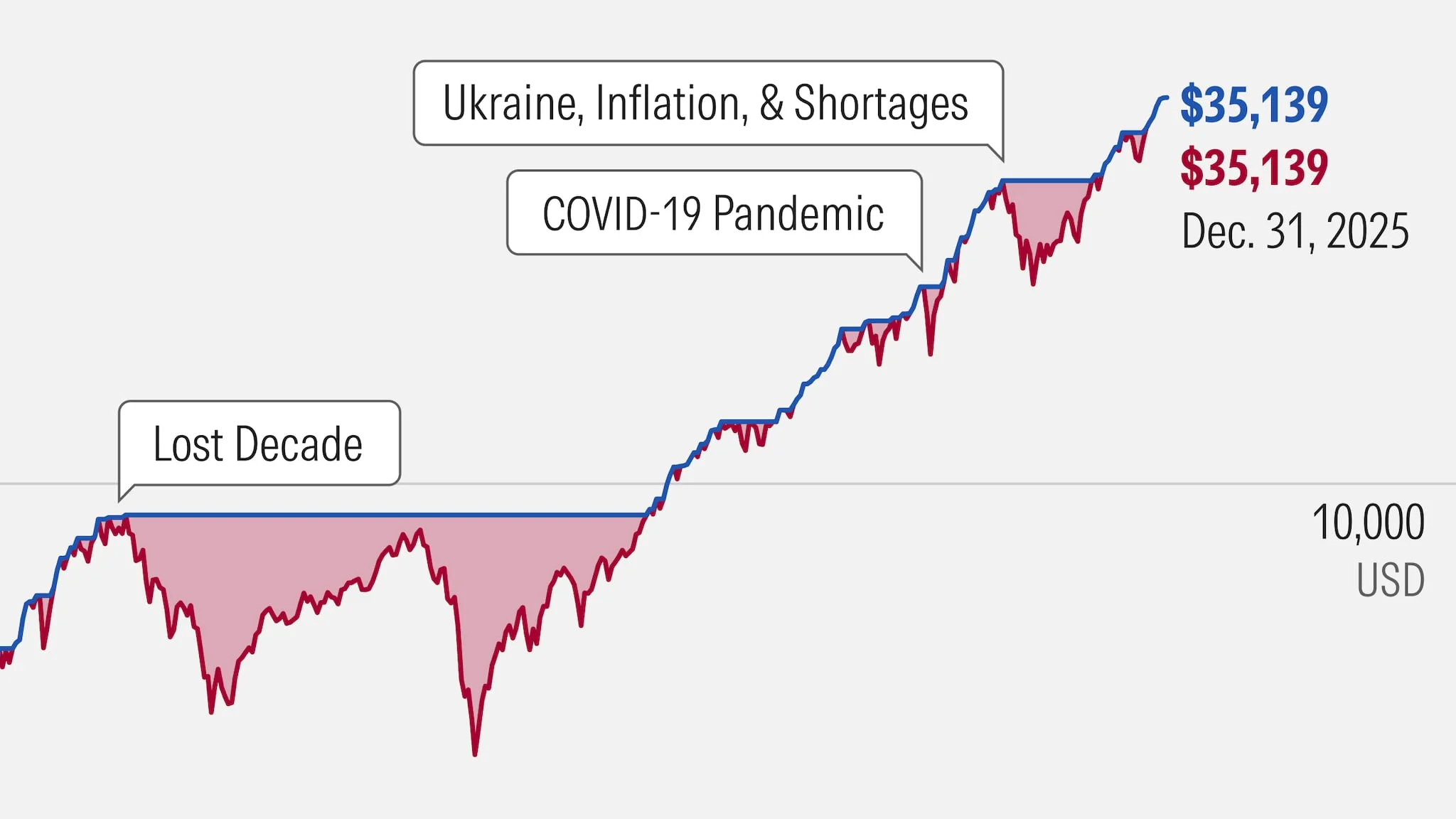

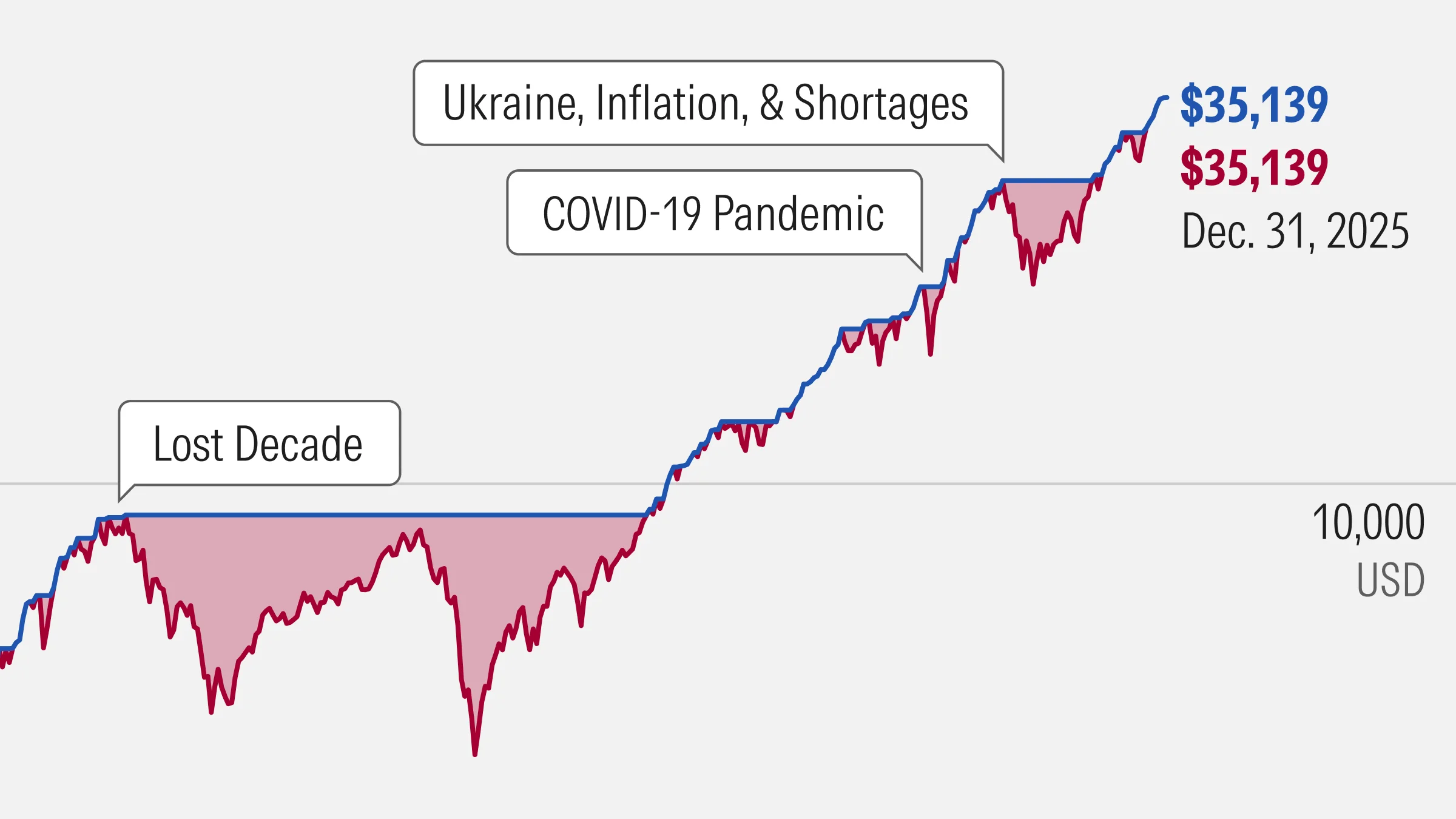

"It’s Impossible to Predict How Long a Stock Market Recovery Will Take": This stark admission from a reputable financial source underscores the inherent uncertainty. While past performance can offer context, it's far from a crystal ball (Morningstar).

Historical Recovery Times Vary Wildly: The longest recovery periods for some asset classes have stretched over six years (Morningstar). This is a crucial point; a "quick bounce back" is not guaranteed, and investors need to be prepared for potentially prolonged periods of recovery.

What Triggers a Downturn? While specific events like tariff threats or economic slowdowns play a role, the fundamental driver is often a shift in investor sentiment, where "investors are more motivated to sell than to buy" (NerdWallet).

Read More: Sir Jim Ratcliffe Says Sorry for Immigration Comments

| Downturn Type | Description | Typical Duration (Estimates) | Key Factors |

|---|---|---|---|

| Correction | A drop of 10% or more from recent highs. | Short-term (weeks to months) | Profit-taking, investor sentiment shifts, minor economic headwinds. |

| Bear Market | A sustained decline of 20% or more from recent highs. | Medium to Long-term (months to years) | Significant economic recession, major geopolitical events, systemic financial issues. |

| Market Crash | A rapid and severe decline in asset prices across a broad market segment. | Very Short-term (days to weeks) | Financial panic, unforeseen disasters, major economic shocks. |

What specific economic indicators are currently being watched most closely to signal an impending downturn?

How does the current market structure (e.g., dominance of certain tech stocks) differ from past periods of volatility, and does this change the recovery playbook?

The "AI Boom" and "Saudi Deals": Engines of Growth or Fleeting Fads?

Amidst the broader market anxieties, specific sectors are experiencing significant tailwinds, often driven by technological advancements and substantial investment. The Artificial Intelligence (AI) revolution and major investments, like those reportedly involving Saudi Arabia, are frequently cited as drivers of market strength.

Read More: India's Market Rules Made Simpler to Help Businesses and Investors

"Tech Bull Market in Full Swing Amid AI Boom": This indicates a strong positive sentiment and performance within the technology sector, largely attributed to the advancements and potential of AI (ii.co.uk).

"Huge Saudi Deals": The mention of substantial deals, presumably involving Saudi capital, suggests a significant injection of funds into specific market segments, potentially bolstering growth narratives (ii.co.uk).

"Market less reliant on a single narrative": A positive sign for market health is when growth is not solely dependent on one sector or theme. The ideal scenario is broader participation, making the market more resilient (US Bank).

Are these "AI boom" and "Saudi deals" fundamentally reshaping industries, or are they speculative bubbles fueled by excessive optimism?

What is the underlying economic reality behind these "huge Saudi deals" and what are their long-term implications?

The Elusive Art of Market Timing: A Fool's Errand?

The perennial question for investors is: when to buy, when to sell, and when to simply hold on. The temptation to time the market—to perfectly predict tops and bottoms—is immense, but the evidence overwhelmingly suggests it’s a strategy fraught with peril.

Read More: Arc Raiders Game Sells 14 Million Copies, Much More Than Expected

"Perfect Market Timing Is a Myth": This is a crucial takeaway. Even seasoned professionals struggle to consistently get it right. The odds are stacked against the individual investor attempting to outsmart the market (Britannica Money).

"The Risk of Missing Big Rallies": The danger of trying to time the market isn't just about making wrong moves; it's about missing out on significant upward movements that can dramatically impact long-term returns. Waiting for the "perfect" moment to re-enter the market can mean leaving substantial gains on the table (Britannica Money).

"Market corrections occur because investors are more motivated to sell than to buy": This highlights the herd mentality that can drive market swings. Trying to predict these shifts individually is a formidable challenge (NerdWallet).

Focus on Long-Term Goals: The most prudent advice consistently revolves around maintaining investment discipline and focusing on long-term objectives, rather than reacting to short-term market noise (Invesco, GAM).

| Strategy | Description | Potential Pitfalls | Long-Term Viability |

|---|---|---|---|

| Market Timing | Attempting to predict and capitalize on short-term market movements (buy low, sell high). | Missing rallies, increased transaction costs, emotional decision-making, failure. | Very Low |

| Buy and Hold | Investing in assets with the intention of holding them for an extended period. | Exposure to prolonged downturns, requires patience, potential for poor initial selection. | High |

| Dollar-Cost Averaging | Investing a fixed amount of money at regular intervals, regardless of market conditions. | May result in buying more shares when prices are high, less optimal than lump sum if market rises steadily. | High |

If perfect market timing is a myth, what are the most effective strategies for investors to navigate volatility and protect their portfolios?

How do government actions, like shutdowns or policy shifts, truly impact long-term market trends versus short-term fluctuations?

The Lingering Question: Reprieve or Recovery?

The market currently seems to be experiencing a "reprieve," a temporary cessation of hostilities. However, the underlying causes of previous volatility—geopolitical tensions, tariff threats, and economic uncertainties—remain.

Read More: Money Spent, Project Slow: Questions About Sector 7G Funds

"The global financial system is not yet out of the woods": This sobering assessment suggests that the current positive sentiment might be fragile. The recovery may be superficial, with deeper issues yet to be resolved (ii.co.uk).

"Tariff negotiations, implementation timelines, legal challenges and inflation trends remain key swing factors": These are not minor details; they are critical variables that can swiftly alter the market's trajectory (US Bank).

"Past performance does not guarantee future results": A mantra repeated across financial analysis, it serves as a crucial reminder that historical recoveries are not blueprints for the present (Invesco, Finsyn, GAM).

What concrete policy shifts or economic data points would truly signal a genuine market recovery, as opposed to a temporary bounce?

In the face of such uncertainty, what responsibility do financial institutions and media outlets have in framing market narratives to avoid exacerbating investor anxiety or promoting false optimism?

Sources:

Article 1: Market snapshot: a temporary reprieve or genuine recovery? - ii.co.uk

Article 3: Stock market corrections and what investors should know - Invesco

Article 4: Markets waltz between tariff threat and reprieve | FXStreet

Article 5: Is The Market Recovery Here? Historical Perspective. - Finsyn

Article 6: How long does it take the markets to recover from a downturn? - IG.ca

Article 7: Trump tariff delay trade is back, sending U.S. markets up on EU reprieve | Fortune

Article 8: What We’ve Learned From 150 Years of Stock Market Crashes - Morningstar

Article 9: How long does a stock market recovery take? - MoneyWeek

Article 10: How Long Will It Take the Market to Recover? - Morningstar

Article 13: Does Market Timing Work? Risks & Alternatives | Britannica Money

Read More: Sir Jim Ratcliffe Says Sorry for Immigration Words