A new plan to tax the richest people in California has created a deep split between major leaders in the Democratic Party. Senator Bernie Sanders is traveling to Los Angeles to support the "billionaire tax," while Governor Gavin Newsom is working to stop it. This disagreement comes as the party prepares for important elections later this year. The tax would target the personal wealth of the state's most successful residents, many of whom work in the technology sector. While supporters say the money is needed to pay for public services, opponents argue it will force wealthy people and their businesses to move to other states.

The Timeline and Key Figures

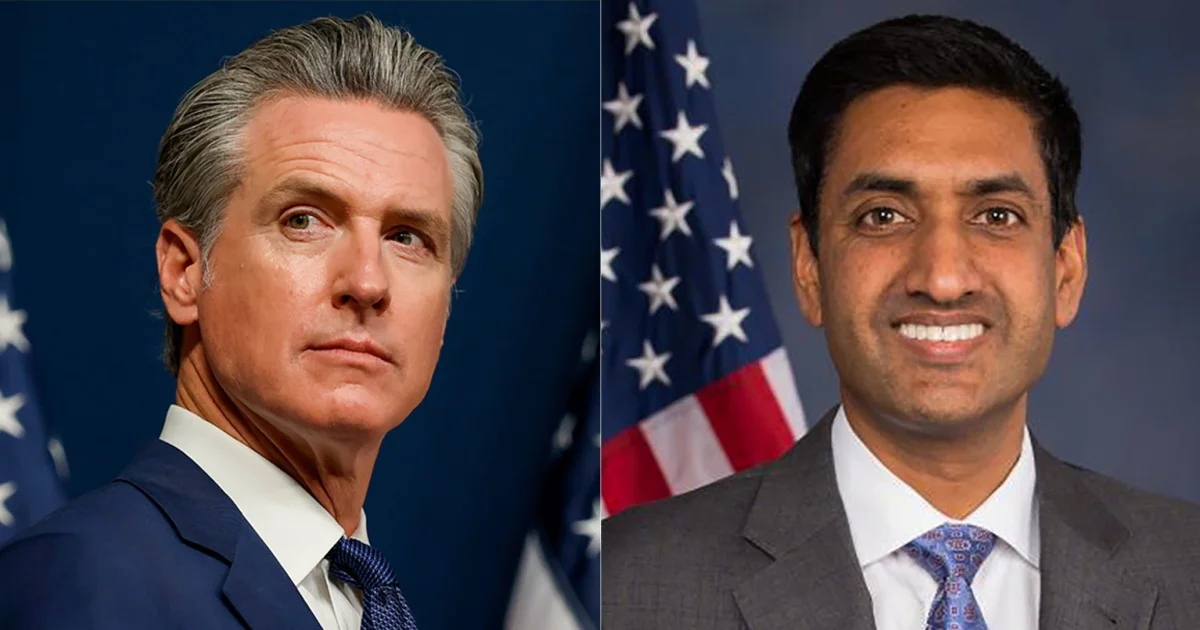

The conflict has grown quickly since the start of 2026. The main actors include national figures and local leaders with different views on how to manage the state's economy.

Read More: Global Counsel Faces Collapse After Lord Mandelson's Epstein Links Cause Client Loss

December 2025: Senator Bernie Sanders officially supports the tax, calling for the "billionaire class" to pay more.

January 2026: California Attorney General Rob Bonta releases the official title and summary for the ballot initiative. Tech leaders like Peter Thiel and Larry Page reportedly threaten to leave the state.

February 2026: Governor Gavin Newsom increases his public opposition. New polls show that while many voters like the idea, they also feel nervous about how it might change the state.

Current: Bernie Sanders is holding rallies in Los Angeles to gain support from labor unions and residents.

"California is facing massive federal healthcare cuts—$20 to $30 billion a year for the next five years," said Suzanne Jimenez, chief of staff of SEIU-UHW, a union supporting the tax.

Evidence and Data

| Subject | Details |

|---|---|

| Tax Rate | A one-time tax based on the net worth of billionaires. |

| Retroactive Date | The tax would apply to anyone living in California as of January 1, 2026. |

| Public Opinion | Nestpoint survey (Feb 2026) shows support for the tax but high "voter anxiety." |

| Economic Risk | Lawmakers report billionaires are already moving to Wyoming, Utah, and Texas. |

The core of the debate is a $20 billion to $30 billion gap in healthcare funding that supporters say the tax would fix.

The Choice Between Fairness and Economic Growth

Supporters of the tax, led by Sanders, argue that wealth has moved away from workers and toward the top 1% for 50 years. They see this tax as a way to fix the state budget and fund schools and hospitals.

On the other side, Governor Newsom and some Silicon Valley representatives, like Sam Liccardo, argue that the tax will actually hurt the state budget. They believe that if the richest people leave, the state will lose the regular income taxes those people already pay. This could lead to less money for police, fire services, and teachers.

The Risk of Wealth Migration

A major part of the debate is whether wealthy people will actually move away.

The Warning: Representative Sam Liccardo stated he has already spoken with three billionaires who moved to other states. He argues that taxing "unrealized gains"—money that exists on paper but is not yet cash—is the fastest way to drive founders out of California.

The Counter-Argument: Supporters suggest that the state's high quality of life and business environment will keep people there. They point out that California has faced these threats before but remains a global leader in technology.

Is the threat of an "exodus" a real danger to the state's tax base, or is it a tactic used to protect personal wealth?

Read More: Gavin Newsom's California Record Faces Questions for 2028 Presidential Run

Political Friction Within the Party

The tax is also changing how Democratic candidates run for office.

Internal Pressure: U.S. Representative Ro Khanna supports the tax, but this has led wealthy tech donors to look for someone to run against him in his next election.

Statewide Race: Katie Porter, who is running for governor, has joined Newsom in opposing the plan.

The National Signal: Bernie Sanders believes this tax should be a "template" or a model for other states to follow.

Expert Analysis

Experts are divided on the long-term impact of this tax. Sam Liccardo argues that the way the law is written would unfairly tax startup owners based on "private market valuations" which can change quickly. He claims, "California’s biggest taxpayers will become Texas’s biggest taxpayers."

Conversely, labor leaders like Suzanne Jimenez focus on the immediate need for cash. She points to the large cuts in federal healthcare money as a reason why the state must find new ways to get funds. They argue that the state cannot afford to let its services fail while billionaire wealth grows.

Current Findings and Next Steps

The situation remains unresolved as both sides prepare for a long fight.

Voter Decision: The proposal is moving toward a public vote where citizens will decide the outcome.

Economic Tracking: Analysts are watching to see if there is a measurable increase in wealthy residents changing their legal address to states without wealth taxes.

Political Fallout: The divide between the progressive wing (Sanders) and the centrist wing (Newsom) may impact how the party talks to voters during the fall elections.

The main question for the state remains: Can California collect more from its richest residents without losing the businesses and people that drive its economy?

Read More: Donald Trump jokes about Nobel Peace Prize at Gaza aid meeting announcement in Norway

Sources

U.S. News & World Report: Bernie Sanders and Gavin Newsom Become Adversaries Over Push to Tax California Billionaires

USA Today: California's 'billionaire tax' faces showdown as Newsom opposes, voters support

Common Dreams: Sanders Backs Push for Billionaire Tax in California as Newsom Raises Money to Fight It

NBC News: Democratic fault lines emerge over California's billionaire tax proposal

Fortune: 'You are really playing with fire with this one': California billionaires tax ignites

The Mercury News: Billionaire tax plan draws fire from California top Democrats