A new plan to tax the richest people in California has created a deep split within the Democratic Party. While Senator Bernie Sanders travels to Los Angeles to support the measure, Governor Gavin Newsom is working to stop it. The plan aims to tax billionaires on their total wealth to pay for public services like healthcare. However, the proposal has led to threats from tech leaders who say they will move their companies to other states. This disagreement comes at a time when the party is trying to stay united before the next elections. The tension highlights a major choice for the state: find new ways to fund the government or keep the wealthy from leaving.

Timeline of the Dispute and Main Figures

The effort to pass this tax has moved quickly from a grassroots idea to a national political issue.

Read More: Global Counsel Faces Collapse After Lord Mandelson's Epstein Links Cause Client Loss

Late 2025: Bernie Sanders officially supports the California tax on billionaires.

January 2026: California Attorney General Rob Bonta releases the official title and summary for the ballot initiative.

February 2026: New polls show that many voters support the idea, but they also worry about how it might change the state's economy.

Current Events: Sanders holds rallies in Los Angeles, while Newsom and other leaders express strong opposition.

Key Figures Involved:

Bernie Sanders: U.S. Senator (Vermont) supporting the tax for "economic fairness."

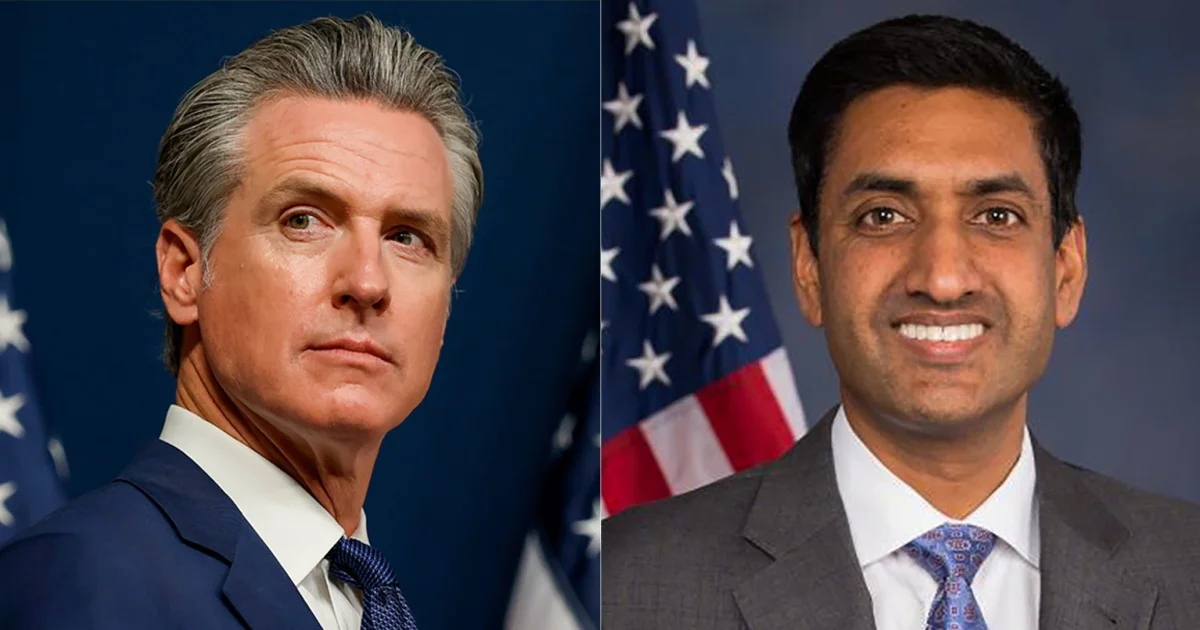

Gavin Newsom: California Governor opposing the tax due to fears of losing taxpayers.

Ro Khanna: U.S. Representative (Silicon Valley) who supports the tax despite pressure from tech leaders.

Sam Liccardo: U.S. Representative who argues the tax will drive wealth to states like Texas.

SEIU-UHW: A large healthcare union pushing for the tax to cover budget gaps.

Data and Official Statements

The proposed tax is not a traditional income tax. Instead, it looks at the total net worth of the state's wealthiest residents.

"We need a tax system that demands that the billionaire class finally pays their fair share of taxes." — Senator Bernie Sanders

"The tax would reduce investment in education, childcare, firefighting, police services, and other core services — rather than strengthening them." — Governor Gavin Newsom

| Feature | Details of the Proposal |

|---|---|

| Tax Target | Billionaires living in California. |

| Effective Date | Retroactive to January 1, 2026. |

| Funding Goal | To cover $20 billion to $30 billion in expected healthcare cuts. |

| Method | Calculated based on total net worth, including unrealized gains. |

The core of the conflict is whether taxing wealth will provide stable money for the state or cause the most successful residents to leave.

The Push for Economic Fairness

Supporters of the tax, led by Bernie Sanders, argue that the current system allows the very wealthy to avoid paying what they owe. They point to a 50-year trend where wealth has moved from the bottom 90% of people to the top 1%.

Suzanne Jimenez, an official with the SEIU-UHW union, states that the money is needed because California expects to lose billions in federal healthcare funding. Proponents believe that the state cannot wait for federal changes and must act locally. Representative Ro Khanna has also supported the measure, even though it has caused some wealthy donors to look for candidates to run against him in future elections.

Read More: Gavin Newsom's California Record Faces Questions for 2028 Presidential Run

Fears of a "Wealth Exodus"

Opponents of the plan, including Governor Newsom, argue that the tax is a danger to the state's economy. They believe that billionaires will simply move to states with no such tax, like Texas, Wyoming, or Utah.

Representative Sam Liccardo has stated that he knows of at least three billionaires who have already left. He argues that taxing "unrealized gains"—money that exists on paper but hasn't been cashed out yet—is a mistake. This could hurt people who start new companies (startups) because their wealth often changes based on market values that go up and down. Is the threat of billionaires leaving a reality, or is it a tactic used to stop the tax? Evidence shows some movement, but the total impact is still being studied.

Read More: Donald Trump jokes about Nobel Peace Prize at Gaza aid meeting announcement in Norway

Division Among Top Democrats

The tax has created unusual alliances and rivalries. While Sanders and Khanna are in favor, other well-known Democrats are siding with the Governor. Katie Porter, a former congresswoman running for governor, has expressed concerns about the way the tax is designed.

The division is also visible in the tech industry. Some leaders in Silicon Valley are spending money on ads to convince party insiders to vote against the measure at upcoming conventions. This creates a difficult situation for the Democratic Party, which needs both the support of labor unions (who want the tax) and the financial support of the tech industry.

Expert Analysis

Experts see this as a test case for wealth taxes across the United States.

Political Impact: Observers note that this fight is happening just as Democrats want to show a united front for midterm elections. The public disagreement between Sanders and Newsom suggests a deep gap between the "progressive" and "moderate" wings of the party.

Economic Risk: Sam Liccardo warns that "California’s biggest taxpayers will become Texas’s biggest taxpayers." He believes the innovation economy depends on keeping venture capitalists in the state.

Fiscal Necessity: Union leaders argue that without this tax, the state will have to cut essential services for the poor and elderly due to a lack of federal money.

Conclusion

The investigation into the California billionaire tax shows a state at a crossroads. On one side, there is a strong movement to address wealth inequality and fund healthcare. On the other side, there is a fear that high taxes will destroy the state’s status as a tech leader.

Read More: California Billionaire Wealth Tax Proposal Creates Split Between State Leaders

Current Findings:

The tax would be retroactive, starting from the beginning of 2026.

There is a clear split between high-level Democratic leaders.

Billionaires like Peter Thiel and Larry Page have reportedly considered leaving the state.

Public polling shows that while voters like the idea of fairness, they are nervous about the economic consequences.

The next steps involve a major rally by Bernie Sanders and a state Democratic convention where the party must decide how to handle this internal conflict. Whether this tax will help or hurt California's budget remains a question that only the voters may eventually answer.

Primary Sources and Context

U.S. News: Bernie Sanders and Gavin Newsom Become Adversaries

Context: Reports on the upcoming Sanders rally and the rift with Newsom.USA Today: California's 'billionaire tax' faces showdown

Context: Details on February 2026 polling and Newsom's warnings about core services.Common Dreams: Sanders Backs Push for Billionaire Tax

Context: Provides the union perspective and the specific fiscal gaps the tax aims to fill.The Mercury News: Billionaire tax plan draws fire from top Democrats

Context: Focuses on the Silicon Valley reaction and comments from Sam Liccardo.NBC News: Democratic fault lines emerge

Context: Analyzes the national political implications for the Democratic party.