The craft beer company BrewDog has started a formal process to find a buyer for its business. After reporting total losses of £148 million since 2019, the company board has hired AlixPartners to manage the sale. This move follows a period of financial struggle and public disagreement over how the company is run. The sale puts the investments of 220,000 small shareholders, known as "Equity Punks," at risk. Many of these individuals bought shares believing the company was a "unicorn" valued at £2 billion. However, recent reports suggest the final sale price may be much lower than that high point. As the company looks for new owners, the future of its 72 global bars and four major breweries remains uncertain.

The Financial Path to a Formal Sale

The company began as a small brewery in Scotland and grew quickly by asking fans to invest money directly. This "Equity for Punks" program raised millions of pounds.

Read More: How Mellow's Indie Launchpad Helps Small Game Studios Hire Workers

2017: A private equity firm, TSG Consumer Partners, invested in the company. This deal included "preference shares," which give TSG a guaranteed return before other investors get paid.

2021: The company reached a peak valuation of £2 billion.

2019–2024: BrewDog recorded five years of losses, totaling £148 million.

July 2025: The company announced it would close 10 pubs across the UK, including locations in London, Aberdeen, and Leeds.

Present: A "quickfire" sale process is underway. Potential buyers must submit offers quickly, leading to concerns that the company might be broken into smaller pieces.

"BrewDog was, and is, built on a cult of personality." — Equity for Punks Forum Statement

Documented Evidence of Financial and Structural Change

Data from recent filings and news reports show a gap between the company’s public image and its current financial state.

| Category | Key Detail | Data Point |

|---|---|---|

| Total Losses | Financial deficits since 2019 | £148 million |

| Small Investors | Number of "Equity Punks" | 220,000 people |

| Job Impacts | Recent pub closures | 10 UK locations |

| Peak Value | Highest estimated worth (2021) | £2 billion |

| Current Assets | Global bar count | 72 bars |

Read More: How Nicholas J. Fuentes Gets Money for His Political Activities

The core issue for small investors is the "waterfall" payment structure, where large firms like TSG are paid first, potentially leaving nothing for the public.

The "Preference Share" Conflict

Small investors vs. Large private equity

Small investors bought shares hoping the company would eventually join the stock market. However, the deal with TSG Consumer Partners changed how money is distributed.

Viewpoint A (The Deal Necessity): Taking money from TSG allowed the company to expand globally and build breweries in the US and Germany. This was seen as a way to keep the company growing when it needed cash.

Viewpoint B (The Investor Risk): The TSG deal included "preference" terms. This means if the company is sold for a low price, TSG gets their money back first with interest. Small investors only get money if there is anything left over after TSG is paid.

The Future of the Brand

A unified company vs. Asset break-up

Read More: Why PSU Banks and Capital Goods Are Leading the Stock Market Gains

There are different ideas about what will happen to the company next.

Viewpoint A (Whole Sale): A large beer company might buy BrewDog to keep its top brands, like Punk IPA and Hazy Jane, together under one roof.

Viewpoint B (Break-up): Buyers might only want specific parts, such as the 72 bars or the four breweries. This could mean the company is sold in pieces to different bidders.

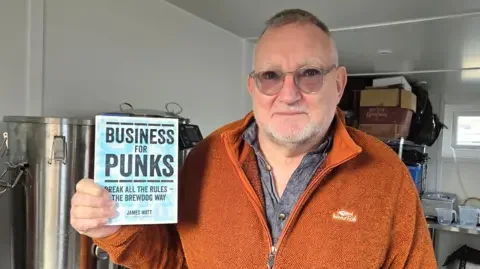

Viewpoint C (Founder Return): Reports indicate that James Watt, the former CEO and major shareholder, may be looking for financial partners to help him buy the company back.

Allegations and Leadership

Brand identity vs. Workplace claims

BrewDog marketed itself as "anti-establishment" and "punk," but it has faced internal problems.

Worker Claims: In the past, some former staff members used a BBC investigation to claim the work culture was difficult.

Management Response: Lawyers for James Watt have stated that these claims are false. The company has focused on "redeployment" for staff affected by the recent pub closures to keep them employed.

Expert Analysis

Financial analysts and restructuring experts note that the speed of the sale is a sign of pressure. AlixPartners, the firm managing the sale, specializes in helping businesses that need to change quickly to survive.

Read More: How Santos Job Cuts and Asset Sales Affect Australian Energy Workers

Financial Insight: Experts point out that because BrewDog has high-interest debt and five years of losses, the "unicorn" valuation of £2 billion is likely no longer accurate.

Legal Perspective: Lawyers tracking the case highlight that small investors who spent thousands of pounds—like the investor who put in £12,000—were often unaware of the specific details in the TSG deal until it was discussed on online forums.

"BrewDog has officially launched a formal sale process that could lead to the break-up of the company." — Hounslow Herald Report

Summary of Findings

The evidence shows that BrewDog is in a difficult financial position. The company has lost £148 million over five years and is now closing pubs to save money. The "Equity for Punks" investors, who provided the early funding for the company, are now in a position where they might lose their entire investment.

Read More: How ASX Bank and Miner Swings Affect Australian Investors

What happens next?

The board will review "indicative offers" from potential buyers.

The company must decide if it will sell as one business or be broken apart.

If the sale price does not cover the debts and the guaranteed payments to TSG, small investors will likely receive no money for their shares.

The transition from a high-growth "punk" brand to a company seeking a buyer marks a significant shift in the UK's craft beer industry.

Primary Sources

BBC News: I invested £12,000 in Brewdog - I think I've lost it all

Hounslow Herald: BrewDog Sale Sparks Fury as 220,000 'Equity Punks' Face Total Investment Wipeout

Little Law: The $1 billion BrewDog deal that left everyone empty-handed

Read More: Why London Park Cafes Are Being Given to Daisy Green and What It Means for Locals