The Australian share market has been rocked by a brutal sell-off, shedding over $60 billion in a single day. This dramatic plunge, the worst since Donald Trump's "liberation day" tariffs in April 2026, has sent shockwaves through the investment community. Fears surrounding the dizzying valuations of Artificial Intelligence (AI) companies, the volatile world of cryptocurrency, and the uncertainty surrounding interest rate hikes have coalesced into a potent cocktail of panic, forcing investors to flee to safety. This isn't just a minor dip; it's a full-blown market rout that is erasing months of gains and leaving many questioning the foundations of recent market booms.

A Familiar Fury: Echoes of Past Panics

This isn't the first time the ASX has witnessed such a seismic event. The market's volatility, particularly in recent years, has been punctuated by significant drops, often triggered by a confluence of global and domestic anxieties. Understanding these past incidents provides crucial context for the current crisis.

Read More: Retirees Need Cars But Worry About Money

February 2018: The ASX saw a staggering 3% drop, wiping $60 billion off the market. This sell-off impacted every sector, with technology, energy, and healthcare bearing the brunt. (Source: abc.net.au)

August 2019: Another $60 billion vanished from the ASX, marking the worst day in 18 months. Concerns over global growth and potential recession in Germany, alongside weakening Chinese growth, fueled investor unease. (Source: theguardian.com)

November 2025: The market suffered two significant blows. On November 18th, the ASX plunged 1.9%, erasing $60 billion, driven by a tech rout and hawkish Reserve Bank of Australia (RBA) minutes that dashed rate-cut hopes. Just two days prior, on November 14th, $37 billion was wiped out as doubts about interest rate cuts, AI overvaluation, and a Wall Street crunch combined. (Sources: ts2.tech, smallcaps.com.au)

March 2025: US recession fears sent ripples across the globe, causing the ASX to shed over $45 billion. The tech-heavy Nasdaq and S&P 500 experienced significant drops, impacting major tech players. (Source: sbs.com.au)

April 2025: Nearly $110 billion was wiped off Australian shares as the ASX 200 dropped a severe 4.2%. (Source: abc.net.au)

Read More: Protests in Melbourne During Israeli President's Visit

These recurring patterns suggest a market susceptible to rapid shifts in sentiment, often amplified by global economic forces and specific domestic concerns like interest rate policy. The recurring theme of significant value destruction underscores the fragility of investor confidence in certain periods.

The Perfect Storm: AI, Crypto, and Interest Rate Jitters

The current market maelstrom appears to be driven by a potent mix of factors that have converged with alarming speed. The narrative of ever-increasing tech valuations, fueled by the promise of AI, is now facing intense scrutiny.

| Trigger Factor | Details of Concern |

|---|---|

| AI Hype & Valuations | Nvidia's earnings are a key bellwether for the global AI trade and high-growth tech valuations. Concerns are mounting that significant investments in AI, like Amazon's $200 billion capex plan, may not yield the expected returns. This has led to a 12.6% dive in the tech sector for the week. |

| Cryptocurrency Volatility | Bitcoin's sharp fall below $US60,000 for the first time since October 2024 has spooked investors. This broad equity derisking, coupled with concerns about AI and precious metals, suggests a wider reassessment of speculative assets. |

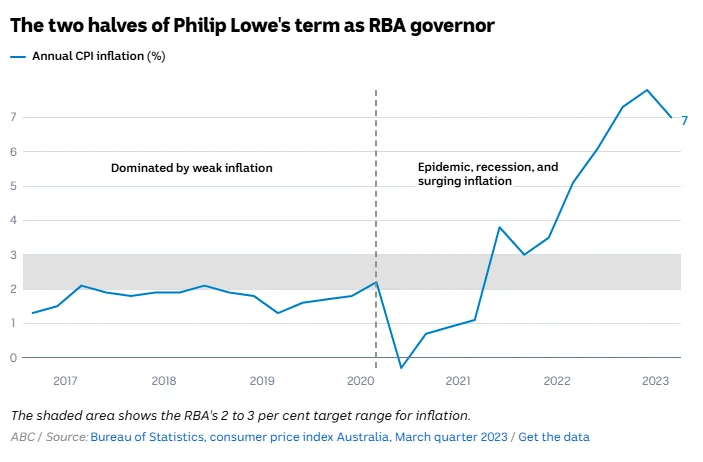

| Interest Rate Uncertainty | Hawkish RBA minutes and CBA's outlook have crushed hopes for imminent rate cuts. Investors are now questioning the steady downward trajectory of rates in 2025, with the possibility of rates holding steady or even increasing to combat inflation becoming a real concern. |

| Global Economic Worries | Sliding commodity prices, recession fears in Germany, and weakening Chinese growth contribute to a general sense of unease about the global economic outlook, impacting resource-heavy markets like Australia. |

Read More: India's Market Rules Made Simpler to Help Businesses and Investors

The speed and simultaneity of these concerns are particularly troubling. As one analyst noted, "The speed of this sell-off suggests we’re in a forced deleveraging event rather than an orderly correction." (Source: afr.com) The questioning of AI, crypto, and precious metals—three pillars that drove markets in 2025—all at once significantly increases the odds of further market unwinding.

The Tech Tsunami: Sector-Specific Devastation

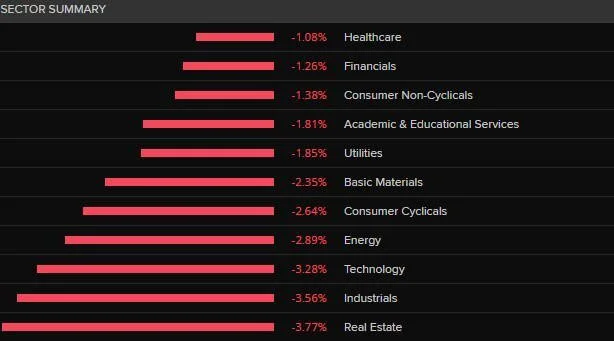

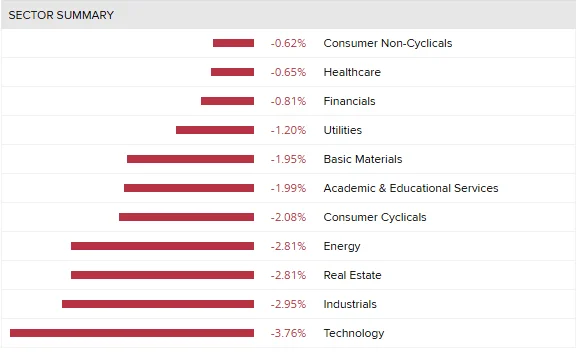

The technology sector has been at the epicenter of this storm, bearing the brunt of investor anxieties. Its rapid ascent in recent years, fueled by innovation and speculation, now appears to be facing a harsh reckoning.

Broad Sector Decline: The tech sector on the ASX plunged by a staggering 12.6% for the week. (Source: afr.com) This follows a 6% drop on November 18th, contributing to a 17% loss for the month. (Source: afr.com)

Individual Stock Carnage: Companies like Web Travel have seen their share prices plummet by 28%. (Source: afr.com) TechnologyOne, a prominent Australian software company, has been a poster child for this rout, with its shares down 5% in the latest market movement and previously experiencing sharp intraday volatility. (Sources: ts2.tech, smh.com.au)

Global Tech Woes: The Australian tech downturn mirrors global trends. Major US tech giants like Amazon fell 11% in after-hours trading following their capital expenditure plans. The "Magnificent Seven" stocks (Amazon, Apple, Meta, Alphabet, Microsoft, Nvidia, and Tesla) collectively fell over 5% amid broader tech sell-offs. (Sources: afr.com, sbs.com.au)

Read More: Many Protests Happen in Australian Cities

The narrative around tech valuations is clearly shifting. The once-unstoppable march of growth stocks is now being questioned as investors re-evaluate the sustainability of these sky-high prices in the face of economic headwinds and the very technology that was meant to drive future growth.

Beyond Tech: Broader Market Tremors

While technology has been hit hardest, the contagion effect has spread across the ASX, impacting nearly every sector. This indicates that the current sell-off is not merely a sector-specific correction but a broader market phenomenon driven by deep-seated investor concerns.

Commodities Under Pressure: Mining giants like BHP shed 3.1%, and Fortescue lost 1.2%, reflecting concerns about global growth and demand for raw materials. (Source: smh.com.au)

Financial Sector Wobbles: The "big four" banks also saw significant losses. Commonwealth Bank fell 0.2%, Westpac 1.2%, NAB 1.6%, and ANZ 1.5%. (Source: smh.com.au)

Real Estate and Uranium Stocks: These sectors have also been dragged down, highlighting the widespread nature of the "equity derisking." (Source: afr.com)

Gold Miners Tumble: Even traditional safe-haven assets like gold miners are not immune, with Northern Star losing 1.7% and Evolution Mining falling 1.4%. (Source: smh.com.au)

Read More: Money Spent, Project Slow: Questions About Sector 7G Funds

The fact that all 11 sectors on the ASX finished in the red on November 18th, 2025, is a stark indicator of the widespread anxiety gripping the market. (Source: afr.com) This broad-based decline suggests that investors are systematically de-risking their portfolios, a behavior that can signal a more prolonged downturn.

The Path Forward: Navigating the Uncertainty

The recent market rout has erased significant value and shattered investor optimism. The immediate future for the ASX appears fraught with uncertainty, as the core drivers of recent market booms – AI, crypto, and low interest rates – are all under intense scrutiny.

What does this mean for individual investors?

Short-term traders are likely to remain focused on volatility, sector rotation, and macro catalysts. (Source: ts2.tech)

The market's reaction to upcoming Nvidia earnings will be a critical indicator for the tech sector's future.

Domestic interest rate expectations will continue to heavily influence the ASX, particularly with the RBA's stance under the microscope.

Read More: Barbeques Galore Stores Close After Company Faces Money Problems

The question now is whether this is a temporary correction or the beginning of a more significant bear market. The speed and breadth of this sell-off suggest that the underlying concerns are substantial. Investors are no longer willing to bet on the continuation of the speculative highs seen in 2025.

"The fact that investors are questioning the three pillars that drove markets in 2025 – AI, crypto, and precious metals – all at once, raises the odds of further unwinding." (Source: afr.com)

Moving forward, investors will be closely watching for:

Clarity on global economic growth: Will major economies like China and Germany avoid a significant slowdown?

Interest rate trajectory: Will central banks be forced to maintain higher rates for longer to combat inflation?

AI's tangible impact: Can AI companies translate their grand visions into sustainable profits?

Read More: Northern Ireland Gets £400 Million for Health and Schools

The current market conditions demand caution and a clear-eyed assessment of risk. The era of easy money and unchecked optimism appears to be over, replaced by a more sober reality where fundamentals and long-term value are once again paramount.

Sources:

ABC News: "ASX suffers worst day in almost a year in 'panic' sell-off — as it happened" - https://www.abc.net.au/news/2026-02-06/asx-markets-business-news-friday-6-february-live-updates/106312232

Australian Financial Review: "ASX 200 LIVE: ASX dives 2pc in biggest sell-off since ‘liberation day’; Web Travel sinks 28pc" - https://www.afr.com/markets/equity-markets/asx-to-drop-us-techs-extend-sell-off-bitcoin-plunges-below-us64-000-20260206-p5o00n

TS2: "Australian Stock Market Today: ASX 200 Plunges 1.9% as Tech Rout and Hawkish RBA Wipe $60 Billion – 18 November 2025" - https://ts2.tech/en/australian-stock-market-today-asx-200-plunges-1-9-as-tech-rout-and-hawkish-rba-wipe-60-billion-18-november-2025/

Australian Financial Review: "ASX 200 news from Tuesday 18th November 2025: Shares down 1.7pc as tech plunges; James Hardie up 7pc" - https://www.afr.com/markets/equity-markets/asx-to-slip-wall-st-hovers-on-rate-nvidia-positioning-20251118-p5ng50

ABC News: "$60 billion wiped off ASX as investors make mad scramble for exits" - https://www.abc.net.au/news/2018-02-06/asx-australian-share-market-plunges-3-pc/9400098

Small Caps: "Wrap: Four months of gains wiped out in $37 billion rout" - https://smallcaps.com.au/article/wrap-four-months-of-gains-wiped-out-in-dollar37-billion-rout

Stockhead: "Closing Bell: ASX plunges more than 2pc amid tech firestorm | Stockhead" - https://stockhead.com.au/news/closing-bell-tech-firestorm-ravages-asx-plunging-more-than-2pc/

TS2: "ASX Today: Tech Rout and Rate Cut Jitters Wipe $37 Billion from Australian Stock Market – 14 November 2025" - https://ts2.tech/en/asx-today-tech-rout-and-rate-cut-jitters-wipe-37-billion-from-australian-stock-market-14-november-2025/

ABC News: "$57b wiped off Aussie share market after worst trade in five months — as it happened" - https://www.abc.net.au/news/2025-09-03/asx-markets-business-live-news/105727816

The Guardian: "$60bn wiped from Australian stock market on worst day for ASX in 18 months" - https://www.theguardian.com/australia-news/2019/aug/15/60bn-wiped-from-australian-stock-market-on-worst-day-for-18-months

Sydney Morning Herald: "More than $60 billion wiped from ASX in market rout" - https://www.smh.com.au/business/markets/asx-set-to-slide-as-wall-street-falls-bitcoin-tumbles-20260206-p5o00u.html

SBS News: "More than $45 billion wiped off ASX over US recession fears" - https://www.sbs.com.au/news/article/more-than-45-billion-wiped-off-asx-over-us-recession-fears/h4mrlcri2

The Nightly: "‘Share prices halving’: Tech stocks suffer rout amid AI rise" - https://thenightly.com.au/business/asx-technology-sector-decline-continues-as-software-stocks-suffer-rout-at-hands-of-ai-rise-c-21501861

ABC News: "$57 billion wiped from ASX, Dow plunges 1000 points on Wall Street" - https://www.abc.net.au/news/2022-05-06/asx-wallstreet-stocks-currencies-commodities/101043146

ABC News: "ASX swept into global sell-off as gold miners tumble on precious metals rout — as it happened" - https://www.abc.net.au/news/2026-02-02/asx-markets-business-news-live-updates/106293384

ABC News: "Nearly $110b wiped off Australian shares as ASX 200 drops 4.2pc" - https://www.abc.net.au/news/2025-04-07/asx-markets-business-news-live-updates/105144276