A significant portion of the American population is experiencing considerable financial hardship, with more than half of households reporting difficulties in meeting their basic monthly expenses. This widespread struggle is often described as a "cost-of-living crisis," leading many to live paycheck to paycheck and express pessimism about future financial improvement. The pressure extends to essential needs such as groceries, gas, and utility bills, forcing difficult choices about spending and debt management.

Overview of Financial Difficulties

Multiple reports and surveys highlight a consistent pattern of financial insecurity across the United States:

Bill Payment Challenges: 52% of Americans report struggling to pay their bills, a figure echoed across several studies. Some reports indicate this figure is as high as two-thirds of consumers needing their next paycheck to cover expenses.

Paycheck-to-Paycheck Living: A substantial number of U.S. adults, estimated at over half, have been living paycheck to paycheck for an extended period, with little expectation of immediate financial relief.

Perception of Crisis: An overwhelming 9 in 10 Americans believe they are experiencing a "full-blown cost-of-living crisis."

Limited Savings: Alongside bill payment struggles, many Americans also find it difficult to save money, contributing to a feeling of being trapped financially.

Contributing Factors to Financial Anxiety

Several interconnected factors are identified as drivers of this widespread financial strain:

Read More: Man with Bat Quickly Stopped in Road Fight

Rising Costs of Necessities: Increases in the prices of essential goods and services, such as groceries, gas, and utilities, are directly impacting household budgets. While the rate of price increases may be slowing in some areas, overall prices remain higher than in previous years.

Income Instability and Gaps: In some cases, economic insecurity stems from a lack of sufficient income rather than solely from rising costs. This can be exacerbated by unexpected life events, such as job loss or the death of a spouse, which can disrupt established financial flows.

Debt Burdens: Managing existing debts, including student loans and mortgages, adds to financial pressure. Debt is frequently cited as a significant source of money anxiety for individuals and families.

Demographic Vulnerabilities: Certain groups appear to be more susceptible to financial struggles. Reports indicate that women and Generation X individuals are more likely to report financial difficulties. Even households with incomes exceeding \$100,000 are not immune, with nearly half of these earners reporting living paycheck to paycheck.

Coping Mechanisms and Future Outlook

In response to these pressures, many Americans are adopting various strategies to manage their finances:

Read More: UK Economy Grows Very Slowly at End of 2025

Reduced Spending: Consumers are cutting back on non-essential purchases and reducing activities like driving.

Increased Income Streams: Some individuals are taking on side jobs to supplement their primary income.

Credit Card Usage: A notable portion of Americans are relying more on credit cards to cover expenses.

Pessimism Regarding Relief: A significant number of individuals do not anticipate their financial situation improving in the near future, contributing to a general sense of fatigue and anxiety surrounding money matters.

Expert Insights and Data Sources

Data supporting these observations comes from a variety of surveys and reports:

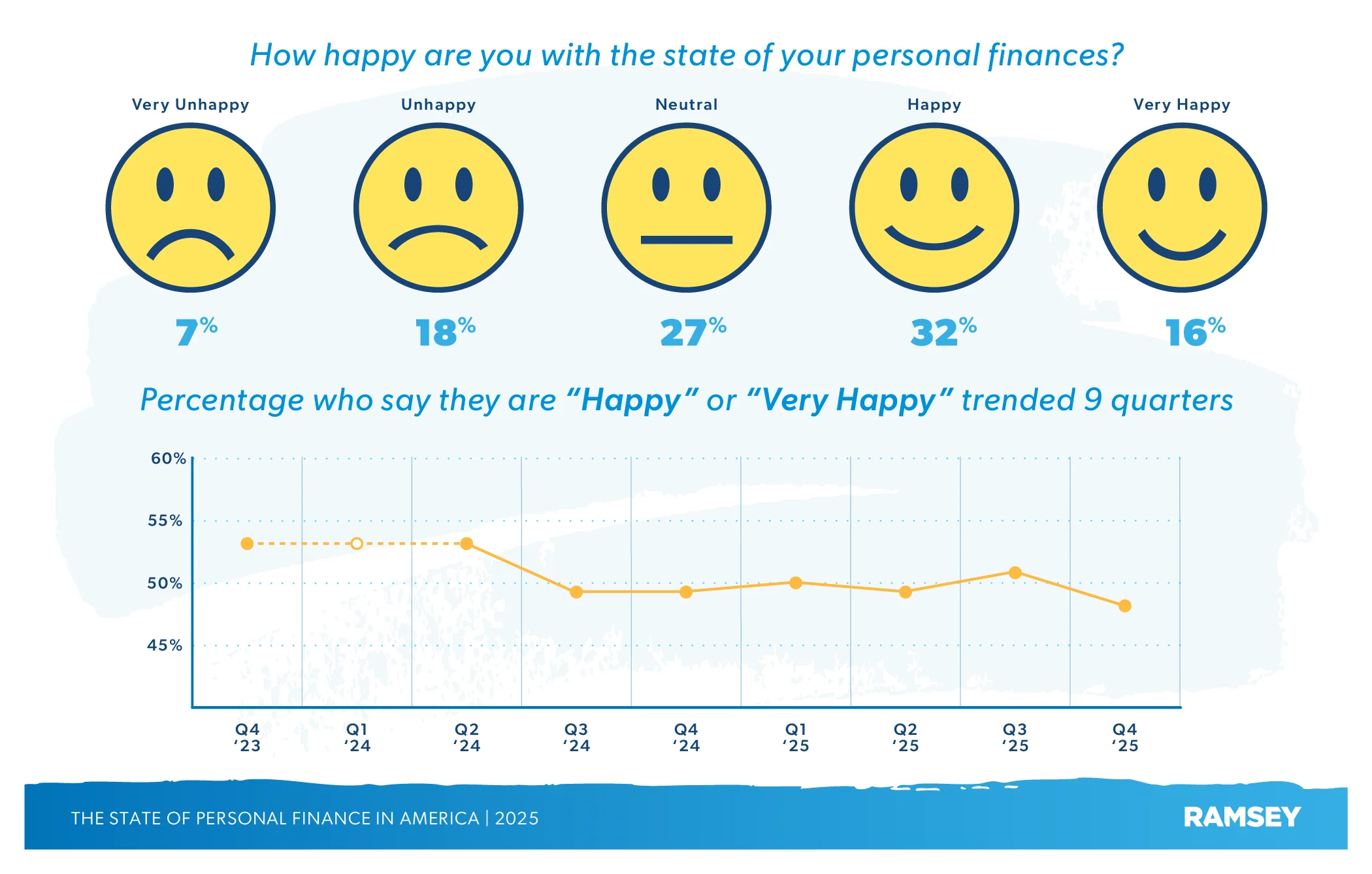

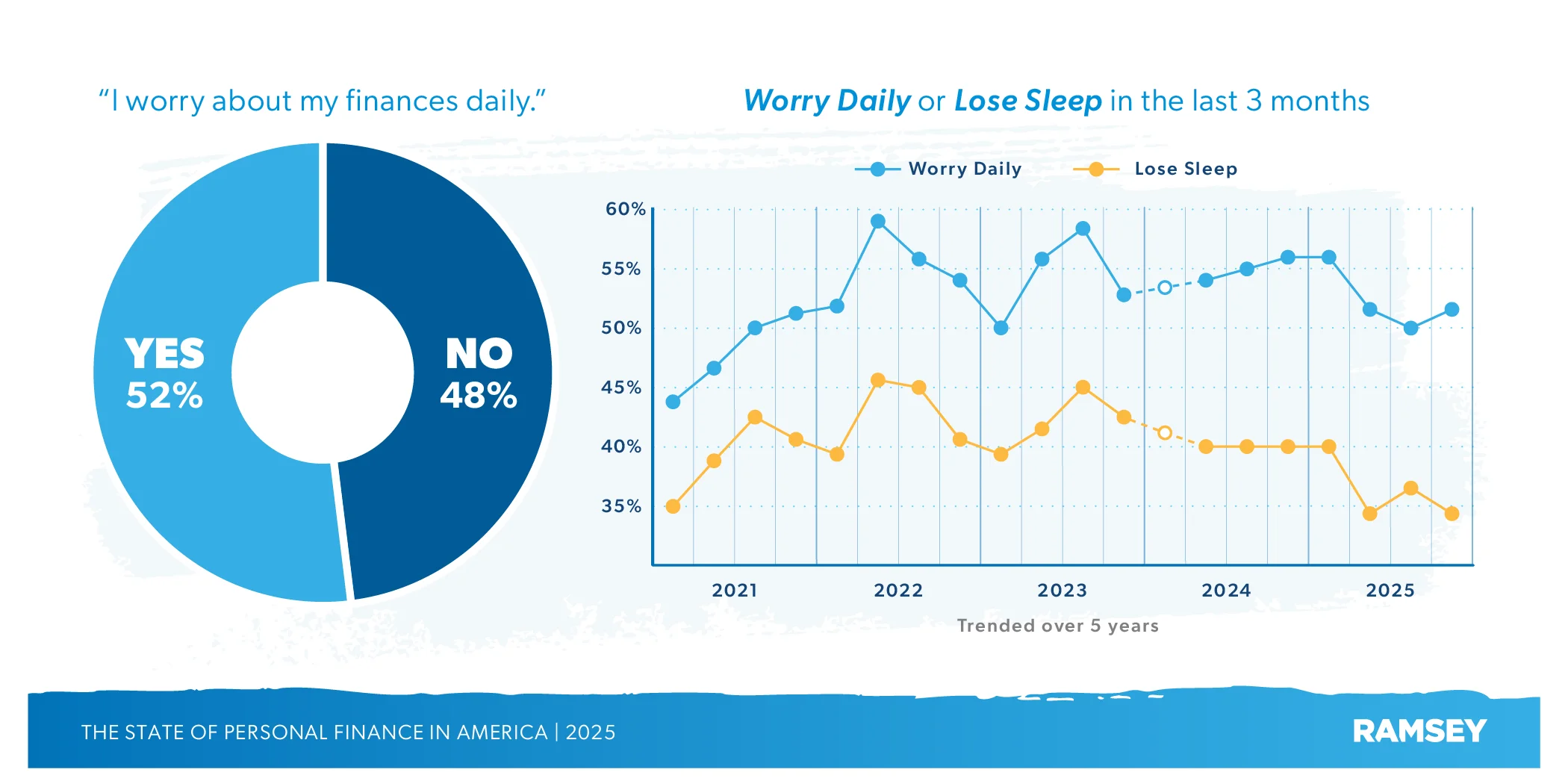

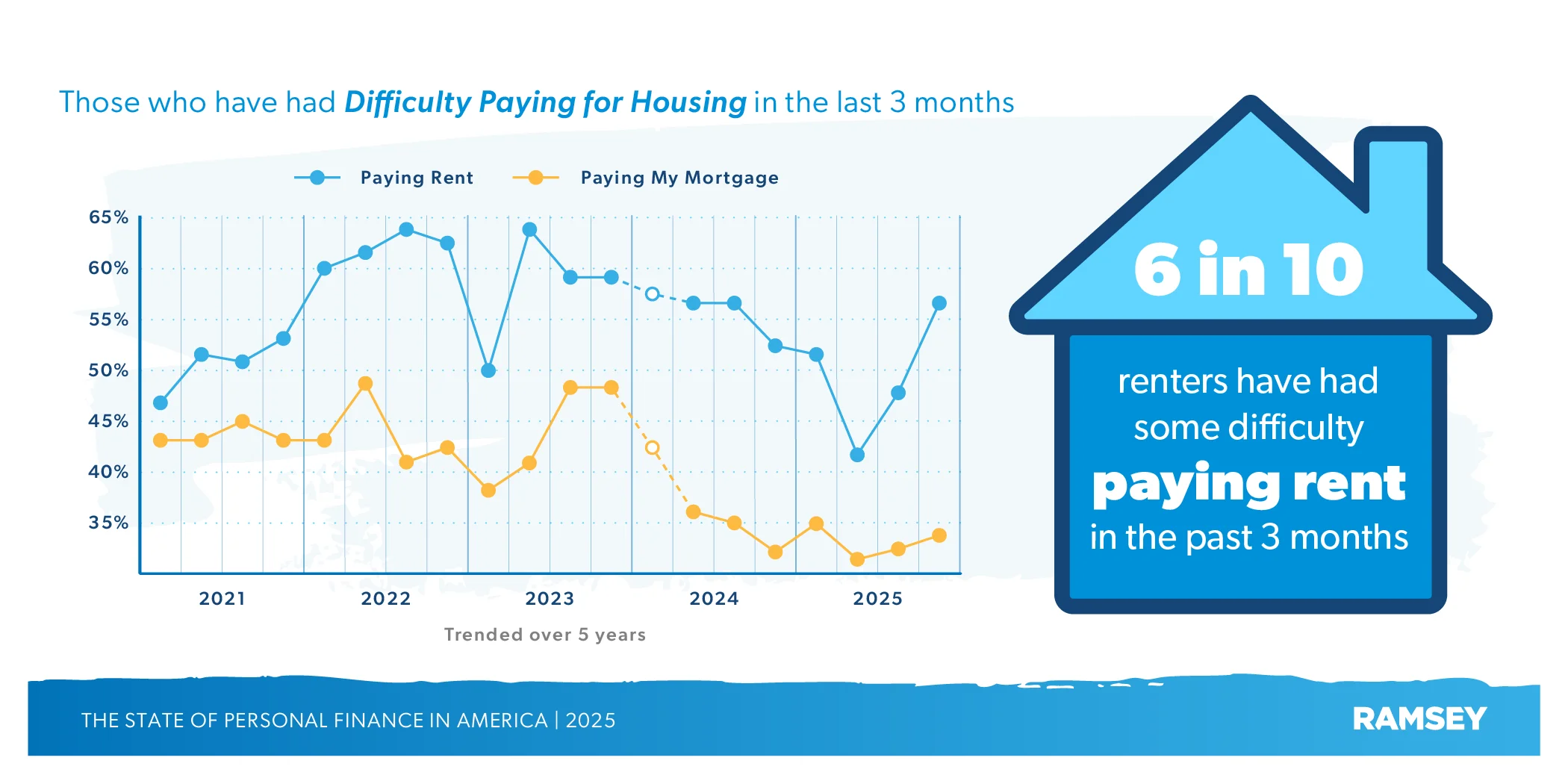

A Ramsey Solutions report indicates 52% of Americans are living paycheck to paycheck and expresses concern about their future financial outlook.

A Citizen Watch Report, citing a study by StudyFinds, highlights that 52% struggle to pay bills and that nearly 3 in 10 plan to use refund money on necessities.

PYMNTS.com reports that two-thirds of consumers depend on their next paycheck to cover bills, contrasting short-term coping strategies with long-term planning for those not living paycheck to paycheck.

A CNN Business poll reveals 39% of Americans worry about their ability to pay bills, with a significant portion adopting coping mechanisms like side jobs and increased credit card use.

Livemint notes that over half of Americans struggle to pay bills and save, and in some areas, the primary driver of insecurity is a lack of income, not just rising costs.

Read More: Seattle Pays $29 Million to Family of Indian Student Killed by Police Car

These reports collectively paint a picture of a population under considerable financial stress, grappling with the rising cost of living, income challenges, and mounting debt, with a prevailing sense of uncertainty about the future.

Sources

Citizen Watch Report: "SURVEY: 9 In 10 Americans See Full-Blown ‘Cost-Of-Living Crisis’… 52% Struggling To Pay Bills". Published 1 day ago. https://citizenwatchreport.com/survey-9-in-10-americans-see-full-blown-cost-of-living-crisis-52-struggling-to-pay-bills/

Livemint: "More Than Half of Americans Struggle to Pay Bills and Save Money". Published November 19, 2024. https://www.livemint.com/companies/news/more-than-half-of-americans-struggle-to-pay-bills-and-save-money-11732039342212.html

Moneywise: "52% of Americans are stuck living paycheck to paycheck, says new Ramsey Solutions report — and they don’t expect relief anytime soon. Here’s why". Published September 2, 2025. https://moneywise.com/news/economy/52-of-americans-live-paycheck-to-paycheck-says-ramsey-solutions-and-they-dont-expect-relief-anytime-soon

Ramsey Solutions: "The State of Personal Finance in America Q4 2025". https://www.ramseysolutions.com/budgeting/state-of-personal-finance

PYMNTS.com: "Two-Thirds of Consumers Say They Need Their Next Paycheck to Pay the Bills". Published February 26, 2025. https://www.pymnts.com/consumer-insights/2025/two-thirds-of-consumers-say-they-need-their-next-paycheck-to-pay-the-bills/

CNN Business: "39% of Americans worry they can’t pay the bills". Published July 23, 2024. https://www.cnn.com/2024/07/23/business/inflation-cost-of-living-cnn-poll

)