Is the dream of homeownership becoming a mirage for more Britons, even as the bricks and mortar market appears to be "steadying"? This week, reports have trumpeted the "fastest jump in UK house prices in over a year," a headline that should, on the surface, signal robust economic health. Yet, peel back the layers and a tangled web of affordability crises, regional divides, and speculative buying emerges, leaving one to question who truly benefits from this supposed market "steadiness."

The narrative of rising house prices is a consistent drumbeat across various indices, including Nationwide and Halifax. However, this rise is happening while affordability is frequently cited as a major challenge. How can prices climb at their fastest pace in years if people are struggling to afford them? Are we witnessing a market driven by genuine demand, or is something else at play? This investigation aims to untangle these complexities.

A MARKET UNSTEADIED: PAST WHISPERS OF WOES

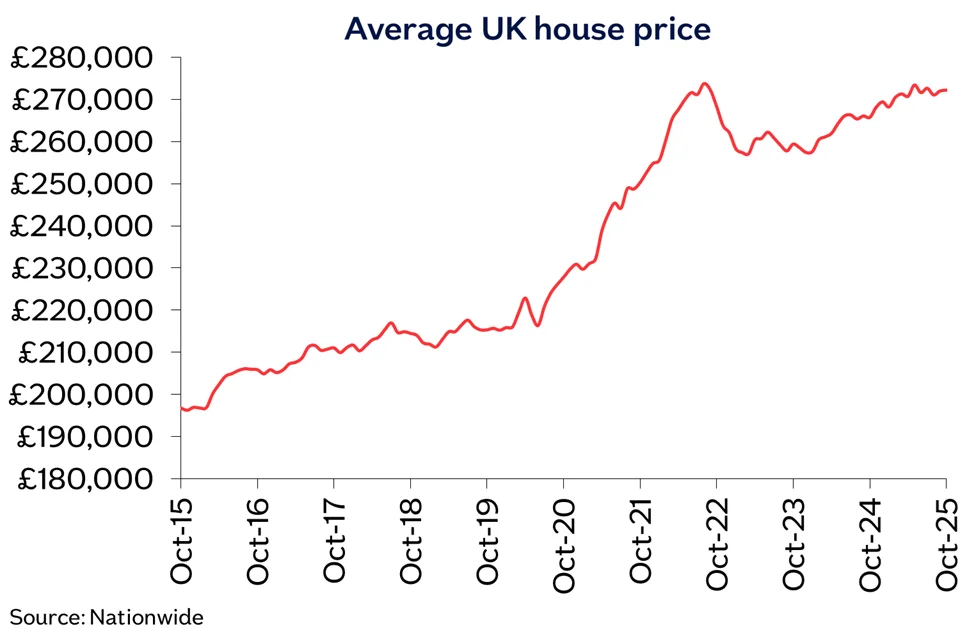

The UK housing market has been a persistent topic of discussion, with cycles of boom and bust, and anxieties about accessibility for ordinary citizens. The period from mid-2023 to spring 2024 saw a decline in house prices, a phase now seemingly reversed. This earlier dip was followed by a rebound, with Nationwide reporting a surprising acceleration in November 2024, the fastest annual growth rate since November 2022.

Read More: Sir Jim Ratcliffe Says Sorry for Immigration Comments

Even before the recent "surge," there were clear signs of regional disparity. As far back as April 2022, the South West of England was identified as having the biggest yearly jump in house prices, driven by a supply and demand imbalance (Business Live, April 2022). Conversely, areas like London have often lagged, with some reports indicating stagnant or falling prices in the capital.

Past incidents also highlight the market's sensitivity to external factors:

Pre-Budget Jitters: Uncertainty over potential tax changes, particularly stamp duty, has historically led to either a rush of buyers or a market slowdown, depending on the expected outcome. The Guardian noted in November 2025 that demand was improving "despite market uncertainty over likely tax changes in this month’s budget," suggesting buyers were anticipating clarity.

Interest Rate Rollercoaster: The Bank of England's base rate cuts have been a significant factor. As mortgage rates fell after the summer of 2024, market activity reportedly increased. However, this is juxtaposed with the fact that millions still face rising mortgage repayments as fixed deals end.

The Affordability Puzzle: Despite price growth, "affordability continues to be a challenge," with buyers opting for smaller deposits and longer mortgage terms (The Guardian, November 2025). This begs the question: how sustainable is a market where affordability is a constant concern?

THE NOVEMBER 2024 SURGE: A TEMPORARY HIGH?

The most striking recent development is the November 2024 surge in house prices, reported by Nationwide as the fastest annual pace in two years. This acceleration, reaching a 3.7% annual growth rate, up from 2.4% in October, has surprised many.

Read More: Thomas Partey Denies Rape and Sexual Assault Charges

"House prices grew at the fastest annual pace for two years in November, according to the latest survey from Nationwide." (BBC News, December 2024)

What fueled this rapid ascent? Several factors are cited:

Resilient Housing Market Activity: Despite higher interest rates, mortgage approvals neared pre-pandemic levels. This suggests a persistent underlying demand, even if it strains budgets.

Strong Labour Market and Income Growth: Low unemployment and solid income gains, even after inflation, are said to be underpinning this activity (Nationwide, December 2024). But how much of this income growth is truly keeping pace with the rising cost of housing, especially in the South?

Anticipation of Stamp Duty Changes: Many analysts point to upcoming changes in stamp duty, expected in April, as a driver. Buyers are reportedly rushing to complete purchases before these changes take effect, creating a temporary spike in demand.

Regional Divergence: While the national picture shows growth, the North of England is reportedly surging, while London and southern regions lag (Euronews, October 2025). This suggests a more complex, uneven recovery.

Read More: New Files Show Sarah Ferguson and Prince Andrew Stayed Friends with Epstein

| Factor | Impact on House Prices (November 2024) |

|---|---|

| Mortgage Approvals | Increased, nearing pre-pandemic levels, indicating underlying demand. |

| Labour Market/Incomes | Solid conditions provided support, but questionably outpaced price rises. |

| Stamp Duty Speculation | Buyers bringing forward purchases to avoid future tax increases. |

| Regional Dynamics | Northern surge contrasting with sluggish southern markets. |

The November 2024 price surge appears to be a confluence of sustained demand, supportive economic conditions, and immediate speculative pressure from anticipated stamp duty changes.

THE AFFORDABILITY DILEMMA: A HOUSE OF CARDS?

The persistent narrative of rising house prices is invariably accompanied by the specter of affordability challenges. Despite the recent upticks, many buyers are finding it harder to enter the market. This has led to several coping mechanisms:

Smaller Deposits: Buyers are putting down less upfront, increasing their loan-to-value ratios.

Longer Mortgage Terms: To make monthly payments manageable, borrowers are extending the duration of their loans, often beyond traditional 25-year terms.

Regional Price Gaps: While the national average climbs, significant disparities persist. Northern regions with lower starting prices are driving much of the recent national growth, making them more accessible. In contrast, wealthier southern areas and London often see prices stagnate or fall. London remains the only region where the average house price is falling year-on-year (Which?, April 2024).

Read More: Champion Horse Constitution Hill Tries New Race Type

"With house prices rising more slowly than incomes for almost three years now, we expect the trend of gradually improving affordability to continue." (The Guardian, November 2025)

This quote from The Guardian in November 2025 offers a sliver of optimism, suggesting that income growth has been outpacing price growth over a longer period. However, this is directly contradicted by reports of current affordability challenges and buyers resorting to longer terms and smaller deposits. How can both be true? Is the "improving affordability" a trend that has stalled, or is it a statistical anomaly masked by regional differences and the increasing reliance on extended mortgage terms?

Furthermore, household debt levels, while lower relative to income than in the mid-2000s, are still a concern, especially with rising interest rates impacting borrowing costs.

The increasing reliance on longer mortgage terms and smaller deposits to manage monthly payments, despite some reports of income growth outpacing price growth, highlights a precarious balance in the UK housing market.

SPECULATION AND STAMP DUTY: MANIPULATING THE MARKET?

The looming prospect of stamp duty changes has become a recurring theme, injecting an element of speculative frenzy into the market. Reports from Halifax in February 2025 indicated that buyers were rushing to complete deals "before a stamp duty increase this spring." This suggests that a significant portion of the recent activity might not be driven by genuine long-term housing needs but by a short-term tax avoidance strategy.

"Upcoming changes to stamp duty are likely to generate volatility, as buyers bring forward their purchases to avoid the additional tax." (Nationwide, December 2024)

This anticipation of tax changes can distort genuine market signals:

Artificial Demand Spike: A surge in activity simply to beat a deadline can inflate prices temporarily, creating a false impression of robust, organic growth.

Post-Deadline Slump: What happens after the stamp duty changes take effect? Is there a risk of a subsequent market slowdown or even a price correction as the artificial demand dissipates?

Unequal Advantage: Those with the means to act quickly and absorb potential stamp duty hikes stand to benefit, further widening the gap between property owners and aspiring first-time buyers.

The UK government's approach to stamp duty has consistently been a tool to either stimulate or cool the property market. However, its implementation appears to be creating more cyclical volatility than sustainable stability.

The cyclical nature of stamp duty changes appears to be a significant, and potentially destabilizing, driver of short-term housing market activity, creating artificial demand spikes rather than reflecting genuine, sustained need.

EXPERT VOICES AND THE ROAD AHEAD

Economists and housing experts offer varying perspectives, often tinged with caution. Robert Gardner, Nationwide's Chief Economist, predicts that "lower borrowing costs could help the market in the 12 months ahead" and expects "housing market activity to strengthen a little further as affordability improves gradually" (The Guardian, December 2025). This forecast relies heavily on continued income growth outstripping price rises and a further modest decline in interest rates.

However, other analyses paint a more nuanced picture. The divergence between regions, with the North surging while London lags, suggests a market not functioning as a unified whole. This raises critical questions:

Can the North's growth sustain the national average, or will southern stagnation eventually drag it down?

Are first-time buyers truly benefiting from improved affordability, or are they merely able to secure larger, longer debts?

What is the long-term impact of relying on speculative buying driven by tax changes?

The Financial Conduct Authority (FCA) is reportedly planning reforms to the mortgage market to assist first-time buyers and the self-employed (The Guardian, December 2025). This indicates an acknowledgement at the regulatory level that the current system is not adequately serving a crucial segment of the population.

THE IMPLICATIONS: WHO'S REALLY WINNING?

The current trajectory of the UK housing market, characterized by rapid price jumps alongside persistent affordability issues and speculative rushes, paints a picture of a system under strain. While headline figures of price growth might appease existing homeowners and industry stakeholders, the underlying reality for many Britons struggling to get onto the property ladder, or facing escalating mortgage costs, is one of increasing precarity.

The evidence suggests that the market is not "steadying" in a way that promotes broad-based, sustainable growth. Instead, it appears to be oscillating between periods of speculative fervor and underlying economic pressure. The reliance on longer mortgage terms and the cyclical impact of stamp duty changes point towards a market that is perhaps more fragile than the headline price increases suggest.

Moving forward, a critical examination is needed:

Data Granularity: A deeper dive into who is buying, how they are financing their purchases, and the true affordability for different income brackets is essential.

Regional Analysis: Continued focus on regional disparities to understand if national trends mask significant localized crises or booms.

Long-Term Affordability Strategies: Are the FCA's reforms enough, or are more fundamental interventions needed to address the systemic imbalance between housing costs and incomes?

The current situation raises more questions than answers, and without a clear understanding of these complex dynamics, the dream of secure homeownership risks becoming an ever-more distant reality for many.

Sources:

MoneyWeek. (2024, June 6). What’s happening with UK house prices? Latest property market moves and forecasts. https://moneyweek.com/investments/house-prices/house-prices

The Guardian. (2025, November 7). UK house prices rise at fastest rate since January 2025. https://www.theguardian.com/money/2025/nov/07/uk-house-prices-rise-at-fastest-rate-since-january-2025

The Guardian. (2024, December 2). UK house prices rise at fastest rate in nearly two years. https://www.theguardian.com/money/2024/dec/02/uk-house-prices-rise-nationwide

MoneyWeek. (2025, October 31). Nationwide HPI: UK property values climb as market steadies ahead of Budget. https://moneyweek.com/investments/house-prices/nationwide-hpi-uk-property-values-climb-as-market-steadies-ahead-of-budget

The Guardian. (2025, February 7). UK house prices jump to new high as stamp duty rise looms, says Halifax. https://www.theguardian.com/business/2025/feb/07/uk-house-prices-jump-to-new-high-as-stamp-duty-rise-looms-says-halifax

The Guardian. (2025, December 15). UK house prices tipped to rise by up to 4% in 2026 as affordability improves – as it happened. https://www.theguardian.com/business/live/2025/dec/15/uk-house-prices-2026-forecast-affordability-improves-stock-market-pound-business-live-news-updates

Business Live. (2022, April 22). UK property market: South West sees biggest yearly jump in house prices in England. https://www.business-live.co.uk/economic-development/uk-property-market-south-west-23759968

BBC News. (2024, December 2). House prices surprise with fastest rise for two years, says Nationwide. https://www.bbc.co.uk/news/articles/c0mvn4g3r3ko

The Guardian. (2025, February 28). UK house prices rise for sixth straight month despite ‘affordability challenges’. https://www.theguardian.com/business/2025/feb/28/uk-house-prices-rise-nationwide-average

Which?. (2024, April 22). What's happening to house prices? https://www.which.co.uk/news/article/whats-happening-to-house-prices-aVCwI8I22pBe

Euronews. (2025, October 1). UK house price growth outpaces forecasts as North surges, London lags. https://www.euronews.com/business/2025/10/01/uk-house-price-growth-outpaces-forecasts-as-north-surges-london-lags

Nationwide. (n.d.). Strong end to the year for UK house prices. https://www.nationwide.co.uk/media/hpi/reports/strong-end-to-the-year-for-uk-house-prices

Financial Times. (2025, November 7). UK house prices hit record high as October growth outstrips forecasts. https://www.ft.com/content/9141f486-19d6-4ac4-a13d-674d9d3ed19d

Statista. (n.d.). Annual house price increase by month UK 2015-2025. https://www.statista.com/statistics/751619/house-price-change-uk/