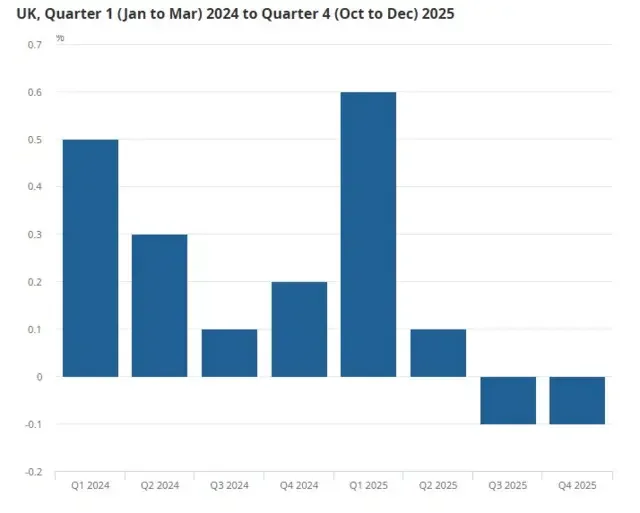

The United Kingdom's economy ended 2025 with a slight increase, as Gross Domestic Product (GDP) grew by 0.1% in the final three months of the year. This figure suggests a period of subdued growth for the year overall, though some indicators point towards potential improvements in early 2026. The reported GDP performance came in slightly below analyst expectations and fuels ongoing discussions about the pace and sustainability of economic expansion.

GDP is a key measure of an economy's health, representing the total value of goods and services produced. Steady GDP growth is generally desired as it typically correlates with increased spending, job creation, and higher tax revenues. Conversely, a contraction in GDP for two consecutive quarters signals a recession, which can lead to pay freezes and job losses. While GDP provides a broad overview, it does not fully capture aspects of living standards or wealth distribution.

Read More: UK Economy Grows Very Slowly at End of 2025

Key Figures and Timelines

Q4 2025 Growth: The UK economy expanded by 0.1% in the final quarter of 2025.

Annual Growth 2025: The overall GDP growth for 2025 is reported at 1.3%, noted as higher than initial consensus expectations.

January 2026 Performance: Early data for January 2026, including retail sales, indicated a performance stronger than anticipated.

Productivity Signs: Tentative signs of improvement in underlying economic productivity have been observed.

Consumer Spending: Showing more promising signs, consumer spending has bounced back, supported by real wage growth translating into higher retail and online spending.

September 2025 Slowdown: In September 2025, the economy experienced a slight contraction, partly attributed to a significant fall in car production following a cyber attack.

Expert Commentary and Observations

Economist Lord O’Neill, a cross-bench peer and former Treasury minister, suggested that the Q4 growth figures are "not that important" given the earlier, stronger January data. He remarked that while the 2025 annual GDP figure of 1.3% is "nowhere near strong enough or good enough to be impacting normal people," it is "actually better" than expected.

Read More: Many People Still Waiting Long Times for NHS Hospital Care

Sandra Horsfield from Investec Economics expressed a more positive outlook on the UK's growth prospects, indicating that the Autumn budget was less of a hindrance to near-term economic activity than initially feared. However, she also noted that it remains "hard to see what will drive a sustained increase in the underlying rate of growth this year."

Economic Performance and Expectations

The latest GDP figures have placed additional pressure on Chancellor Rachel Reeves, with growth figures reportedly being slower than expected leading up to a crucial budget. Labour has identified growth as a top priority, and the current economic pace is adding to concerns about its adequacy.

"We've just heard from economist Lord O’Neill… who says in some ways today’s Q4 growth figures are 'not that important'. Speaking to BBC Radio 4’s Today programme, he says we have already had some data for January, including for retail sales, which has been 'surprisingly stronger than people expected'." - Article 1

"The growth figures announced today came in slightly under analysts' expectations." - Article 4

"Less than two weeks ahead of a crucial Budget, Chancellor Rachel Reeves says there is 'more to do to build an economy that works for working people'." - Article 6

Underlying Economic Factors

GDP per Head: The breakdown of GDP per head, which accounts for population size, offers a different perspective on individual economic benefit. A larger population means each person's share of the economic output is smaller.

Drivers of Growth: While consumer spending shows signs of recovery, the impetus for a sustained increase in the underlying rate of growth for 2026 remains a subject of analysis.

Sectoral Performance: The automotive sector experienced a significant downturn in September 2025 due to a cyber attack impacting production, contributing to a monthly economic contraction.

Broader Economic Context

Recession Definition: A recession is technically defined as two consecutive quarters of GDP shrinkage. The current figures indicate avoidance of this immediate classification.

Limitations of GDP: It is important to acknowledge that GDP is not a complete measure of well-being, failing to detail the distribution of wealth or specific aspects of living standards.

Conclusion

The UK economy concluded 2025 with marginal growth, a performance that, while better than some initial predictions, highlights a subdued economic year. Early indicators for 2026, particularly in retail and consumer spending, offer some encouragement, and tentative signs of productivity improvement are noted. However, the pace and sustainability of this growth remain central to economic and political discourse, especially as the government focuses on its growth agenda. Further analysis will be needed to understand the factors driving the recent rebound and the potential for more robust economic expansion in the coming year.

Sources

BBC News: https://www.bbc.com/news/live/cy4wg0y0j02t - "UK economic growth 'subdued' in 2025, ONS says, as GDP rises by 0.1% in final quarter - live updates" (Published 2 hours ago)

The Guardian: https://www.theguardian.com/business/live/2026/feb/12/uk-gdp-report-economy-december-q4-2025-growth-rachel-reeves-budget-news-updates - "UK economy ends 2025 ‘in the slow lane’ after growing just 0.1% in Q4 – business live" (Published 9 hours ago)

BBC News: https://www.bbc.co.uk/news/live/cy4wg0y0j02t - "UK economy grew by 0.1% in last three months of 2025 after 'subdued' year overall - live updates" (Published 2 hours ago)

BBC News: https://www.bbc.com/news/live/c87427qpzrpt - "UK economic growth slows to 0.1% in final figures before Budget" (Published Nov 13, 2025)

BBC News: https://www.bbc.co.uk/news/articles/c0j7p38jg15o - "What is GDP and how fast is the UK economy growing?" (Published Jan 15, 2026)

Europesays.com: https://www.europesays.com/uk/758919/ - "Latest UK GDP figures set to be released - live updates - United Kingdom" (Published 9 hours ago)