Recent economic data from the United Kingdom points to a weakening growth trajectory, prompting the Bank of England (BoE) to signal a more accommodating monetary policy. This shift, termed a "dovish tilt," has stirred mixed reactions within financial markets, impacting the value of the British Pound and raising questions about the nation's economic outlook. The Bank's reduced growth forecasts and the increasing number of policy members favoring interest rate cuts suggest a potential pivot towards easing monetary conditions. This development occurs against a backdrop of global economic movements, including the performance of the US Dollar and Eurozone assets, all of which contribute to the complex interplay affecting Sterling's strength.

Economic Signals and the Bank of England's Response

Reports indicate that the UK economy is experiencing a slowdown, evidenced by recent Purchasing Managers' Index (PMI) data.

Read More: UK Economy Grows Very Slowly at End of 2025

Labor Market Strain: The services sector has seen the longest period of job shedding in 16 years. This trend suggests that companies are increasingly using automation to manage rising labor costs and shrinking profit margins, rather than expanding their workforce.

Interest Rate Policy: Some members of the Bank of England's Monetary Policy Committee (MPC) have voted for a rate cut, signaling a stronger inclination towards easing monetary policy than previously indicated. This suggests the bank is closer to reducing interest rates.

Growth Forecasts: The BoE has significantly lowered its growth projections for the British economy for the current year. This recalibration of economic expectations underscores concerns about the pace of future expansion.

Inflation Outlook: While inflation is currently around 2.5%, it is anticipated to rise in the coming months, partly due to business tax increases. However, the expectation is that it will eventually trend back towards the BoE's 2% target rate.

Policy Divisions: The fact that some MPC members advocated for a larger rate cut highlights the level of concern within the bank regarding economic headwinds.

Sterling's Performance in a Shifting Landscape

The British Pound's value has been a subject of dynamic change, influenced by both domestic economic factors and international currency movements.

Read More: Many People Still Waiting Long Times for NHS Hospital Care

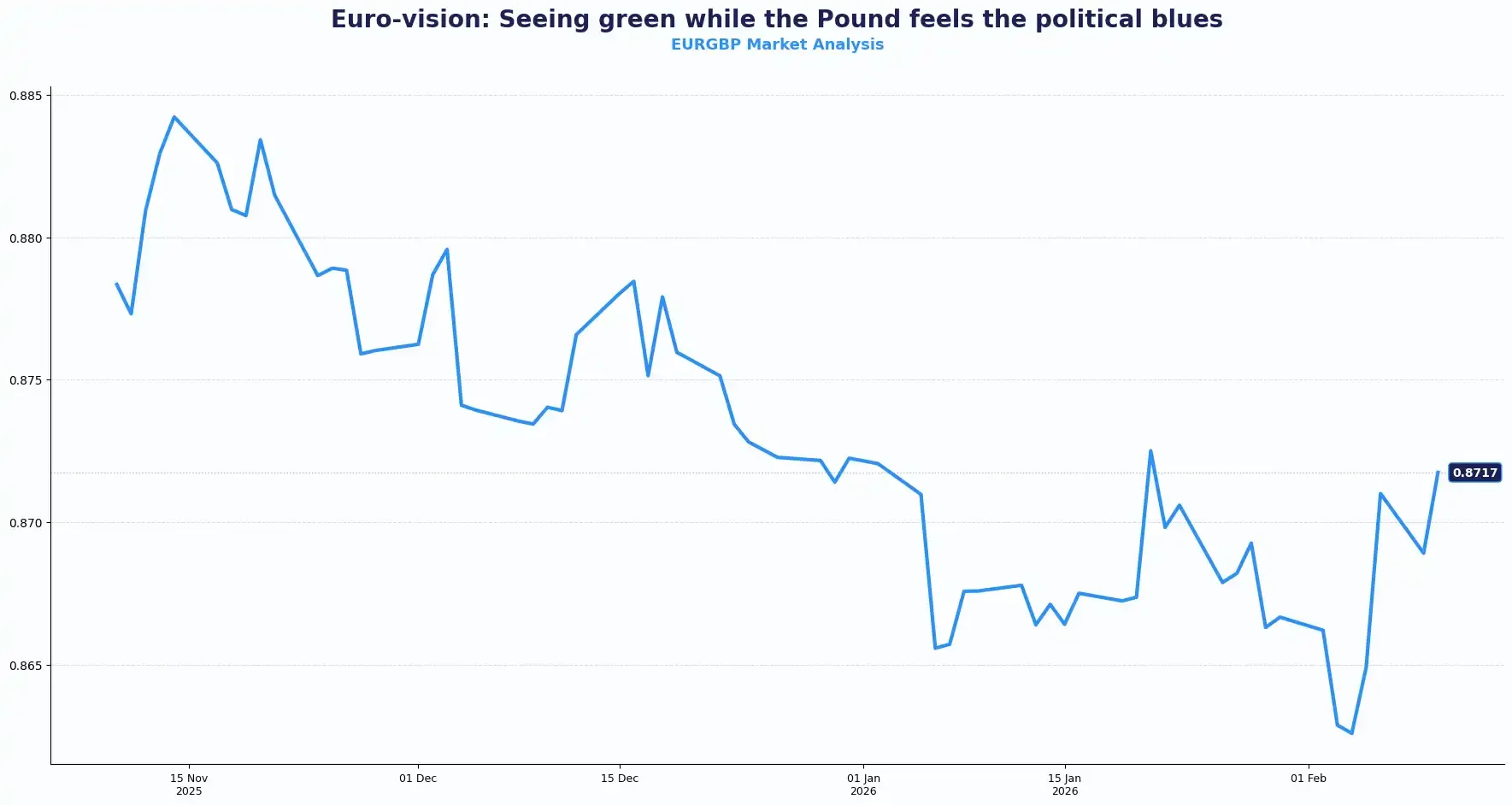

Impact of Dovish Tilt: The Bank of England's move towards a more accommodative policy has created a divided market. While this shift might be seen as beneficial for some domestic entities, it has put pressure on others, particularly UK exporters who face challenges with a stronger Pound.

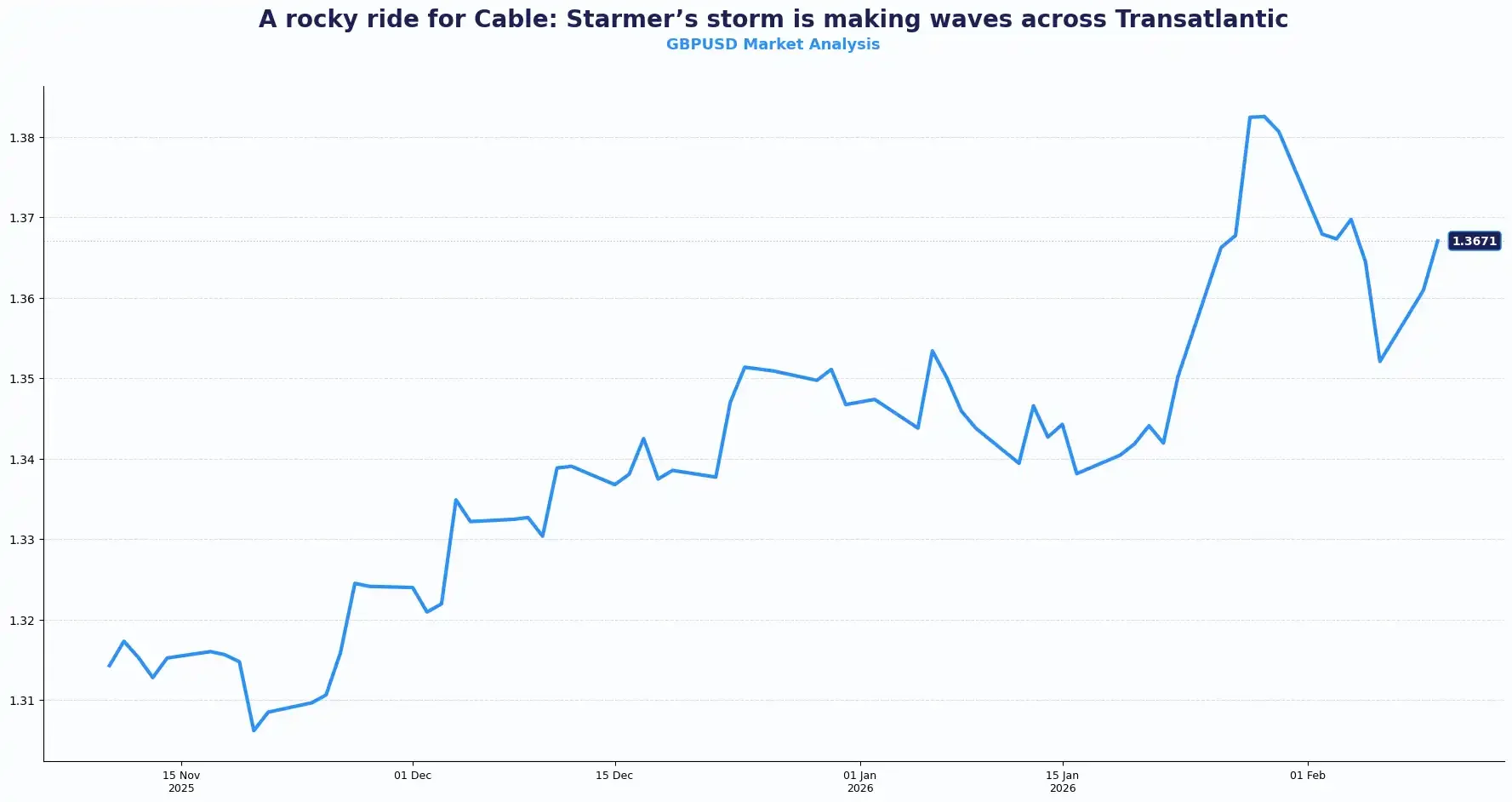

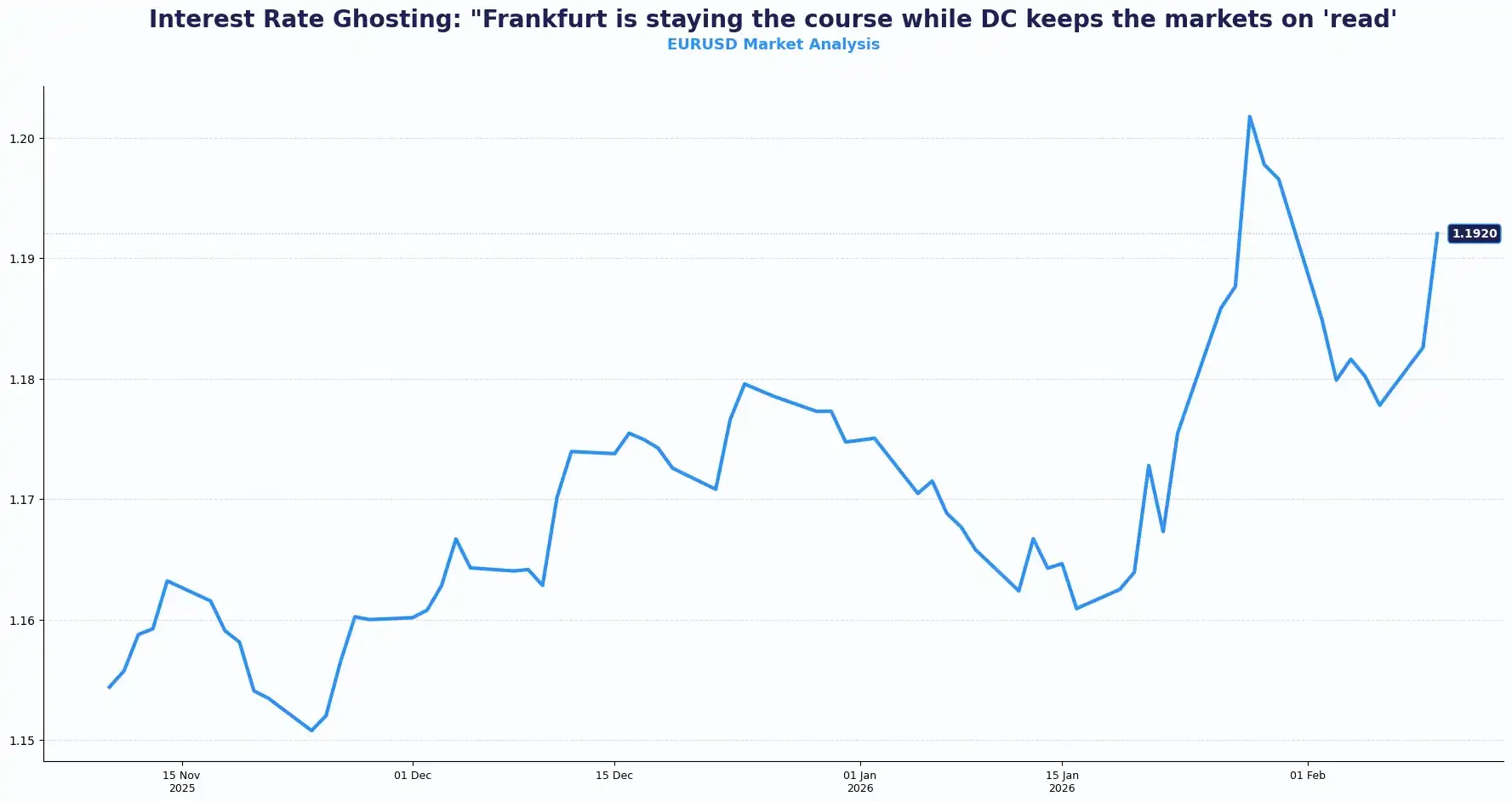

Exchange Rate Dynamics: Despite a reduction in the base interest rate, Sterling has shown resilience against other major currencies. Factors such as the relative yield advantage of UK assets compared to the Eurozone and a weakening US Dollar have supported the GBP/USD exchange rate, pushing it to levels not seen in over a year.

External Influences: The US Dollar's performance is a key factor. Any signs of strength in the US labor market could further embolden the Dollar and put pressure on the Pound.

Political Factors: Domestic political instability has also been cited as a factor weighing on Sterling, creating uncertainty in currency markets.

Differing Perspectives on Economic Health

Analysis of the economic situation reveals divergent views on the UK's performance and the Bank of England's approach.

Read More: US Debt Growing Fast, Experts Say It's a Problem

| Viewpoint | Evidence/Rationale |

|---|---|

| Cooling Economy and Dovish Leanings | Weak PMI data, longest job shedding period in services in 16 years, and MPC members voting for rate cuts suggest a cooling economy. |

| Sterling's Resilience | Relative yield advantage of UK assets, a weaker US Dollar, and the BoE's policy pivot have paradoxically strengthened GBP/USD. |

| Government Concerns | Treasury chief expresses dissatisfaction with the current growth rate, aiming for faster economic stimulus despite a welcomed rate cut. |

| Inflationary Pressures | Inflation is expected to rise in the short term due to factors like business tax increases, before potentially falling back towards the target. |

Expert Insights

The Bank of England's recent actions and economic forecasts have drawn commentary from financial analysts.

"The fact two did vote for a bigger cut gives a sense of how concerned some policymakers are about the headwinds to growth." - Luke Bartholomew, deputy chief economist at abrdn.

Read More: Global Food Prices Dropped in April

This observation from Bartholomew highlights the underlying concerns among some policymakers regarding the challenges facing the UK economy. The divergence in voting patterns within the MPC underscores the differing assessments of economic risks and the appropriate monetary response.

Conclusion and Future Considerations

The UK economy is navigating a period of deceleration, prompting the Bank of England to signal a shift towards a more supportive monetary stance. The combination of weakening economic data, particularly in the labor market, and internal policy discussions favoring interest rate cuts are key indicators. Sterling's reaction has been complex, demonstrating resilience in certain pairings despite the underlying economic signals. The interplay between domestic policy, inflation expectations, and global currency dynamics, including the strength of the US Dollar, will continue to shape the Pound's trajectory. Future economic data releases, particularly on employment and trade, will be crucial in assessing the direction of the UK economy and the Bank of England's subsequent policy decisions.

Read More: Minister Asks to Stop Firing Top Civil Servant While New Papers Come Out

Sources:

InvestingCube: https://www.investingcube.com/deep-analysis/the-sterling-slump-why-the-boes-dovish-tilt-is-rattling-gbp-usd-bulls/ - Article discusses UK services PMI data, job shedding trends, and the BoE's dovish tilt impacting GBP/USD.

FinancialContent (for Buffalo News): https://markets.financialcontent.com/buffnews/article/marketminute-2026-2-2-sterling-resilient-as-bank-of-england-pivots-toward-dovish-easing-cycle - Reports on Sterling's resilience amidst BoE's dovish pivot and its impact on UK assets and exporters.

Globalnews.ca: https://globalnews.ca/news/11008862/bank-of-england-february-2025-rate-cut/ - Covers the BoE's reduced growth forecasts, interest rate cuts, inflation outlook, and political commentary on economic growth.

Currency Solutions: https://www.currencysolutions.com/insights/sterling-slides-on-starmer-crisis-and-rate-cut-bets/ - Focuses on Sterling's decline influenced by political instability and renewed bets on rate cuts.

The Pound Hub: https://thepoundhub.com/british-pound/pound-sterling-continues-to-decline-as-weak-uk-data-prompts-boe-dovish-bets/ - Details Sterling's underperformance against major currencies due to weak UK data and BoE dovish expectations.