Tariffs Have Added Financial Strain to Households

Recent research indicates that trade tariffs enacted during the previous presidential administration have resulted in a significant financial burden for American households. The average household reportedly spent an additional $1,000 in the past year due to these tariffs. This figure is projected to increase, with estimates suggesting an average cost of $1,300 per household by 2026 if the current tariff structures remain in place.

Overview of Tariff Costs

The Tax Foundation, a nonpartisan research group, has published findings that detail the financial impact of these tariffs. Their analysis suggests that the tariffs represent the largest increase in U.S. taxes as a percentage of the Gross Domestic Product (GDP) since 1993. This policy, a signature economic initiative, is seen as potentially worsening concerns about the rising cost of living, especially at a time when many families are already facing persistently high prices.

Read More: UK Economy Grows Very Slowly at End of 2025

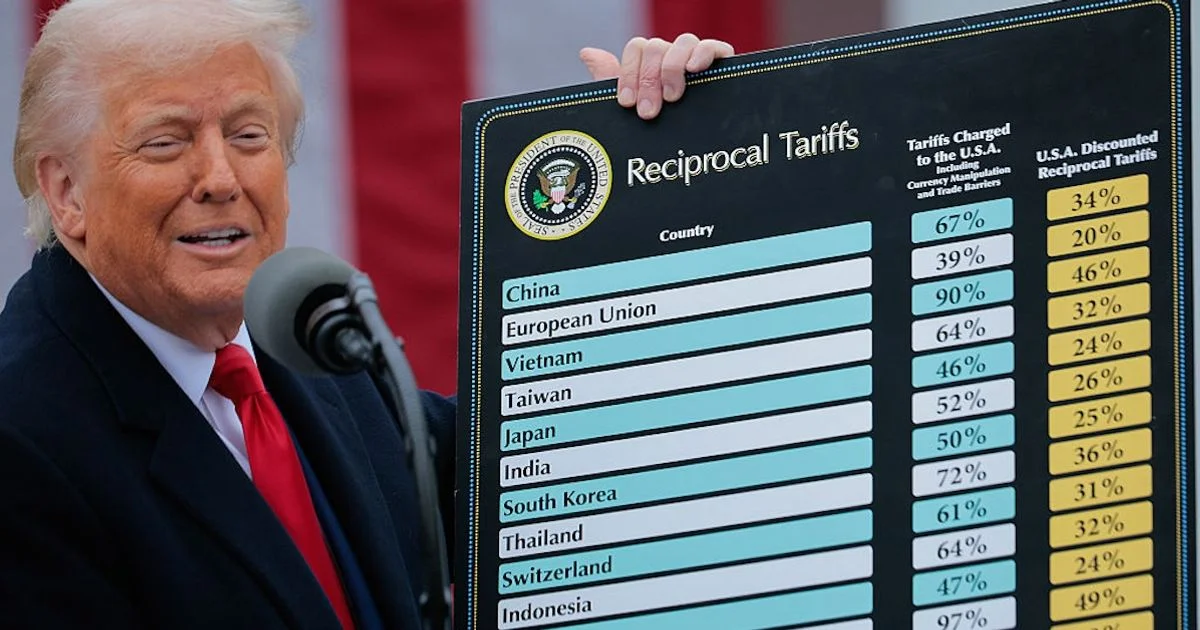

Increased Tariff Rates

Data from the Tax Foundation reveals a substantial jump in the average effective tariff rate in the United States. This rate reportedly rose from approximately 2% in 2024 to around 10% in 2025. This escalation marks the highest level seen since 1946.

Legal Basis for Tariffs

The legality of certain tariffs is a subject of ongoing examination. The previous administration utilized the International Emergency Economic Powers Act (IEEPA) as the legal foundation for imposing these tariffs. However, legal proceedings have not yet reached a final ruling on the appropriateness of this legal basis for such measures. During oral arguments in November, several justices expressed skepticism regarding whether IEEPA could be used for this specific purpose.

Research and Analysis

The Tax Foundation's research is central to understanding the reported costs. Their findings are cited across multiple news outlets, emphasizing the consistent message regarding the financial impact on households. The projected increase in costs by 2026 highlights a potentially compounding effect if these policies persist.

Expert Insights

The Tax Foundation describes the tariffs as "the largest U.S. tax increase as a percent of GDP since 1993." This statement underscores the magnitude of the policy's economic effect. The organization's analysis connects the tariffs directly to current cost of living challenges, indicating that the policy exacerbates existing financial pressures on households.

Conclusion

The available evidence from the Tax Foundation strongly suggests that tariffs implemented during the previous administration have imposed a tangible cost on American households. The estimated $1,000 per household in the last year, with a projected rise to $1,300 by 2026, points to a significant and potentially growing financial strain. The legal challenges surrounding the basis for some of these tariffs also remain a key point of consideration.

Sources:

Tax Foundation Research on Tariffs

Published: 5 hours ago

Link: https://abcnews.go.com/Business/trumps-tariffs-cost-american-households-1000-year-research/story?id=130003484

Context: This article directly cites the Tax Foundation's findings on the cost of tariffs for American households.

Analysis of Trump's Tariffs

Published: 16 hours ago

Link: https://www.scrippsnews.com/politics/the-president/new-analysis-shows-trumps-tariffs-cost-us-households-an-average-of-1-000-last-year

Context: This report also highlights the average cost per household and touches upon the legal arguments surrounding the tariffs.

Political Wire Report on Tariff Costs

Published: 20 hours ago

Link: https://politicalwire.com/2026/02/09/trumps-tariffs-cost-u-s-households-1000-last-year/

Context: This article reiterates the Tax Foundation's central finding regarding the cost of tariffs for the average American household.

Read More: Nikki Haley Says Many People Don't Feel Hopeful About the Economy