Shifting Tariffs Cause Supply Chain Jitters and Budgetary Questions

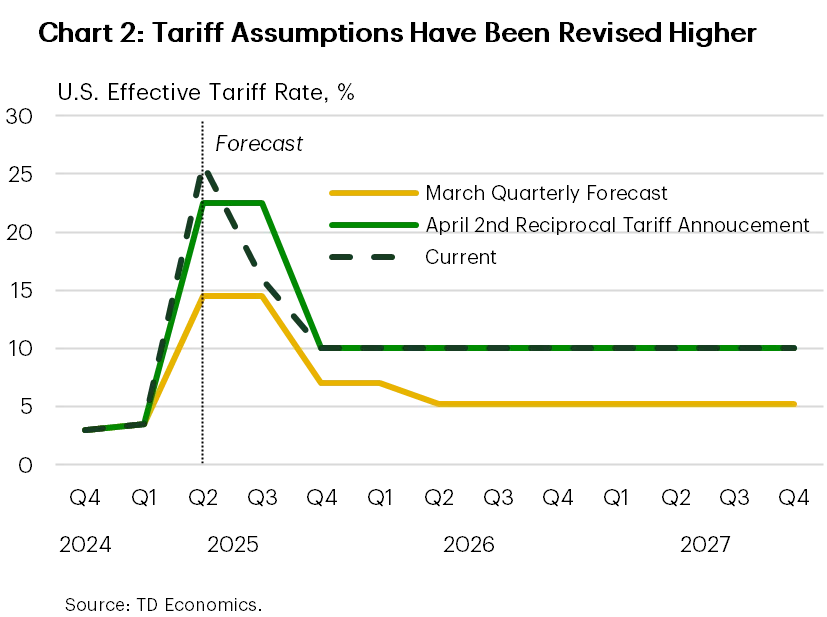

Recent changes in U.S. tariff policy, particularly those announced around April 2nd and then altered on April 9th, have created noticeable ripples in the economy. These shifts, often described as "tariff whiplash," are leading to increased stress on supply chains and making it harder to predict future government income from tariffs. While some official reports suggest tariffs have caused less disruption than feared for now, the unpredictability itself raises concerns for long-term economic planning and the federal budget.

Context: A Series of Tariff Announcements and Revisions

The period around early April 2025 saw significant activity regarding U.S. tariffs, primarily aimed at China.

April 2nd: An initial announcement of reciprocal tariffs was made.

April 9th: This was followed by a 90-day pause on the announced reciprocal tariffs.

Ongoing Uncertainty: The on-again, off-again nature of these tariff decisions has continued, leading to a policy environment marked by heightened trade uncertainty.

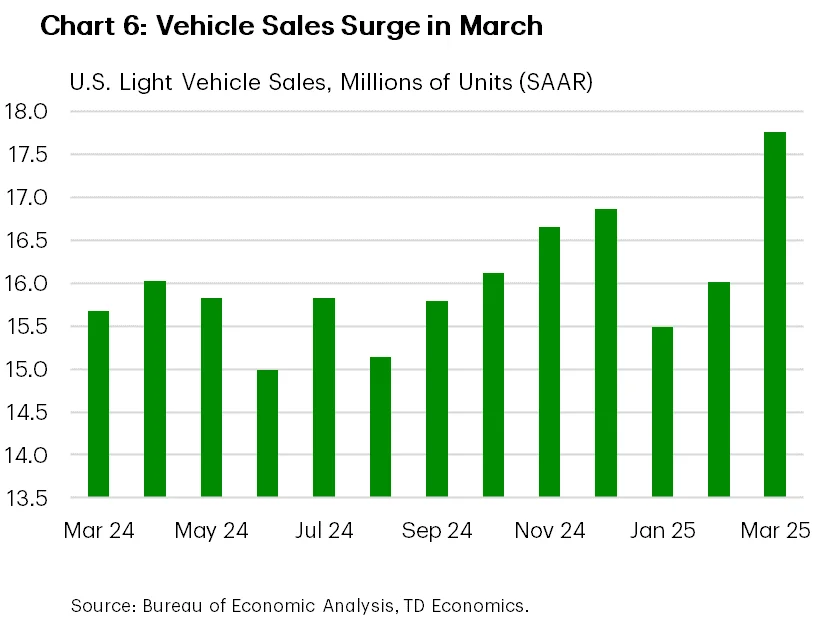

These actions have directly influenced economic behavior. Businesses and consumers reacted to the initial tariff announcements by increasing imports before they took effect. This "front-loading" of imports led to several observable economic effects.

Evidence of Economic Impact

The changes in tariff policy have left a clear trail in economic data and analyses.

Supply Chain Stress: The surge in imports ahead of anticipated tariffs caused congestion at ports. This also kept air freight prices elevated and led to increased manufacturing overtime. The Oxford Economics report noted that this front-loading "is not likely over" due to the fluctuating tariff approach.

Inventory Stocking: To mitigate future tariff impacts, businesses have been increasing their inventories. This stocking is expected to contribute a significant portion to GDP growth for the year, estimated between 0.25 and 0.4 percentage points per quarter, according to Oxford Economics.

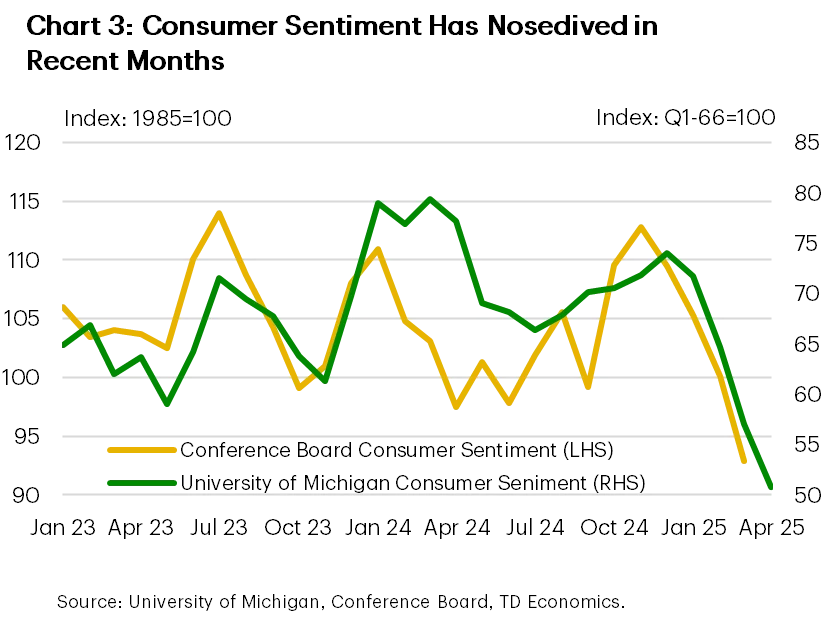

Financial Market Reactions: Treasury yields experienced notable volatility following the tariff announcements, indicating market uncertainty. TD Economics highlighted that tighter financial conditions, partly driven by tariff impacts, are adding to economic slowdown concerns.

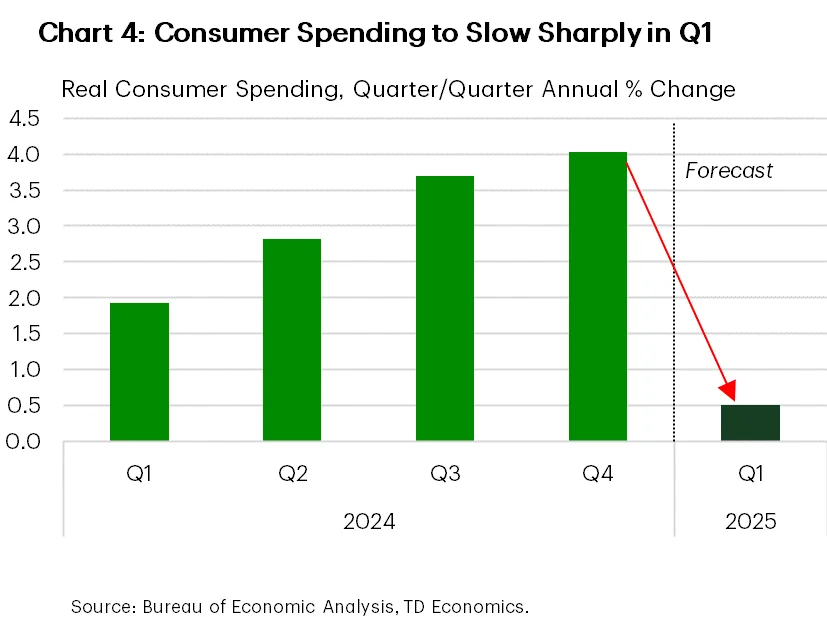

GDP Distortions: The first quarter GDP figures were expected to show significant distortions due to these tariff-related activities, as reported by TD Economics.

Tariffs: A Complex Revenue Source for the Budget

The way tariffs are being incorporated into budget discussions presents distinct challenges.

Regressive Nature of Tariffs

Tariffs act as a tax on imported goods.

In the short term, they tend to be a "regressive tax," meaning they disproportionately affect lower-income households. This is because a larger portion of their income is spent on goods that might be subject to tariffs.

The impact can become more complex in the long run as consumers and businesses adjust their buying habits to avoid higher-priced goods.

Forecasting Difficulty

The unpredictable nature of tariff policy makes it "difficult to forecast" government receipts from these duties, as noted by Northern Trust.

This uncertainty complicates the process of integrating tariff revenue into official budget considerations.

Impact on Trade Negotiations

Relying heavily on tariff revenue for budget balancing could hinder the U.S.'s ability to negotiate concessions in trade talks. Offering to lower tariffs as part of a deal would be more difficult if those revenues are already factored into budget plans.

Similarly, if the goal is to lower tariffs as part of future trade agreements, counting on current tariff income to manage the budget would create a conflict.

Conflicting Views on Disruption Levels

While economic data points to significant supply chain stress and budgetary forecasting issues, recent assessments offer a slightly different perspective on overall disruption.

Perspective 1: Significant Disruption and Stress

Oxford Economics explicitly states that "tariff whiplash is starting to cause US supply-chain stress."

The "on-again, off-again approach" is seen as a primary driver of this ongoing stress.

TD Economics notes that tariffs are "muddying the water" for economic forecasting and contributing to tighter financial conditions.

Perspective 2: Less Disruption Than Feared, For Now

The International Monetary Fund (IMF) upgraded its U.S. economic outlook, stating that tariffs have "so far proved less disruptive than expected."

This assessment suggests that immediate, widespread economic damage from the tariffs has been less severe than some anticipated.

However, the IMF also cautioned that these duties "still pose risks" to the broader economy.

Expert Analysis

The fluctuating nature of tariff policy presents a dual challenge: immediate economic strains and long-term fiscal uncertainty.

"Reliance on tariff revenue may make it harder for the U.S. to offer concessions in trade talks." - Northern Trust

"Tariff threats and heightened trade policy uncertainty began causing stress in supply chains." - Oxford Economics

"The U.S. and global economies will grow a bit more this year than previously forecast as the Trump administration's tariffs have so far proved less disruptive than expected, the International Monetary Fund said Tuesday, though the agency also said the extensive duties still pose risks." - PBS NewsHour (quoting IMF)

Conclusion: A Budgetary Tightrope Walk

The recent tariff adjustments have created a complex economic landscape. The "tariff whiplash" has demonstrably stressed U.S. supply chains, leading to actions like increased import volumes and inventory buildup that distort short-term economic indicators. This pattern raises concerns about the stability and efficiency of trade flows.

From a budgetary standpoint, the revenue generated by tariffs is proving difficult to forecast accurately due to the policy's volatility. This uncertainty complicates fiscal planning and may limit future flexibility in trade negotiations. While some assessments, like the IMF's, suggest tariffs have caused less disruption than initially feared at this moment, the inherent risks and the ongoing strain on supply chains indicate that the full economic consequences are still unfolding.

The federal budget faces a challenge in balancing the potential revenue from tariffs against the economic disruptions they cause and their impact on trade policy flexibility. The unpredictability of these tariffs requires careful monitoring to understand their evolving effects on both the economy and the nation's fiscal health.

Sources:

Yale Budget Lab: Fiscal and Economic Effects of the Revised April 9 Tariffs. https://budgetlab.yale.edu/research/fiscal-and-economic-effects-revised-april-9-tariffs

Oxford Economics: Tariff whiplash starting to cause US supply-chain stress. https://www.oxfordeconomics.com/resource/tariff-whiplash-starting-to-cause-us-supply-chain-stress/

Northern Trust: The Link Between Tariffs And The U.S. Federal Budget. https://www.northerntrust.com/united-states/insights-research/2025/weekly-economic-commentary/the-link-between-tariffs-and-the-us-federal-budget

TD Economics: Tariff Policy and Whiplash Weaken U.S. Growth Outlook. https://economics.td.com/us-tariff-policy-growth-outlook

PBS NewsHour / Associated Press: IMF upgrades U.S. economic outlook as tariffs cause less disruption, for now. https://www.pbs.org/newshour/nation/imf-upgrades-u-s-economic-outlook-as-tariffs-cause-less-disruption-for-now