A prominent YouTuber, Tai Lopez, known for his online persona and lavish displays of wealth, is facing serious allegations of running a $112 million Ponzi scheme. The U.S. Securities and Exchange Commission (SEC) has filed a civil lawsuit accusing Lopez and his business partners of misleading investors. The scheme allegedly involved using new investors' money to pay off earlier investors, a defining characteristic of a Ponzi scheme. This situation raises significant questions about the integrity of online investment promotions and the scrutiny applied to such ventures.

The Accusations Unfold

The SEC's complaint outlines a pattern of alleged misconduct by Tai Lopez and his associates. The core of the accusation centers on fraudulent securities offerings. Investors were reportedly promised substantial returns, with promises of success shared from the ventures.

Misleading Promises: Investors were allegedly told their money would be used to revive distressed retail brands.

Financial Irregularities: Instead of using funds as stated, the SEC claims money was diverted to support failing business acquisitions and to personally enrich the defendants.

Ponzi Scheme Mechanics: New investor funds were allegedly used to make payments to existing investors, a method that sustains the appearance of profitability temporarily before collapsing.

Key Figures Involved

The SEC lawsuit names several individuals central to the alleged scheme:

Read More: Amazon Prime Was Faster and Saved People Money in 2025

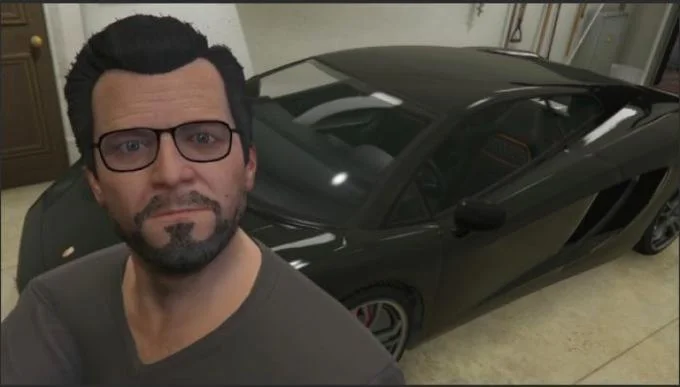

Tai Lopez: A well-known YouTuber and entrepreneur, his public image, often featuring luxury items like his black Lamborghini, is central to the narrative.

Alex Mehr: Identified as a co-founder of the Miami-based holding company, Retail Ecommerce Ventures (REV).

Maya Burkenroad: Lopez's younger cousin and the Chief Operating Officer (COO) of REV. The SEC complaint also names her, alleging she aided in the fraudulent activities. Her prior professional background is also a point of contention, with the SEC disputing her claimed extensive management experience.

REV's Business Model and Acquisitions

Retail Ecommerce Ventures (REV), the company at the heart of the allegations, was established with the stated goal of acquiring and transforming struggling brick-and-mortar businesses into successful online brands.

Acquired Brands: REV, through its founders, purchased several well-known retail names. These include:

RadioShack

Pier 1 Imports

Modell’s Sporting Goods

Dress Barn

Linens 'n Things

Investment Strategy: The business model presented to investors involved acquiring these distressed companies with the aim of revitalizing them through e-commerce strategies.

The Role of Online Influence

Tai Lopez's significant online presence, amplified by his viral "Here in my garage" meme and associated advertisements showcasing a lavish lifestyle, played a crucial role in his business ventures. His visibility as a business influencer and creator brought considerable attention to his activities.

Read More: UK Economy Grew Very Little at End of 2025

Brand Building: Lopez carefully crafted an online persona that emphasized success and financial prosperity.

Investor Attraction: This persona was leveraged to attract investors, with promises of shared success and high returns.

Public Scrutiny: The current allegations directly impact the carefully built public image and online influence he wielded.

Legal Proceedings and Investor Concerns

The SEC's civil lawsuit is moving through the federal court system. Lopez and Mehr have not yet publicly responded to the allegations. The outcome of this case could have implications for how influencer-backed businesses and online investment opportunities are perceived and regulated.

SEC Action: The lawsuit seeks disgorgement of alleged illicit gains and prejudgment interest.

Investor Fallout: The allegations have caused concern among those who invested in REV, given the nature of the accusations.

Potential Resolutions: Lopez and Mehr may contest the SEC's claims or pursue a settlement.

Read More: Why Some Programmers Choose Special Languages

Source List and Context:

Daily Mail (Article 1): Published 8 hours ago. Provides an overview of the SEC lawsuit, naming Tai Lopez, Alex Mehr, and Maya Burkenroad, and details the alleged use of investor funds and promises made to investors. Link:

https://www.dailymail.co.uk/news/article-15546237/YouTubr-Tai-Lopez-ponzi-scheme.htmlCelebrityNetWorth (Article 2): Published Sep 29, 2025. Focuses on Lopez's indictment for securities fraud, detailing the Ponzi scheme allegations and mentioning the prominent role of REV COO Maya Burkenroad. Link:

https://www.celebritynetworth.com/articles/entertainment-articles/tai-lopez-indicted/CBS News (Article 3): Published Sep 26, 2025. Highlights the acquisition of distressed brands like RadioShack and Pier 1 Imports by Lopez and Mehr through REV, and the SEC's claims regarding misrepresentation of Burkenroad's experience. Link:

https://www.cbsnews.com/news/sec-rev-ponzi-scheme-tai-lopez-alex-mehr/NYMag (Article 4): Published Oct 6, 2025. Discusses Lopez's public persona, including his car displays and interactions with celebrities, in the context of the SEC accusations. It notes his cousin Maya Burkenroad was aware of potential delays. Link:

https://nymag.com/intelligencer/article/youtube-tai-lopez-accused-ponzi-scheme.htmlDexerto (Article 5): Published Sep 30, 2025. Reports on the SEC lawsuit against Tai Lopez and Alex Mehr as founders of REV, listing the retail brands acquired and mentioning Maya Burkenroad's alleged role. Link:

https://www.dexerto.com/youtube/youtuber-tai-lopez-accused-of-112m-ponzi-scheme-3259499/Know Your Meme (Article 6): Published Sep 29, 2025. Explains the origin of the "Here in my garage" meme featuring Tai Lopez and connects it to the recent SEC action concerning an alleged $112 million Ponzi scheme. Link:

https://trending.knowyourmeme.com/editorials/guides/who-is-tai-lopez-and-whats-the-here-in-my-garage-meme-the-meme-origins-of-the-man-just-charged-with-running-a-112-million-ponzi-scheme-explainedCreatorHandbook (Article 7): Published Oct 6, 2025. Details the SEC's filing against Lopez and Mehr, specifying the brands involved and their alleged strategy of transforming distressed brands. Mentions the lack of a public response from the accused. Link:

https://www.creatorhandbook.net/youtuber-tai-lopez-accused-of-running-112-million-ponzi-scheme/LegalUnitedStates (Article 8): Published Sep 29, 2025. Examines how Tai Lopez built his brand before the allegations, highlighting the case as a "wake-up call" for investors and the influencer community. Link:

https://legalunitedstates.com/tai-lopez-ponzi-scheme/eBaum's World (Article 9): Seen on AOL, published 4 months ago. Reports on the arrest of Tai Lopez, known for the "Here in my garage" meme, in relation to an alleged $112 million Ponzi scheme involving investments in brands like RadioShack. Link:

https://www.ebaumsworld.com/articles/the-here-in-my-garage-guy-was-just-arrested-for-allegedly-running-a-112-million-ponzi-scheme/87722164/Tubefilter (Article 10): Published Sep 26, 2025. Reports on the SEC lawsuit against Tai Lopez and Alex Mehr concerning REV, detailing the amount raised through fraudulent means and Ponzi-like payments. It also contrasts the claimed experience of Maya Burkenroad with her actual work history. Link:

https://www.tubefilter.com/2025/09/26/tai-lopez-alex-mehr-sec-lawsuit-rev-radio-shack/