Recent proposals from the Liberal Democrats advocate for a significant overhaul of the UK's Treasury department, suggesting its division to establish a dedicated "Department for Growth." This move, according to party officials, is intended to counter what they describe as an "anti-growth" stance within the current Treasury structure and to drive a more focused approach to economic expansion and cost of living crisis alleviation. The party also links economic stagnation to the consequences of Brexit, citing research on lost tax revenue.

Context of Proposals

The Liberal Democrats' call for a new Department for Growth emerges as a central plank in their economic strategy.

Core Proposal: The party suggests creating a distinct department tasked solely with promoting economic growth. This initiative, as articulated by Daisy Cooper MP, the Liberal Democrats' Treasury Spokesperson and Deputy Leader, aims to sharpen the government's focus on growth-oriented policies.

Geographic Focus: A key element of this proposed department is its intended location outside of London. Cooper has specifically mentioned Birmingham as a potential site for this new body, signaling an effort to decentralize economic focus and stimulate growth in regional areas.

Critique of Current Treasury: The current Treasury is characterized by the Liberal Democrats as "anti-growth." This label implies a perceived lack of proactive measures or a bureaucratic impediment to economic expansion within the existing framework.

Evidence and Policy Underpinnings

The Liberal Democrats' advocacy for economic reform is supported by their interpretation of economic data and policy analyses.

Read More: MDMK Wants More Seats to Get Official Recognition

Brexit's Economic Impact: The party has highlighted research indicating significant economic costs associated with Brexit.

Research suggests Brexit has cost the UK up to £90 billion annually in lost tax revenue.

This figure is being used to bolster the party's call for a bespoke customs union with the EU, which they believe would reduce trade frictions and mitigate long-term output losses.

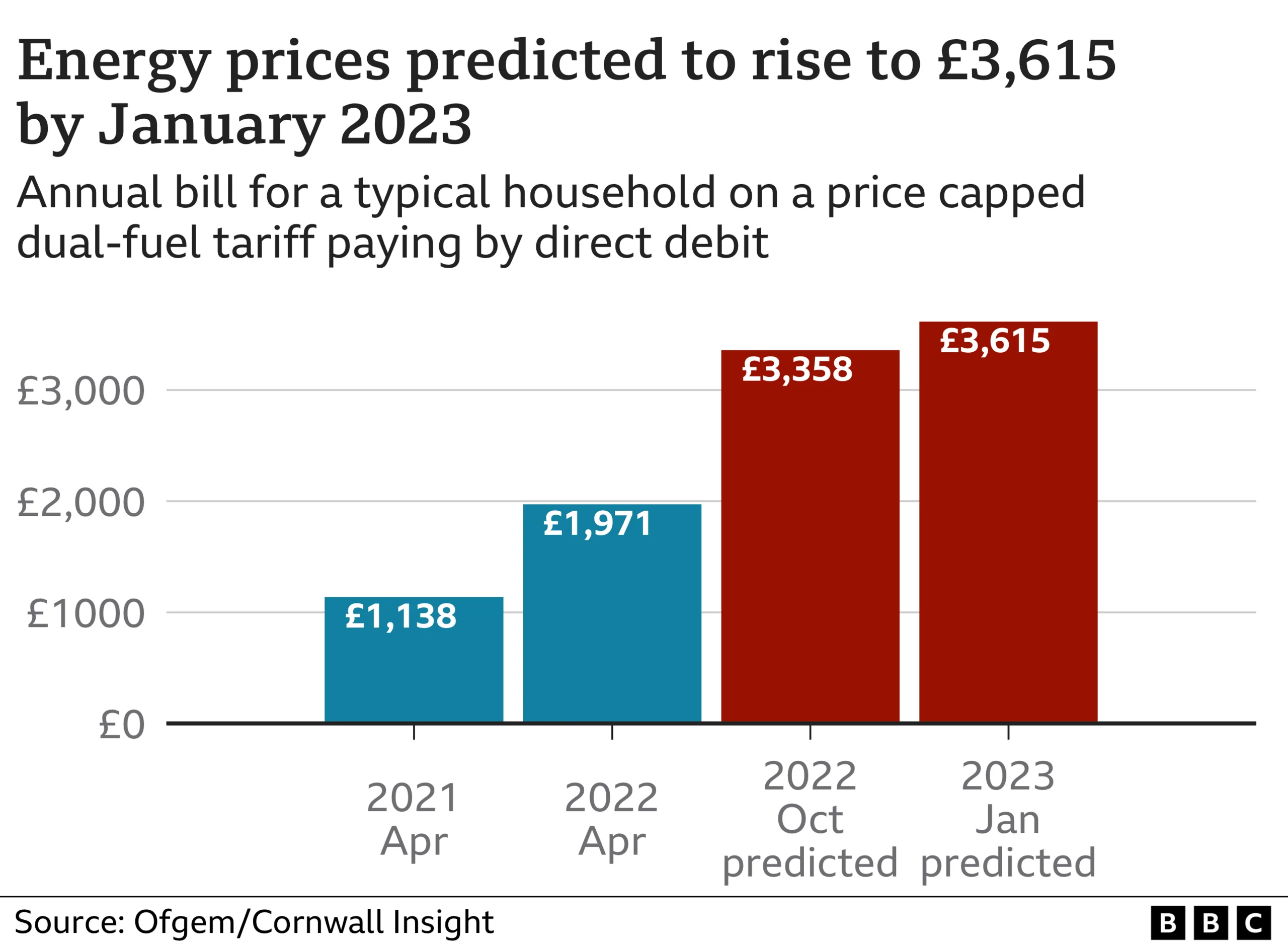

Energy Policy and Cost of Living: Proposals also extend to energy policy, a critical factor in the cost of living.

The party has advocated for the scrapping of proposed increases to the energy price cap.

They also propose taxing the global profits of British energy companies and implementing a windfall tax on large banks' unexpected profits to fund energy efficiency schemes and solar panel installations.

Deep Dives

Restructuring the Treasury: A Focus on Growth

The Liberal Democrats' proposal to split the Treasury centers on the creation of a dedicated Department for Growth.

Read More: Many People Still Waiting Long Times for NHS Hospital Care

Objective: This new department would be mandated to concentrate solely on policies designed to stimulate and sustain economic growth.

Mechanism: By creating a distinct entity, the party aims to ensure accountability and dedicated resources for growth initiatives, which they argue are currently diffused or deprioritized within the broader Treasury remit.

Decentralization: The suggested relocation of this department to Birmingham reflects a broader strategy to rebalance economic activity away from London and the South East.

Addressing Economic Stagnation Post-Brexit

The Liberal Democrats link their growth proposals to the economic consequences of the UK's departure from the European Union.

Tax Revenue Losses: The party's use of research pointing to substantial annual losses in tax revenue is a key argument.

The cited research, while acknowledged by the Commons Library as illustrative, suggests a significant negative economic impact.

This underscores the party's view that current economic challenges are partly a legacy of the post-Brexit trade environment.

Policy Recommendations: In response to these perceived economic challenges, the Liberal Democrats advocate for policies such as rejoining a customs union with the EU to ease trade barriers.

Funding Economic Initiatives Through Targeted Taxation

The party's proposals for funding new schemes involve specific taxation measures.

Read More: Gen Z's Big Test: Can Young Voters Change Bangladesh?

Banking Sector Levy: A call has been made for a time-limited windfall tax on large banks, targeting profits accrued from quantitative easing programs.

The aim is to generate funds for home energy efficiency upgrades and renewable energy projects.

Energy Company Profits: Taxation of global profits of British energy companies is also proposed as a means to address the cost of living crisis and invest in energy infrastructure.

Expert Analysis

While the provided data does not contain direct expert analysis of the Liberal Democrats' specific proposals, historical context and general economic principles can be inferred. Economists often debate the efficacy of departmental restructuring versus the substantive policies enacted. The success of a dedicated "Department for Growth" would likely hinge on its scope of authority, inter-departmental cooperation, and the actual policies it implements. Similarly, the economic impact of Brexit is a subject of ongoing academic and policy debate, with various models producing differing results on costs and benefits. The framing of research by the Liberal Democrats as highlighting substantial losses points to a particular interpretation within this broader discussion.

Conclusion

The Liberal Democrats have presented a series of proposals centered on economic growth, advocating for the restructuring of the Treasury into a dedicated Department for Growth, to be potentially located in Birmingham. This initiative is presented as a response to perceived "anti-growth" elements within the current economic framework and is linked to the party's analysis of Brexit's economic impact, which they contend has led to significant lost tax revenue.

Read More: UK Economy Grows Very Slowly at End of 2025

Key Proposals:

Establishment of a "Department for Growth."

Relocation of this department to Birmingham.

Calls for a customs union with the EU to mitigate post-Brexit trade frictions.

Taxation of large banks and energy companies to fund energy efficiency and renewable energy projects.

Underlying Rationale: The proposals are framed as necessary to address the cost of living crisis and to reverse economic stagnation.

Next Steps: The party's immediate actions appear to involve promoting these ideas through parliamentary channels, such as the proposed Ten Minute Rule Bill concerning a customs union. The effectiveness and reception of these proposals will depend on broader political and economic developments.

Sources

The Guardian: Lib Dems call for ‘anti-growth’ Treasury to be split up – UK politics live

Context: Live news update reporting on parliamentary proceedings and party political statements.

Liberal Democrats Official Website: Get Britain Growing Again

Context: Party press release outlining their economic policy proposals.

UK Fact Check: New research shows Brexit has cost UK up to £90bn per year in lost tax revenue, Lib Dems say

Context: Fact-checking article detailing research cited by the Liberal Democrats regarding Brexit's economic impact.

BBC News: Liberal Democrats call for scrapping of energy price cap rise

Context: News report on Liberal Democrat policy stances regarding energy prices.

New Statesman: “It’s between us and Reform”: The Lib Dem plan to win in 2026

Context: Political analysis piece discussing the Liberal Democrats' electoral strategy.

Evening Standard: Lib Dems call for tax on big banks to create new energy loans scheme

Context: Business news report on Liberal Democrat proposals for taxing banks to fund energy initiatives.

Wikipedia: Anti-growth coalition

Context: A general informational page that might provide background on the term but lacks specific policy detail from the provided data.

Read More: Minister Asks to Stop Firing Top Civil Servant While New Papers Come Out