The glittering allure of gold has once again captivated global markets, with prices staging a dramatic comeback. But beneath the surface of this rebound lies a complex web of geopolitical anxieties and shifting economic tides. While the precious metal is touted as a safe haven, its recent wild swings raise critical questions: Is gold truly a reliable sanctuary for investors, or is it becoming a pawn in a larger, more precarious game? As nations grapple with instability and economic uncertainty, understanding the forces pushing gold’s price is paramount, especially for those, like the citizens of Lebanon, who are desperately seeking tangible security.

A MARKET ON EDGE: WHY THE YELLOW METAL IS SOARING (AGAIN)

Gold's recent surge is no accident. It's a direct response to a confluence of powerful forces, primarily the softening of the US dollar and escalating geopolitical tensions, particularly concerning Iran. When the dollar weakens, it typically makes gold, priced in dollars, cheaper for holders of other currencies, thus increasing demand. Simultaneously, conflicts and uncertainty, like those involving Iran, traditionally drive investors towards gold as a "safe haven" – an asset perceived as less risky during turbulent times.

Read More: Retirees Need Cars But Worry About Money

Softer US Dollar: A weaker dollar reduces the purchasing power of the currency, making dollar-denominated assets, including gold, more attractive to international buyers.

Geopolitical Turmoil: Events like the US downing an Iranian drone (as reported by BBC News) inject immediate fear and uncertainty into global markets, prompting a flight to safety.

Central Bank Activity: Reports indicate that central banks from countries like China and Poland are actively buying gold bullion, which provides a consistent underlying demand that props up prices.

"And when gold prices go up, then she’s the winner." - Alia Shehade, quoted in a report on Lebanon's gold market.

Lebanon's Dilemma: A Nation's Gold, A People's Hope?

The situation in Lebanon offers a stark, human perspective on gold's appeal. With a crippled economy and many citizens having lost their savings, gold and silver are seen as tangible assets offering a sliver of security. The government is even considering tapping into the nation's substantial gold reserves to stabilize the economy. This raises a crucial debate:

Read More: India's Market Rules Made Simpler to Help Businesses and Investors

Should national gold reserves be used in economic crises, potentially forgoing long-term security for immediate relief?

What are the implications of individuals hoarding gold when a nation faces collapse?

Is the intrinsic value of gold being leveraged, or is its price being manipulated by larger global forces?

The desperation in Lebanon underscores gold's role as a perceived tangible store of value when traditional financial systems falter.

A HISTORY OF VOLATILITY: GOLD'S WILD RIDE

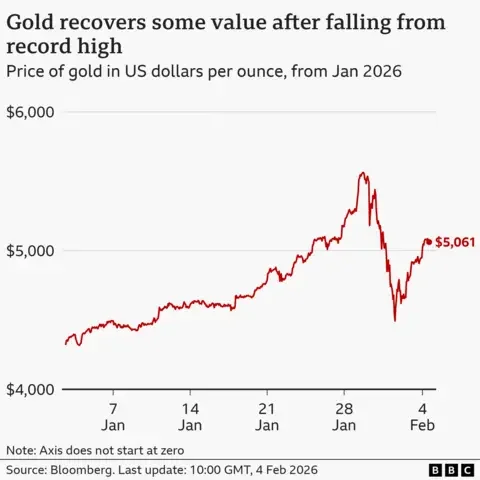

Gold's price action hasn't been a steady climb; it's been a rollercoaster. Just days before its recent rebound, gold experienced a "historic plunge," according to some reports, only to then "snap back" above crucial price levels. This volatility suggests that while gold is a safe haven, it's also susceptible to rapid shifts in sentiment and economic shocks.

Read More: Money Spent, Project Slow: Questions About Sector 7G Funds

| Event | Price Action | Implication |

|---|---|---|

| Record Highs near $5,598 | Reached Peak | Euphoria, strong demand driven by various factors. |

| Violent Slide to lows around $4,400 | Significant Drop | Panic, profit-taking, potential reaction to economic data or Fed signals. |

| Rebound above $5,000 / $5,100 | Sharp Recovery | Renewed safe-haven demand, dollar weakness, geopolitical triggers. |

| "Historic Plunge" followed by Losses | Extended Decline | Market correction, profit-taking, or a shift in perceived risk. |

| Holding near record highs amid turmoil | Stabilization / Slight Rise | Persistent underlying demand for safe assets. |

"Wild fluctuations in the price of gold continued on Wednesday as geopolitical tensions reignited after the US downed an Iranian drone." - BBC News

What caused the "violent slide" from record highs so rapidly? Was it purely market correction, or were there specific economic indicators or policy shifts that triggered it?

How much of this volatility is driven by genuine investor fear versus speculative trading?

If gold can plunge so drastically, how reliable is it as a long-term "safe haven" for individuals or nations like Lebanon?

Read More: Northern Ireland Gets £400 Million for Health and Schools

The rapid swing from near-record highs to significant lows and back highlights gold's susceptibility to market sentiment and geopolitical events, questioning its predictable "safe haven" status.

THE FED FACTOR AND GLOBAL HEADWINDS: MORE THAN JUST GEOPOLITICS?

While Iran tensions and a weaker dollar are key drivers, other significant economic factors are at play. The US Federal Reserve's monetary policy, including interest rate decisions and potential nominations for its leadership, has a profound impact. Reports from January 2026, for instance, link gold's strength to expectations of Federal Reserve rate cuts and a criminal investigation involving the Fed Chair.

Federal Reserve Stance: Anticipation of lower interest rates by the Fed generally makes gold more attractive as it reduces the opportunity cost of holding a non-yielding asset.

US Economic Data: Delayed jobs data and inflation reports (like softer US CPI) can influence Fed policy and, consequently, gold prices.

Broader Market Performance: When major stock indexes like the Nasdaq and S&P 500 reach record highs, it can sometimes lead to a reallocation of funds, with some investors moving to perceived safer assets like gold.

"Macro Calendar Shock: Jobs Data Delay, ADP And The Fed Path For Gold (XAU/USD)" - TradingNEWS

How much influence do Fed nominations and investigations have on market sentiment compared to actual policy decisions?

Is the correlation between high stock market performance and gold demand a sign of diversified investment strategies or a signal of underlying unease within the broader economy?

Could the pursuit of a "Cautious BUY" in gold, as suggested by some analyses, be a precarious strategy given the conflicting signals?

The intertwining of Federal Reserve policy, US economic data, and geopolitical events creates a complex environment where gold's price is influenced by a multi-faceted interplay of factors, not just simple safe-haven logic.

EXPERT VIEWS: CAUTION AMIDST THE CLIMB

Analysts acknowledge the current bullish bias for gold but temper it with warnings of elevated risk. The underlying demand structure, bolstered by central bank purchases and physical demand, remains intact despite market volatility. However, the erratic price swings indicate that the market is highly sensitive.

"Based on the current setup – spot Gold (XAU/USD) holding roughly $5,050–$5,100, structural central bank and ETF demand intact, geopolitical risk elevated, and technical support anchored around $4,885–$4,990 – the balance of evidence still leans positive over the medium term." - TradingNEWS analysis.

What does "elevated drawdown risk" truly mean for the average investor holding gold?

If structural demand is "intact," why the "brutal" volatility and "violent slide"? Is the structural demand strong enough to absorb significant shocks?

How are institutional investors navigating this volatile landscape, and what are their primary concerns beyond short-term price movements?

While structural demand for gold remains, analysts caution that the market is prone to significant "drawdown risk," meaning the potential for substantial losses is high despite a generally positive outlook.

THE GOLDEN QUESTION: SECURITY OR SPECULATION?

The recent performance of gold, driven by a weaker dollar and escalating geopolitical tensions, has seen it reclaim significant price levels after periods of sharp decline. While this demonstrates its allure as a safe haven, the extreme volatility – swinging from record highs to dramatic lows and back – raises fundamental questions about its reliability. For nations like Lebanon, and individuals seeking genuine security, the question is whether gold offers true stability or is simply another speculative asset caught in the crosscurrents of global economics and politics.

The data points to a market where central banks and underlying demand provide a floor, but geopolitical events and the shifting sands of US monetary policy can cause seismic shifts. The "brutal volatility" suggests that while gold may offer refuge, it's a refuge that can be shaken by storms.

What happens if geopolitical tensions de-escalate significantly? Will gold prices plummet again without the "safe haven" premium?

How sustainable is central bank buying as a price support mechanism?

Are the forces driving gold prices currently serving the interests of stability, or are they exacerbating financial anxieties for vulnerable populations?

The future price of gold will undoubtedly continue to be a closely watched indicator of global stability and economic sentiment, but its recent trajectory compels a deeper, more critical examination of its role.

Sources:

Article 1: Gold Bounces Back on Softer Dollar, US-Iran Concerns; Silver Rebounds

Article 2: Gold rebounds above $5,000 after US downs Iran drone

Article 3: Gold Price Forecast - XAU/USD Rebounds Above $5,100 After $5,598 Peak And $4,400 Crash

Article 4: Gold Holds Near Record as Softer U.S. CPI and Iran Turmoil Drive Safe-Haven Demand

Article 5: Gold surges past $5,500 amid Iran tensions, weakening US dollar

Article 6: Silver and gold extend losses after last week's historic plunge - NewsBreak

Article 7: Gold And Silver Hold Steady As Markets Shrug Off US Strikes On Iran - USAGOLD