A Widening Gap Affects Savers

Many individuals are noticing that the interest earned on their savings accounts at large, established banks is significantly lower than what could be earned elsewhere. This difference, while seemingly small on a day-to-day basis, can add up to substantial amounts over time, impacting the growth of savings and their purchasing power. The core of the issue appears to be a disparity in interest rates offered by major financial institutions compared to other available options, like high-yield savings accounts. This situation prompts a closer look at why these discrepancies exist and what it means for consumers.

Context: The Landscape of Savings Accounts

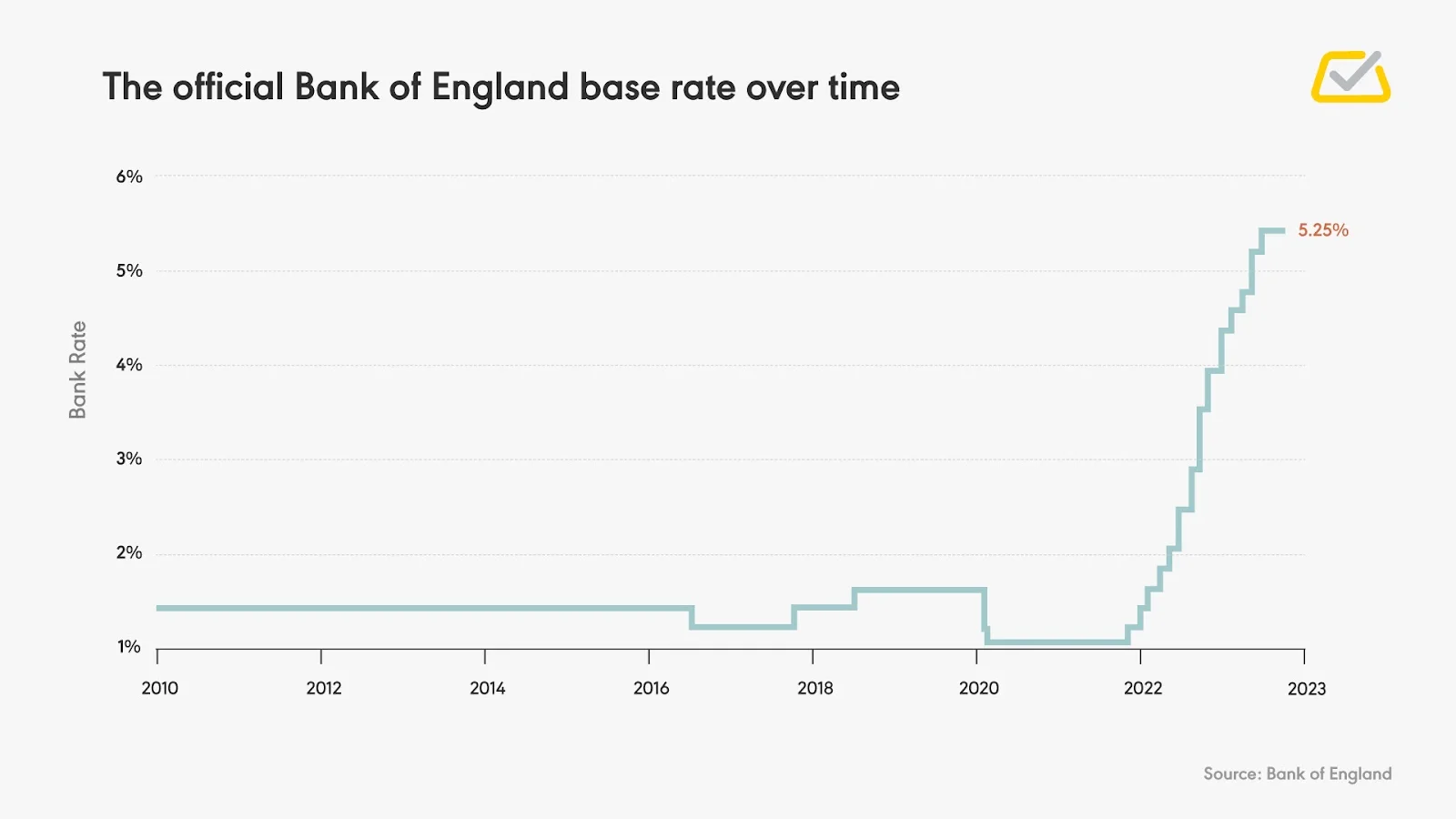

The financial environment described by several reports indicates a trend where traditional, large banks are offering notably low Annual Percentage Yields (APYs) on savings accounts. For example, Article 2 mentions rates as low as 0.01% APY at institutions like Bank of America, Wells Fargo, and Chase, sometimes coupled with monthly fees that further diminish returns unless specific balance or activity requirements are met. In contrast, Article 5 highlights that even modest savings balances in top high-yield accounts can yield hundreds of dollars more annually. The timing of these observations spans from mid-2024 through early 2026, suggesting this is not a new or fleeting phenomenon.

Read More: Retirees Need Cars But Worry About Money

Low Interest Rates: Major banks are observed offering rates like 0.4 percent (Article 1) and 0.01 percent (Article 2) on savings.

Fee Structures: Some banks, such as Bank of America and Wells Fargo, impose monthly maintenance fees unless certain conditions are met (Article 2).

Alternative Options: High-yield savings accounts are presented as an alternative, offering significantly higher interest rates while maintaining FDIC protection (Article 2, Article 5).

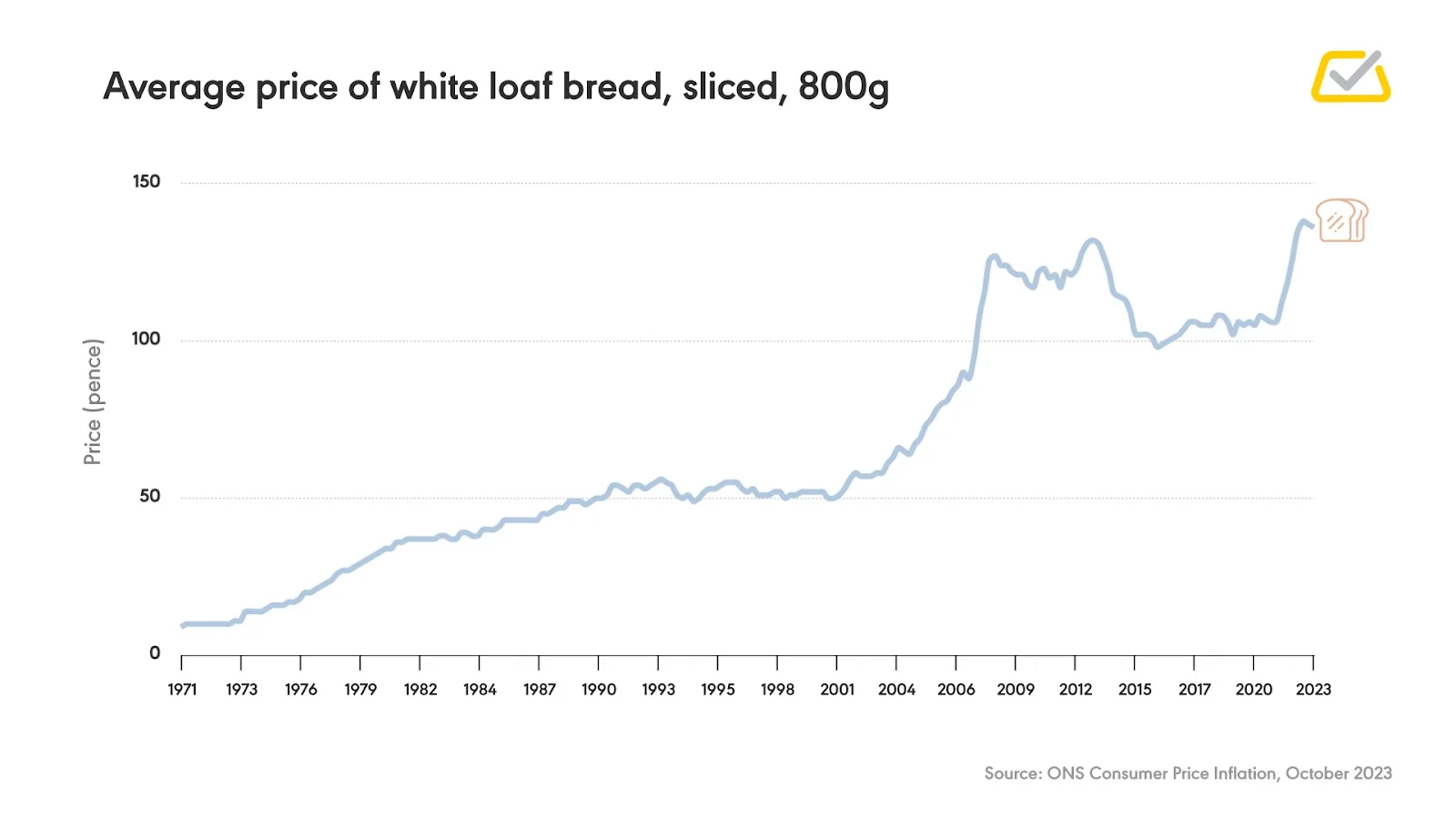

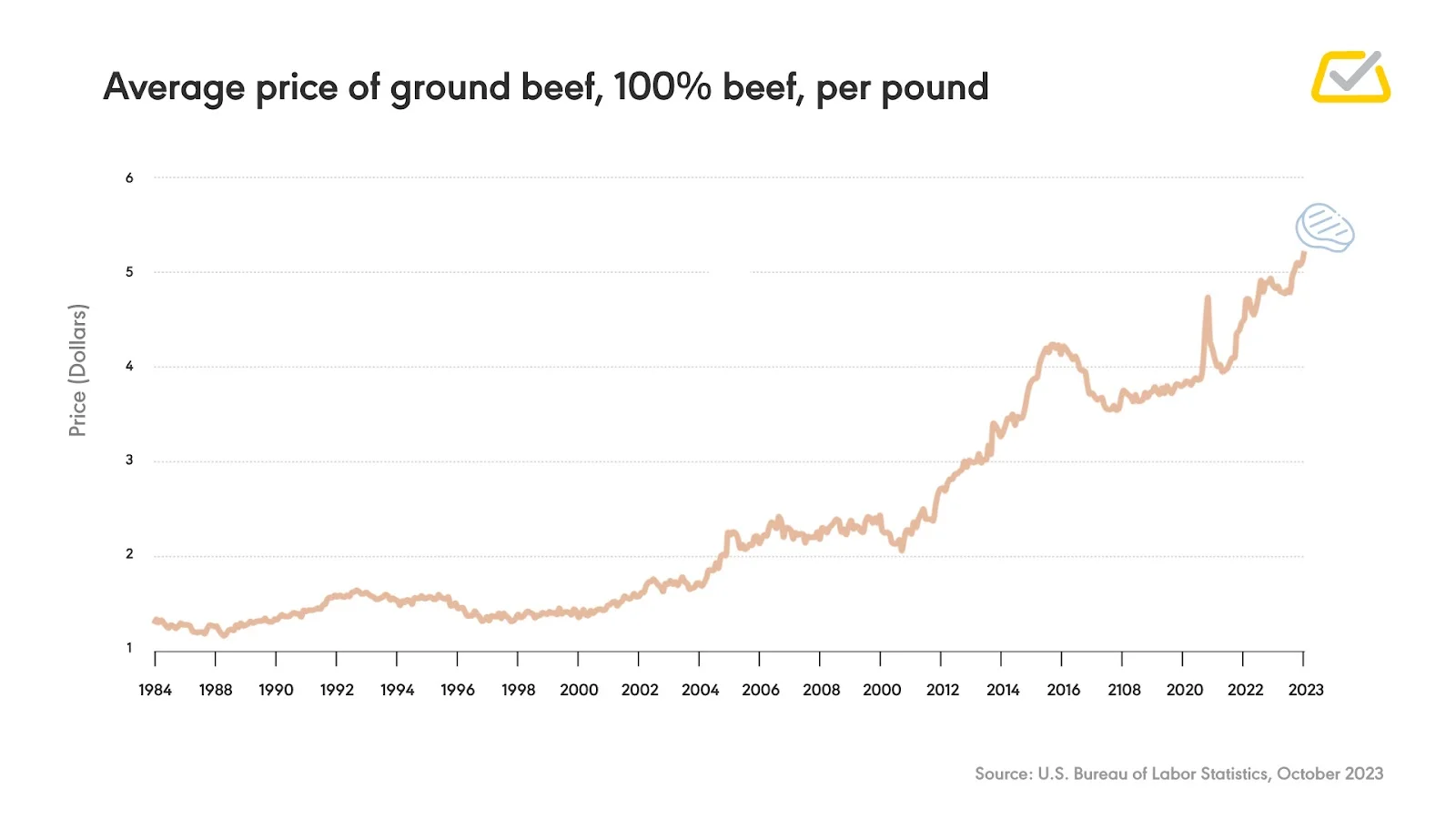

Inflation's Impact: The diminished purchasing power of money due to inflation is also a contributing factor to concerns about savings (Article 3).

Evidence of Divergent Returns

The data points to a clear divergence in how savings are treated by different financial entities.

Traditional Banks' Offerings:

Article 1 states that a measly 0.4 percent is paid on savings accounts by major banks like BlackRock, Wells Fargo, J.P. Morgan, and Bank of America. It also notes that the average one-year certificate of deposit earns only 1.6 percent.

Article 2 specifically calls out Bank of America, Wells Fargo, and Chase for offering 0.01% APY on savings accounts.

Article 4 notes that "Some bank customers are jumping to high-yield savings accounts to escape the shockingly low interest rates of personal savings accounts at big banks."

High-Yield Account Advantages:

Article 2 suggests high-yield savings accounts pay 300-500 times more interest than traditional accounts, offering the same FDIC protection.

Article 5 states that "modest balances can earn hundreds more each year in a top savings account, a difference that multiplies as your money grows." It also emphasizes that earning more is possible without leaving one's primary bank, simply by linking a separate high-yield account.

Institutional Investment vs. Saver Returns:

Article 1 posits that while banks pay savers 0.4 percent, they are "quietly parking billions in investments that generate massive returns." This suggests a profitable strategy for the banks using customer deposits.

Banks' Engagement with Savings Deposits

Reports indicate a potential shift in the priorities of large banks regarding customer savings.

Read More: Banks Open on Feb 12, 2026 Despite Bharat Bandh Call

Limited Interest in Small Deposits: Article 4’s title, "Why big banks aren't interested in your savings account," suggests a deliberate lack of focus on attracting or retaining small savings balances. The article explores why banks may not be raising their rates to capture more customers in this segment.

Deposit Outflows: Article 6, referencing the UK market, asks, "Are High Street Banks Losing £100 Billion in Deposits?" and probes reasons why digital banks might be offering higher rates, implying a competitive pressure on traditional banks to adjust their offerings or a segment of customers seeking better returns elsewhere.

Strategic Use of Funds: Article 1 suggests that banks are leveraging deposited funds for investments that yield significantly higher returns than what is passed on to savers, questioning if this represents a deliberate strategy to profit from the difference.

The Impact on Savers' Purchasing Power

The low interest rates offered by major banks, coupled with the erosive effect of inflation, directly impact the real value of savings.

Read More: India's Market Rules Made Simpler to Help Businesses and Investors

Erosion of Buying Power: Article 3 directly addresses this, stating, "Even though you saved the money, you are still majorly out of pocket as the purchasing power of your money has fallen." This highlights that holding money in accounts that do not keep pace with inflation results in a net loss in what that money can buy.

Financial Disadvantage: The contrast between low savings yields and the potential for higher returns elsewhere implies a financial disadvantage for individuals who keep their primary savings with large institutions without exploring alternatives. Article 5 frames this as "missing out on hundreds of dollars in interest every year."

Consumer Awareness: Article 2 suggests that "The banking industry counts on consumers not paying attention to these details," implying that the current system relies on a lack of awareness among customers regarding alternative, higher-yielding options.

Expert Insights and Observations

Analysis from financial publications points to a calculated approach by banking institutions.

Read More: Money Spent, Project Slow: Questions About Sector 7G Funds

"The banking industry counts on consumers not paying attention to these details, but now you know better." - Article 2 (Nasdaq)

"Why big banks aren't interested in your savings account" - Article 4 (NPR)

"If you’re keeping savings at a big bank, you may be missing out on hundreds of dollars in interest every year." - Article 5 (Investopedia)

These statements collectively suggest that the low rates offered by major banks are not necessarily an oversight but potentially a business model that benefits from customer inertia and a lack of engagement with alternative financial products.

Conclusion: An Analysis of Savings Strategies

The evidence gathered indicates a persistent and significant discrepancy between the interest rates offered on savings accounts at major banks and those available through high-yield savings accounts. This has direct implications for the real return on savers' money, especially when considered alongside inflation.

Read More: Northern Ireland Gets £400 Million for Health and Schools

Key Findings:

Major banks frequently offer Annual Percentage Yields (APYs) of 0.4% or lower, with some instances of 0.01%, while also potentially charging monthly fees.

High-yield savings accounts provide substantially higher returns, often hundreds of times more, while offering comparable safety through FDIC insurance.

The low returns on savings at traditional banks, combined with inflation, actively reduce the purchasing power of saved money.

Some financial reporting suggests that large banks may have a reduced incentive to compete aggressively for small savings deposits.

Implications: Individuals who maintain their savings solely in traditional accounts at large banks may be foregoing significant potential earnings and experiencing a de facto loss in the value of their savings due to inflation. The ease of opening separate high-yield accounts suggests that improved returns are readily accessible.

Next Steps for Savers: Savers concerned about their returns are advised to investigate high-yield savings accounts and compare their offerings with their current bank's rates and fees. It appears prudent to ensure that savings are working effectively to preserve and grow purchasing power.

Sources and Context

Breitbart: [https://www.breitbart.com/politics/2026/02/10/are-the-banks-destroying-your-savings/](https://www.breitbart.com/politics/2026/02/10/are-the-banks-destroying-your-savings/) - Article discusses major banks and their low savings rates versus their investment returns, published recently.

Nasdaq: [https://www.nasdaq.com/articles/big-banks-are-stealing-your-money-why-im-moving-my-savings-2025](https://www.nasdaq.com/articles/big-banks-are-stealing-your-money-why-im-moving-my-savings-2025) - Article from mid-2025 detailing low rates and fees at major banks, advocating for high-yield accounts.

Wahed: [https://www.wahed.com/mme/how-inflation-is-destroying-your-savings](https://www.wahed.com/mme/how-inflation-is-destroying-your-savings) - Article from Bing, discusses the impact of inflation on savings' purchasing power.

NPR (Planet Money): [https://www.npr.org/2024/08/15/1197968131/why-big-banks-arent-interested-in-your-savings-account](https://www.npr.org/2024/08/15/1197968131/why-big-banks-arent-interested-in-your-savings-account) - Explores why big banks might not prioritize attracting savings deposits, published mid-2024.

Investopedia: [https://www.investopedia.com/fed-cut-or-not-keeping-your-savings-at-a-big-bank-could-be-costing-you-a-lot-more-than-you-realize-11865317](https://www.investopedia.com/fed-cut-or-not-keeping-your-savings-at-a-big-bank-could-be-costing-you-a-lot-more-than-you-realize-11865317) - Article from early 2026 discussing the cost of keeping savings at big banks and suggesting alternatives.

London Business Magazine: [https://www.londonbusinessmag.co.uk/high-street-banks-losing-deposits/](https://www.londonbusinessmag.co.uk/high-street-banks-losing-deposits/) - Discusses UK banks losing deposits and the role of digital banks with higher rates, published recently.

Which?: [https://www.which.co.uk/news/article/is-your-bank-short-changing-you-aa6uP5z7opck](https://www.which.co.uk/news/article/is-your-bank-short-changing-you-aa6uP5z7opck) - Article from mid-2024 that was marked as low priority or had extraction issues.